Pershing Square Activist Presentation Deck

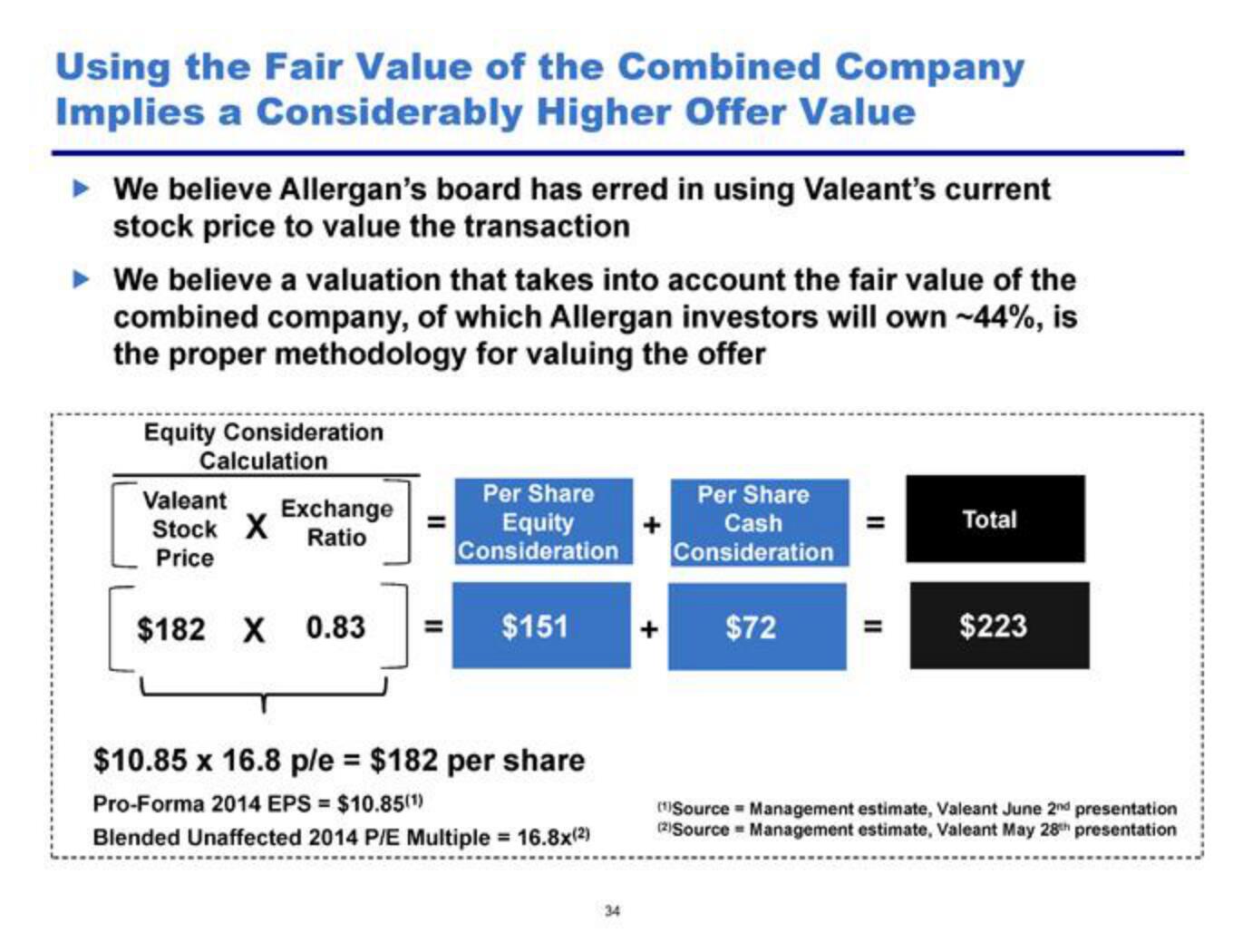

Using the Fair Value of the Combined Company

Implies a Considerably Higher Offer Value

► We believe Allergan's board has erred in using Valeant's current

stock price to value the transaction

We believe a valuation that takes into account the fair value of the

combined company, of which Allergan investors will own ~44%, is

the proper methodology for valuing the offer

Equity Consideration

Calculation

Valeant

Stock X

Price

Exchange

Ratio

$182 X 0.83

Per Share

Equity

Consideration

$151

$10.85 x 16.8 p/e = $182 per share

Pro-Forma 2014 EPS = $10.85(1)

Blended Unaffected 2014 P/E Multiple = 16.8x(²)

34

Per Share

Cash

Consideration

$72

||

Total

$223

(Source Management estimate, Valeant June 2nd presentation

(2) Source Management estimate, Valeant May 28th presentationView entire presentation