Pershing Square Activist Presentation Deck

Valuation Range

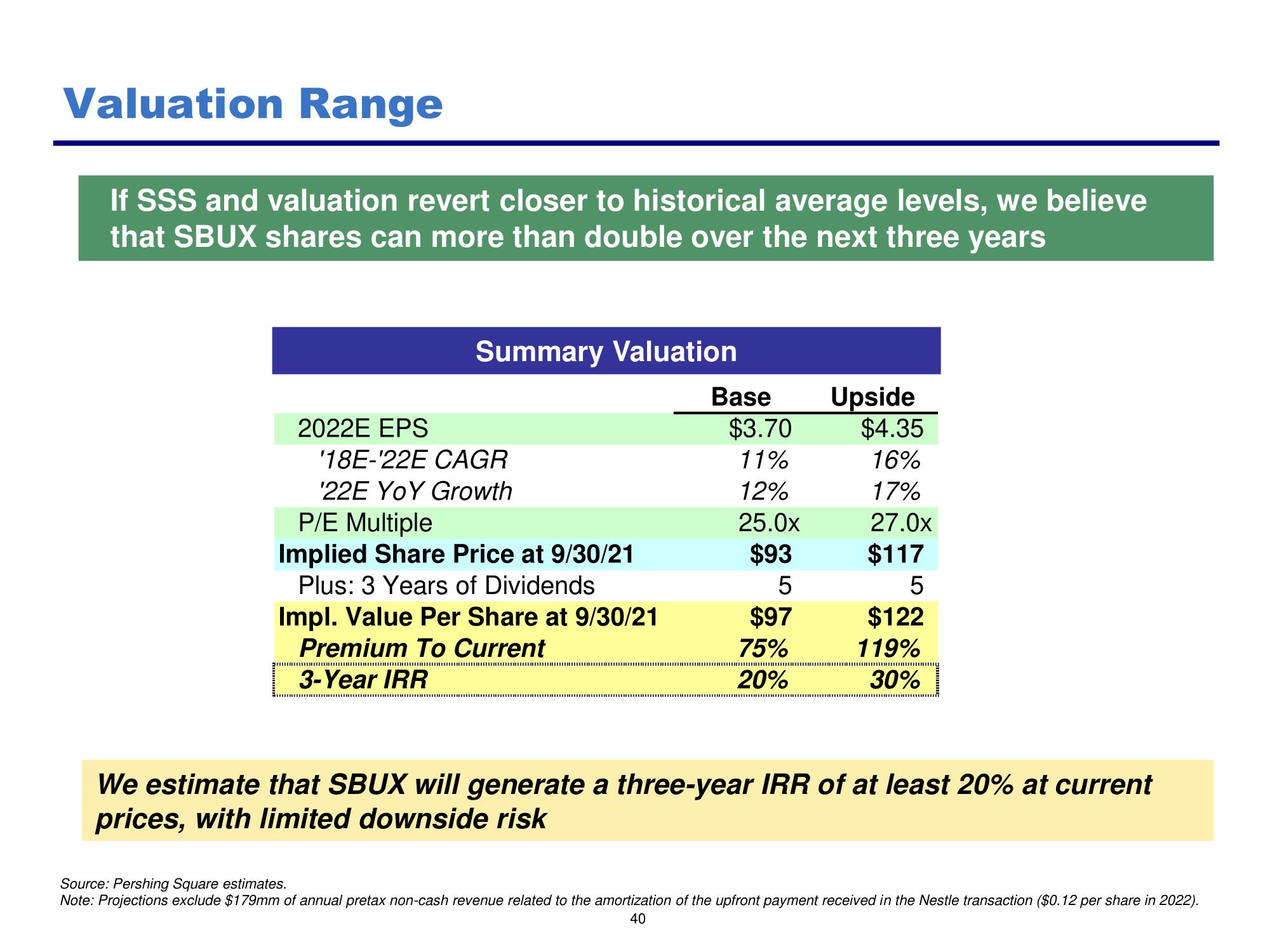

If SSS and valuation revert closer to historical average levels, we believe

that SBUX shares can more than double over the next three years

2022E EPS

Summary Valuation

'18E-'22E CAGR

'22E YOY Growth

P/E Multiple

Implied Share Price at 9/30/21

Plus: 3 Years of Dividends

Impl. Value Per Share at 9/30/21

Premium To Current

3-Year IRR

Base

$3.70

11%

12%

25.0x

$93

5

$97

75%

20%

Upside

$4.35

16%

17%

27.0x

$117

5

$122

119%

30%

We estimate that SBUX will generate a three-year IRR of at least 20% at current

prices, with limited downside risk

Source: Pershing Square estimates.

Note: Projections exclude $179mm of annual pretax non-cash revenue related to the amortization of the upfront payment received in the Nestle transaction ($0.12 per share in 2022).

40View entire presentation