Lyft Investor Presentation Deck

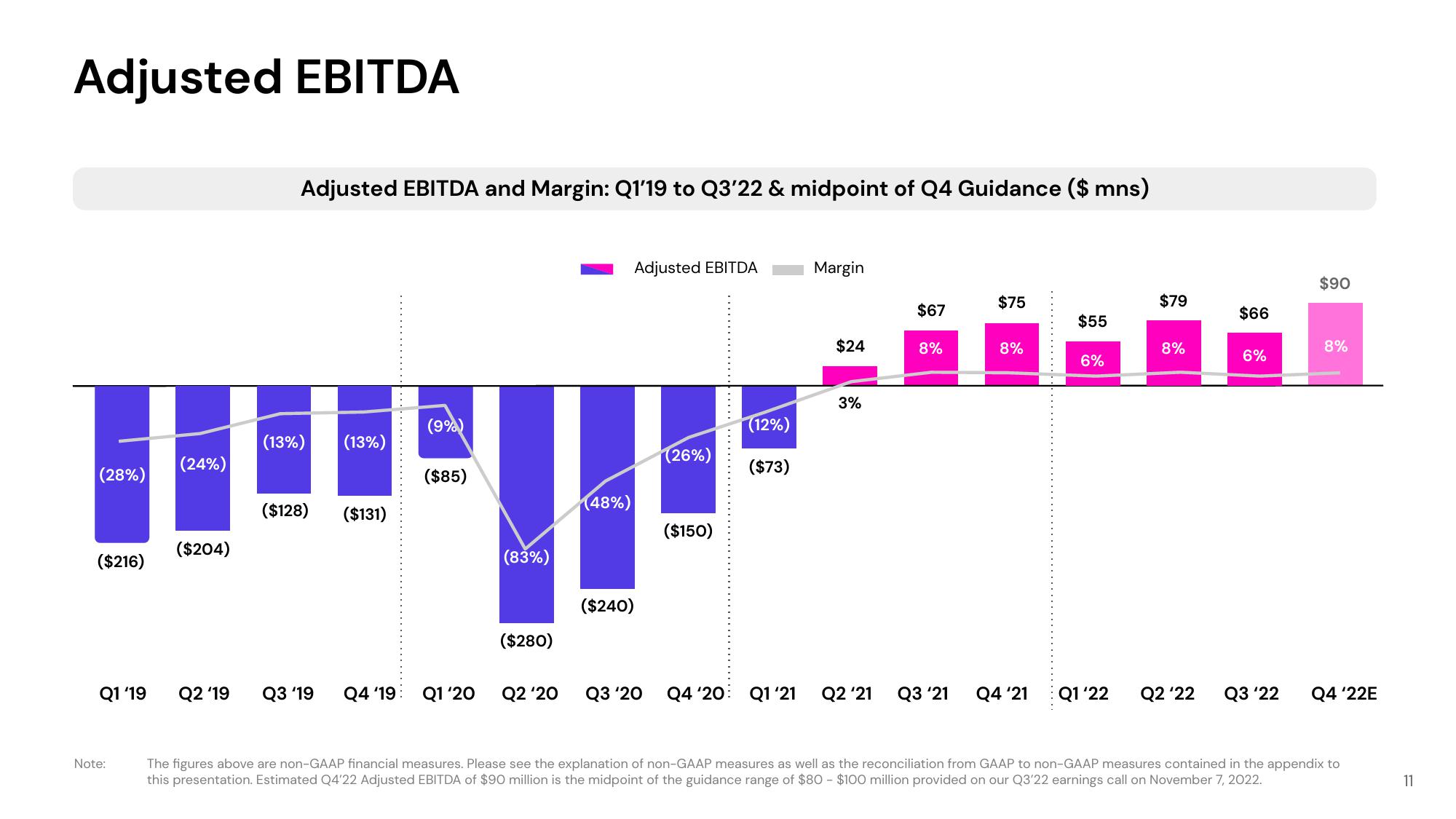

Adjusted EBITDA

(28%)

($216)

Q1 '19

Note:

(24%)

($204)

Adjusted EBITDA and Margin: Q1′19 to Q3′22 & midpoint of Q4 Guidance ($ mns)

(13%) (13%)

($128)

Q2 '19 Q3 '19

($131)

.........

(9%)

($85)

Q4 '19 Q1 '20

(83%)

($280)

Q2 '20

(48%)

Adjusted EBITDA

($240)

Q3 '20

(26%)

($150)

(12%)

($73)

Q4 '20 Q1 '21

Margin

$24

3%

Q2 '21

$67

8%

$75

8%

Q3 '21 Q4 '21

....….........

$55

6%

$79

8%

Q1'22 Q2'22

$66

6%

$90

8%

Q3'22 Q4 '22E

The figures above are non-GAAP financial measures. Please see the explanation of non-GAAP measures as well as the reconciliation from GAAP to non-GAAP measures contained in the appendix to

this presentation. Estimated Q4'22 Adjusted EBITDA of $90 million is the midpoint of the guidance range of $80 - $100 million provided on our Q3'22 earnings call on November 7, 2022.

11View entire presentation