Pershing Square Activist Presentation Deck

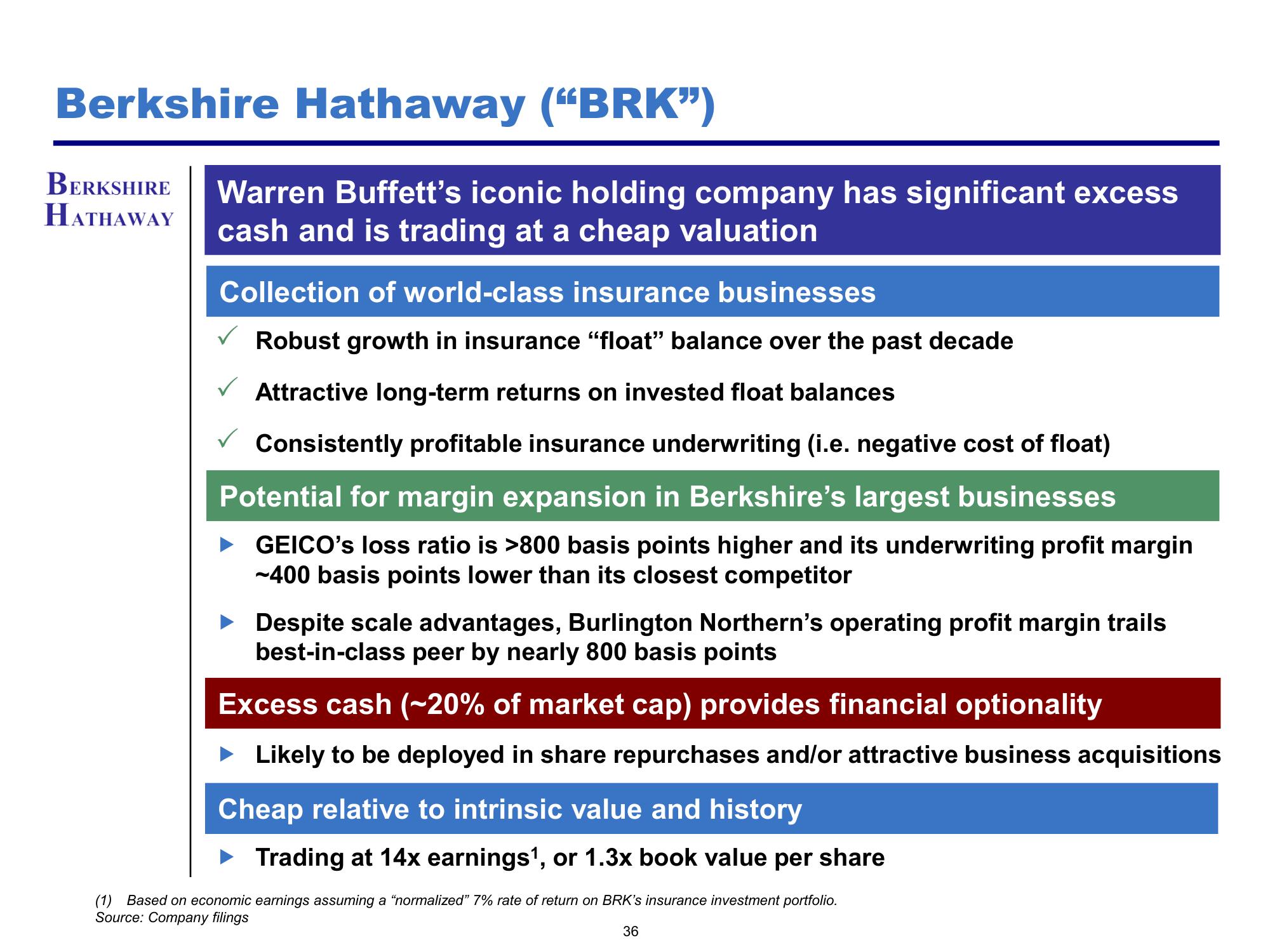

Berkshire Hathaway ("BRK")

HATHAWAY

BERKSHIRE Warren Buffett's iconic holding company has significant excess

cash and is trading at a cheap valuation

Collection of world-class insurance businesses

✓ Robust growth in insurance "float" balance over the past decade

✓ Attractive long-term returns on invested float balances

Consistently profitable insurance underwriting (i.e. negative cost of float)

Potential for margin expansion in Berkshire's largest businesses

► GEICO's loss ratio is >800 basis points higher and its underwriting profit margin

-400 basis points lower than its closest competitor

► Despite scale advantages, Burlington Northern's operating profit margin trails

best-in-class peer by nearly 800 basis points

Excess cash (~20% of market cap) provides financial optionality

Likely to be deployed in share repurchases and/or attractive business acquisitions

Cheap relative to intrinsic value and history

Trading at 14x earnings¹, or 1.3x book value per share

(1) Based on economic earnings assuming a "normalized" 7% rate of return on BRK's insurance investment portfolio.

Source: Company filings

36View entire presentation