Mondee Investor Update

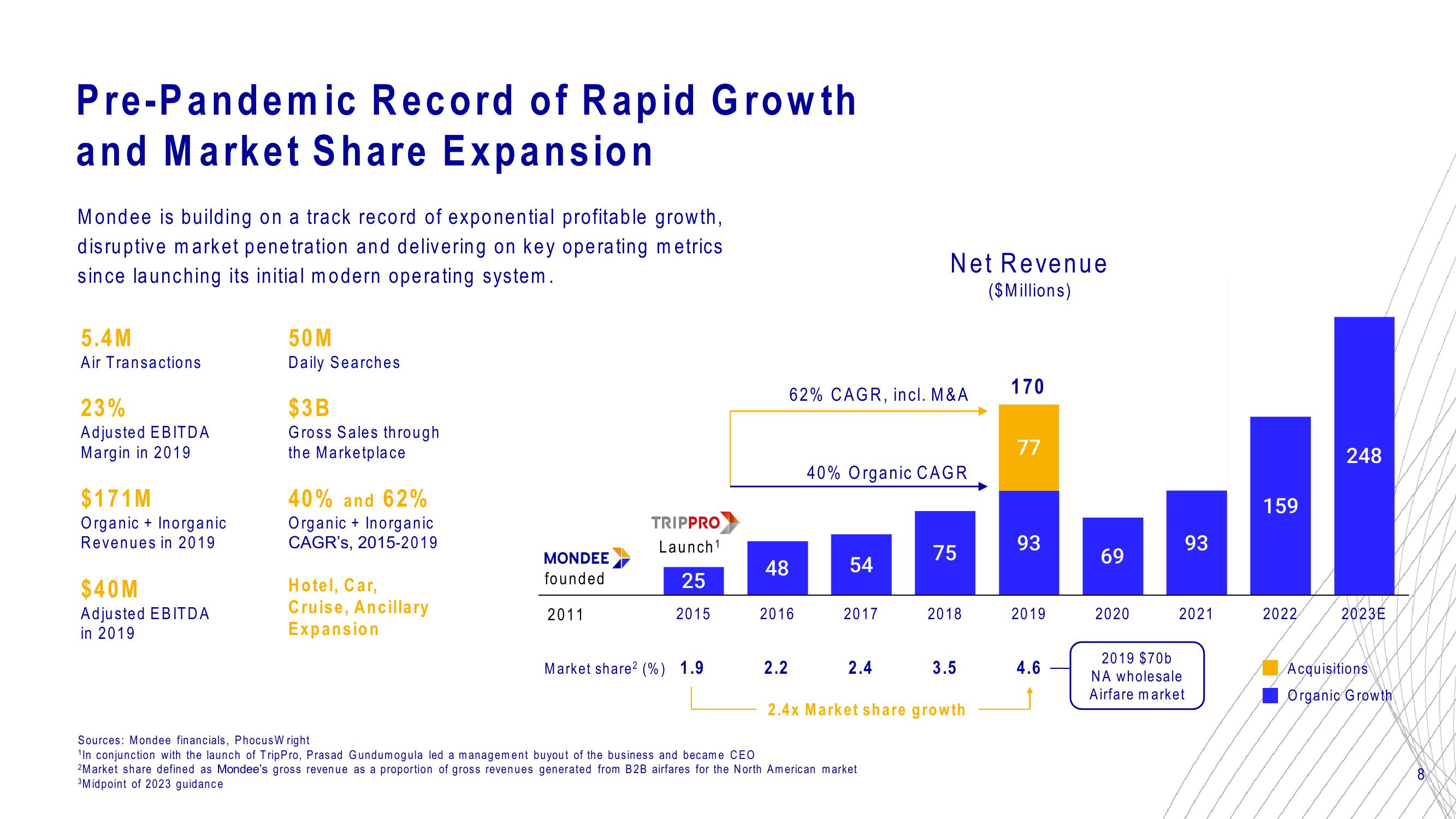

Pre-Pandemic Record of Rapid Growth

and Market Share Expansion

Mondee is building on a track record of exponential profitable growth,

disruptive market penetration and delivering on key operating metrics

since launching its initial modern operating system.

5.4M

Air Transactions

23%

Adjusted EBITDA

Margin in 2019

$171M

Organic + Inorganic

Revenues in 2019

$40M

Adjusted EBITDA

in 2019

50M

Daily Searches

$3B

Gross Sales through

the Marketplace

40% and 62%

Organic + Inorganic

CAGR's, 2015-2019

Hotel, Car,

Cruise, Ancillary

Expansion

MONDEE

founded

2011

TRIPPRO

Launch¹

25

2015

Market share2 (%) 1.9

48

62% CAGR, incl. M&A

2016

2.2

40% Organic CAGR

54

2017

Net Revenue

($Millions)

2.4

Sources: Mondee financials, Phocus Wright

¹In conjunction with the launch of Trip Pro, Prasad Gundumogula led a management buyout of the business and became CEO

2Market share defined as Mondee's gross revenue as a proportion of gross revenues generated from B2B airfares for the North American market

3Midpoint of 2023 guidance

75

2018

3.5

2.4x Market share growth

170

77

93

2019

4.6

Ĵ

69

2020

93

2021

2019 $70b

NA wholesale

Airfare market

159

2022

248

2023E

Acquisitions

Organic GrowthView entire presentation