jetBlue Results Presentation Deck

Earnings before interest, taxes, depreciation, amortization, and special Items

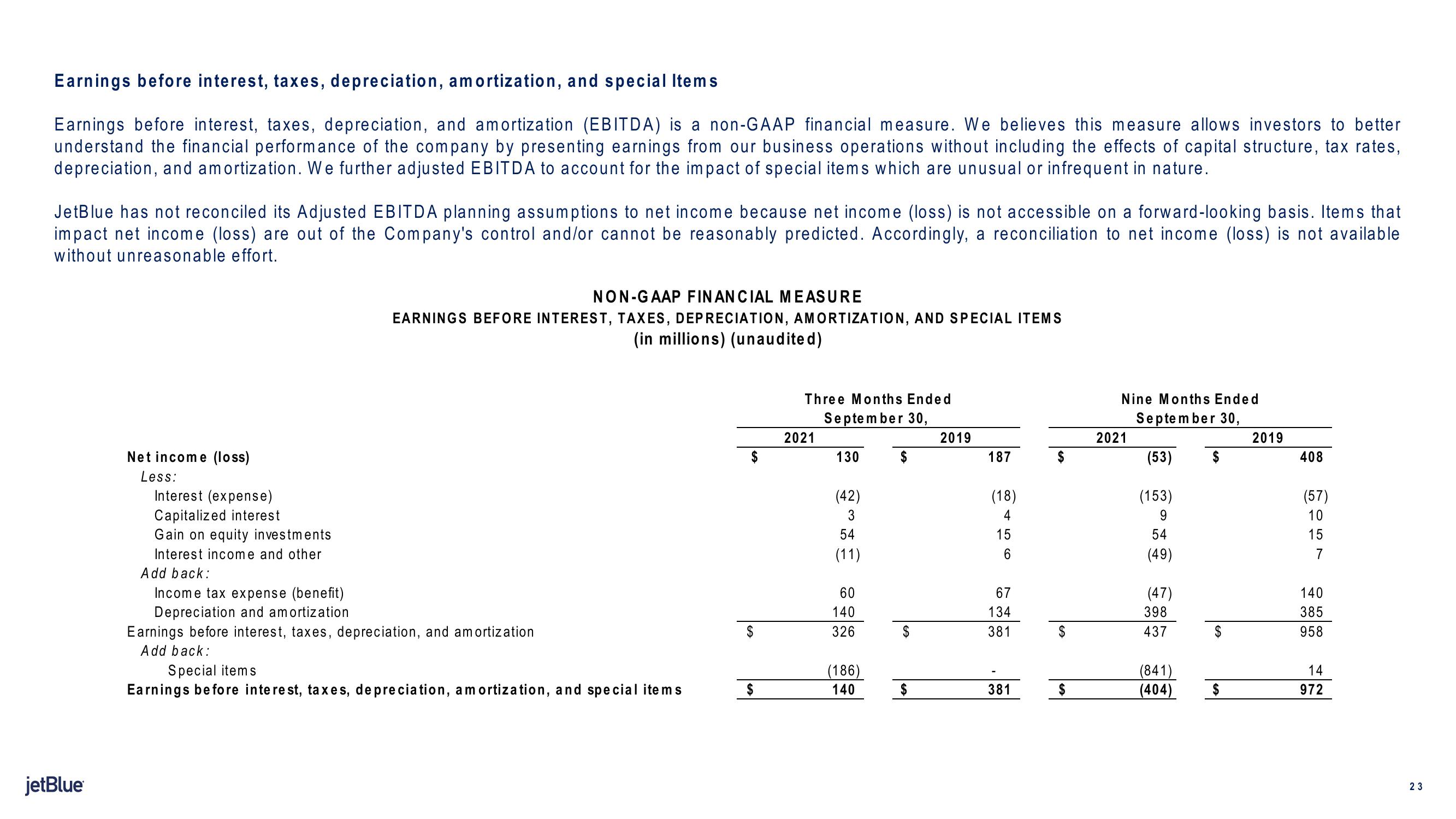

Earnings before interest, taxes, depreciation, and amortization (EBITDA) is a non-GAAP financial measure. We believes this measure allows investors to better

understand the financial performance of the company by presenting earnings from our business operations without including the effects of capital structure, tax rates,

depreciation, and amortization. We further adjusted EBITDA to account for the impact of special items which are unusual or infrequent in nature.

JetBlue has not reconciled its Adjusted EBITDA planning assumptions to net income because net income (loss) is not accessible on forward-looking basis. Items that

impact net income (loss) are out of the Company's control and/or cannot be reasonably predicted. Accordingly, a reconciliation to net income (loss) is not available

without unreasonable effort.

jetBlue

Net income (loss)

Less:

Interest (expense)

Capitalized interest

Gain on equity investments

Interest income and other

Add back:

Income tax expense (benefit)

Depreciation and amortization

NON-GAAP FINANCIAL MEASURE

EARNINGS BEFORE INTEREST, TAXES, DEPRECIATION, AMORTIZATION, AND SPECIAL ITEMS

(in millions) (unaudited)

Earnings before interest, taxes, depreciation, and amortization

Add back:

Special items

Earnings before interest, taxes, depreciation, amortization, and special items

Three Months Ended

September 30,

2021

130

(42)

3

54

(11)

60

140

326

(186)

140

$

2019

187

(18)

4

15

6

67

134

381

381

$

Nine Months Ended

September 30,

(53) $

(153)

9

2021

54

(49)

(47)

398

437

(841)

(404)

$

2019

408

(57)

10

15

7

140

385

958

14

972

23View entire presentation