Baird Investment Banking Pitch Book

Announced

Date

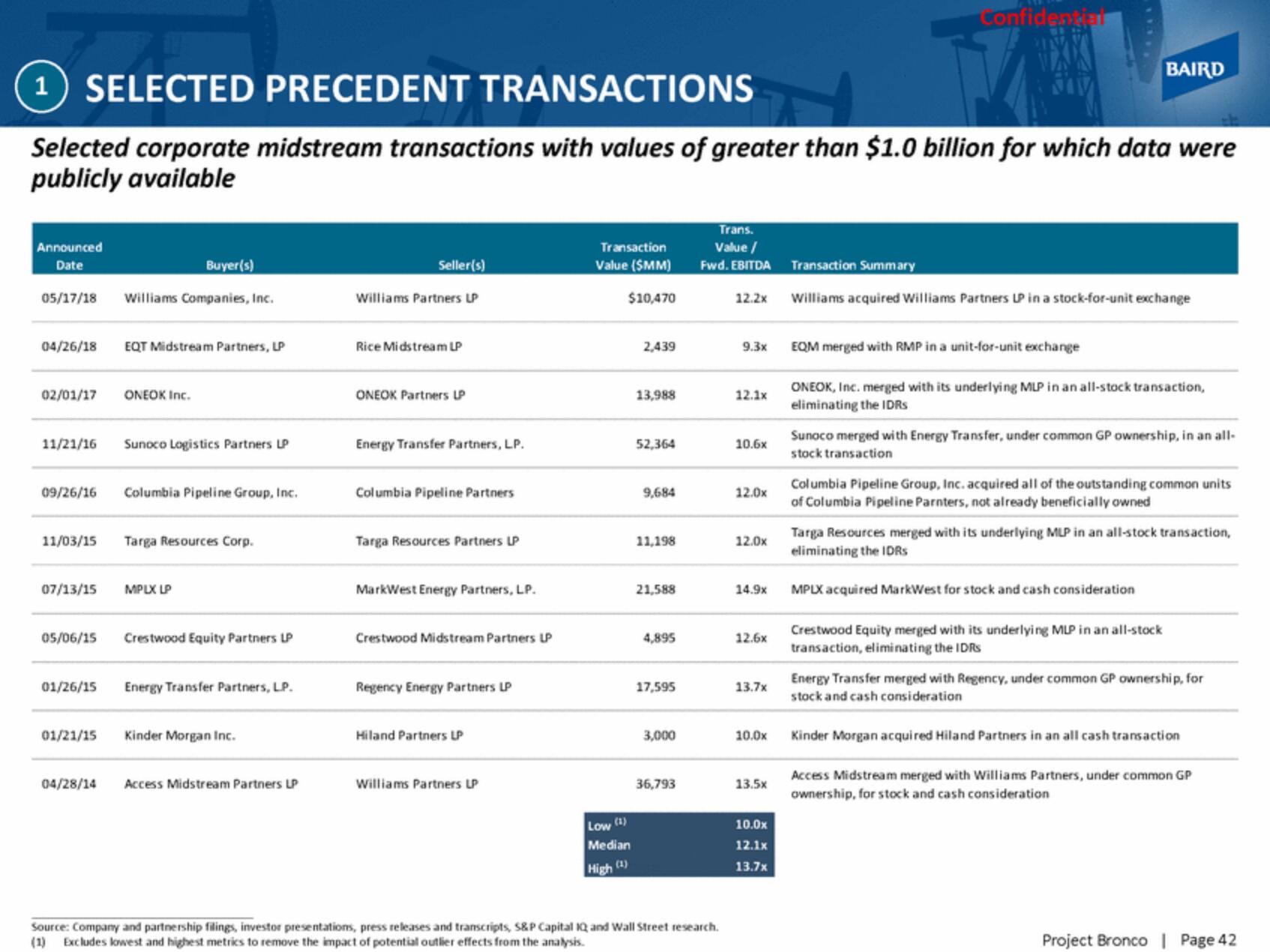

1 SELECTED PRECEDENT TRANSACTIONS

Selected corporate midstream transactions with values of greater than $1.0 billion for which data were

publicly available

05/17/18 Williams Companies, Inc.

04/26/18

02/01/17

11/21/16

11/03/15

07/13/15

09/26/16 Columbia Pipeline Group, Inc.

01/26/15

Buyer(s)

EQT Midstream Partners, LP

ONEOK Inc.

04/28/14

Sunoco Logistics Partners LP

Targa Resources Corp.

MPLX LP

05/06/15 Crestwood Equity Partners LP

Energy Transfer Partners, LP.

01/21/15 Kinder Morgan Inc.

Access Midstream Partners LP

Seller(s)

Williams Partners LP

Rice Midstr am

ONEOK Partners LP

Energy Transfer Partners, LP.

Columbia Pipeline Partners

Targa Resources Partners LP

MarkWest Energy Partners, LP.

Crestwood Midstream Partners LP

Regency Energy Partners LP

Hiland Partners LP

Williams Partners LP

Transaction

Value (SMM)

$10,470

Low (1)

Median

High (1)

2,43

13,988

52,364

9,684

11,198

21,588

4,895

17,595

3,000

36,793

Trans.

Value /

Fwd. EBITDA

Source: Company and partnership filings, investor presentations, press releases and transcripts, S&P Capital IQ and Wall Street research.

(1) Excludes lowest and highest metrics to remove the impact of potential outlier effects from the analysis.

12.2x

9.3x

12.1x

10.6x

12.0x

12.0x

14.9x

12.6x

13.7x

10.0x

13.5x

10.0x

12.1x

13.7x

Confidential

Transaction Summary

Williams acquired Williams Partners LP in a stock-for-unit exchange

EQM merged with RMP in a unit-for-unit exchange

BAIRD

ONEOK, Inc. merged with its underlying MLP in an all-stock transaction,

eliminating the IDRS

Sunoco merged with Energy Transfer, under common GP ownership, in an all-

stock transaction

Columbia Pipeline Group, Inc. acquired all of the outstanding common units

of Columbia Pipeline Parnters, not already beneficially owned

Targa Resources merged with its underlying MLP in an all-stock transaction,

eliminating the IDRS

MPLX acquired MarkWest for stock and cash consideration

Crestwood Equity merged with its underlying MLP in an all-stock

transaction, eliminating the IDRS

Energy Transfer merged with Regency, under common GP ownership, for

stock and cash consideration

Kinder Morgan acquired Hiland Partners in an all cash transaction

Access Midstream merged with Williams Partners, under common GP

ownership, for stock and cash consideration

Project Bronco | Page 42View entire presentation