Melrose Results Presentation Deck

Melrose key financial numbers: GKN pension commitment delivered ahead of schedule

Melrose

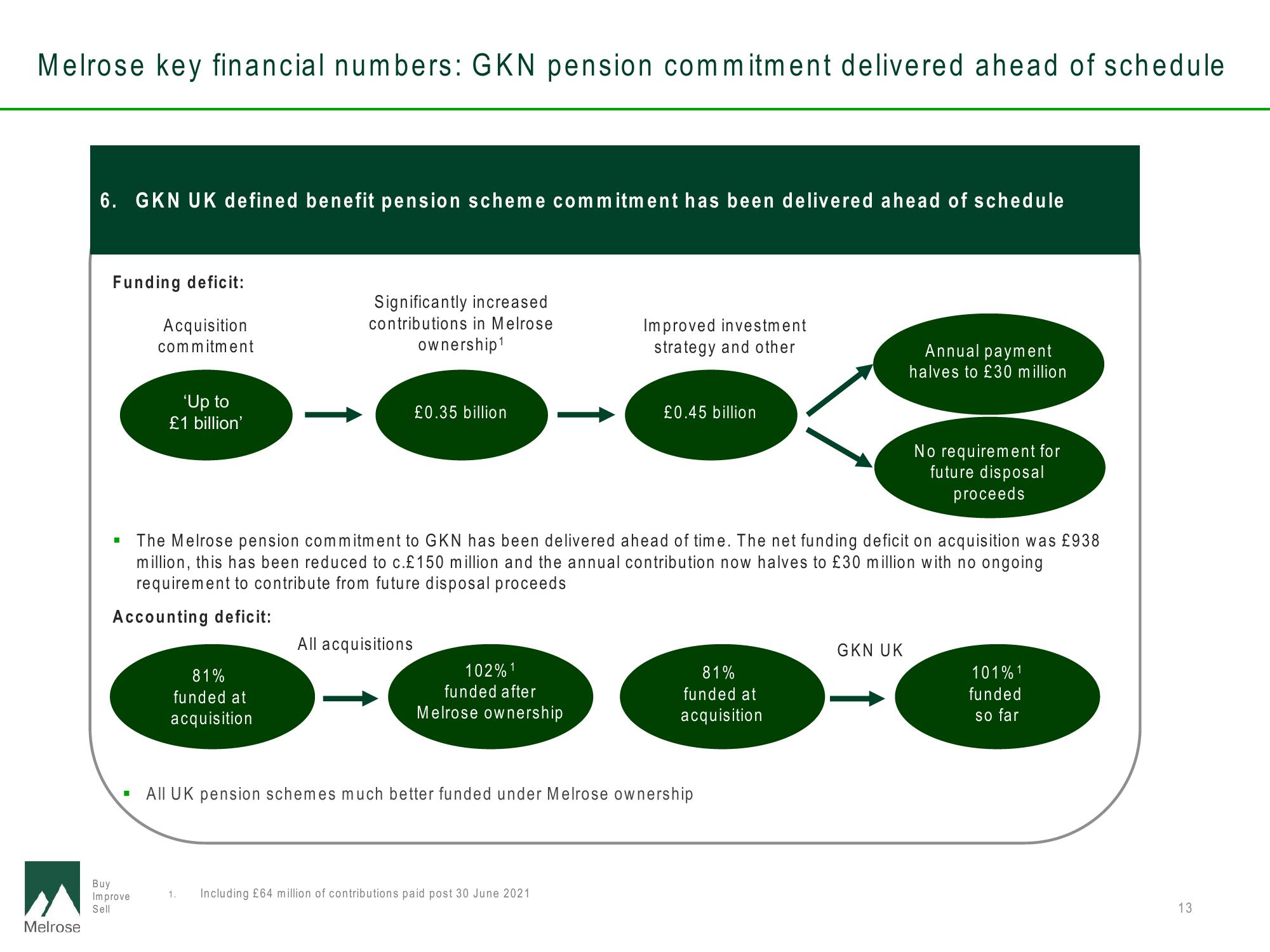

6. GKN UK defined benefit pension scheme commitment has been delivered ahead of schedule

Funding deficit:

Acquisition

commitment

I

'Up to

£1 billion'

Buy

Improve

Sell

Significantly increased

contributions in Melrose

ownership¹

81%

funded at

acquisition

£0.35 billion

The Melrose pension commitment to GKN has been delivered ahead of time. The net funding deficit on acquisition was £938

million, this has been reduced to c.£150 million and the annual contribution now halves to £30 million with no ongoing

requirement to contribute from future disposal proceeds

Accounting deficit:

All acquisitions

102% 1

funded after

Melrose ownership

Improved investment

strategy and other

£0.45 billion

1. Including £64 million of contributions paid post 30 June 2021

81%

funded at

acquisition

All UK pension schemes much better funded under Melrose ownership

Annual payment

halves to £30 million

GKN UK

No requirement for

future disposal

proceeds

101% 1

funded

so far

13View entire presentation