Proterra SPAC Presentation Deck

ARCLIGHT TRANSACTION OVERVIEW

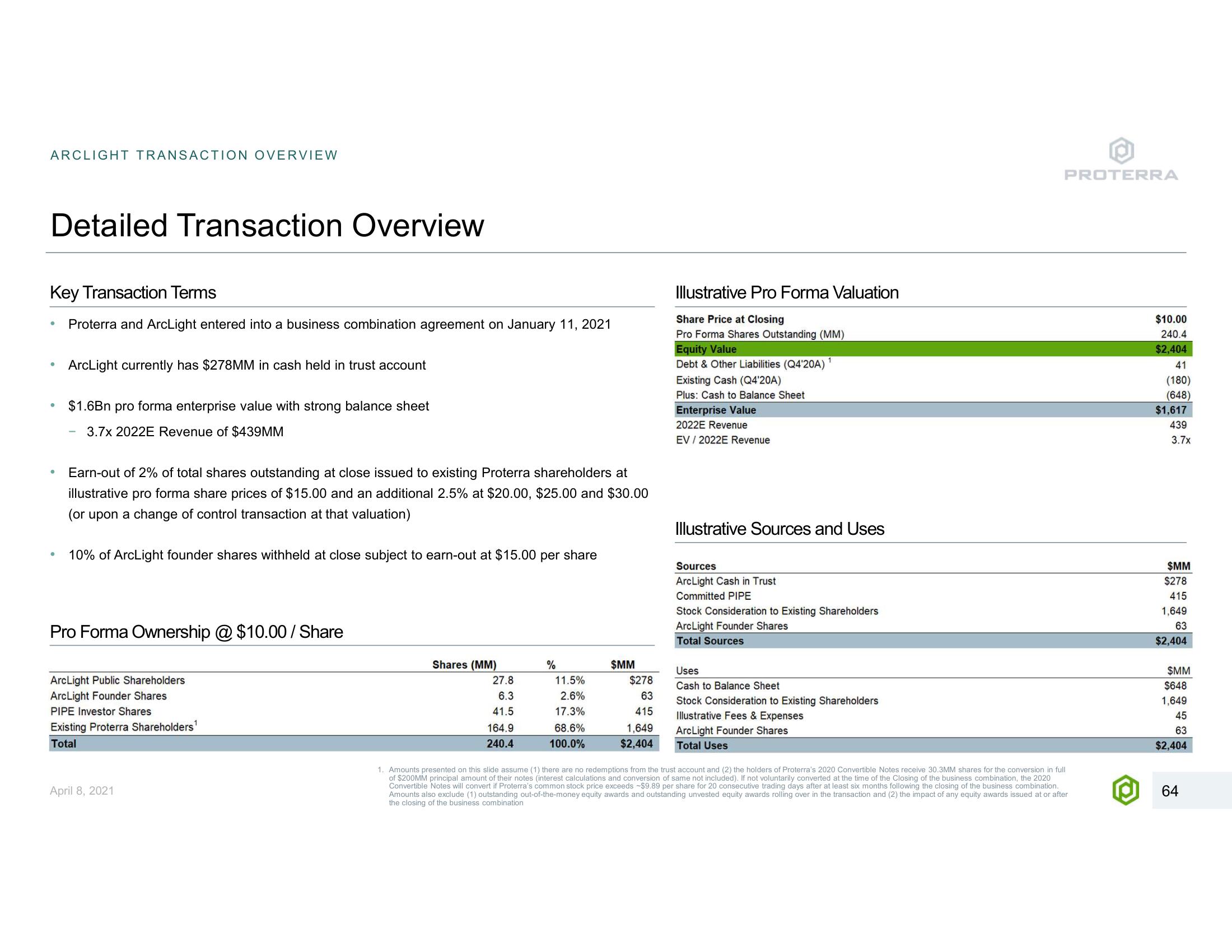

Detailed Transaction Overview

Key Transaction Terms

Proterra and ArcLight entered into a business combination agreement on January 11, 2021

●

ArcLight currently has $278MM in cash held in trust account

$1.6Bn pro forma enterprise value with strong balance sheet

3.7x 2022E Revenue of $439MM

Earn-out of 2% of total shares outstanding at close issued to existing Proterra shareholders at

illustrative pro forma share prices of $15.00 and an additional 2.5% at $20.00, $25.00 and $30.00

(or upon a change of control transaction at that valuation)

10% of ArcLight founder shares withheld at close subject to earn-out at $15.00 per share

Pro Forma Ownership@ $10.00/Share

ArcLight Public Shareholders

ArcLight Founder Shares

PIPE Investor Shares

Existing Proterra Shareholders¹

Total

April 8, 2021

Shares (MM)

27.8

6.3

41.5

164.9

240.4

%

11.5%

2.6%

17.3%

68.6%

100.0%

$MM

$278

63

415

1,649

$2,404

Illustrative Pro Forma Valuation

Share Price at Closing

Pro Forma Shares Outstanding (MM)

Equity Value

Debt & Other Liabilities (Q4'20A)

Existing Cash (Q4'20A)

Plus: Cash to Balance Sheet

Enterprise Value

2022E Revenue

EV/2022E Revenue

Illustrative Sources and Uses

Sources

ArcLight Cash in Trust

Committed PIPE

Stock Consideration to Existing Shareholders

ArcLight Founder Shares

Total Sources

Uses

Cash to Balance Sheet

Stock Consideration to Existing Shareholders

Illustrative Fees & Expenses

ArcLight Founder Shares

Total Uses

PROTERRA

1. Amounts presented on this slide assume (1) there are no redemptions from the trust account and (2) the holders of Proterra's 2020 Convertible Notes receive 30.3MM shares for the conversion in full

of $200MM principal amount of their notes (interest calculations and conversion of same not included). If not voluntarily converted at the time of the Closing of the business combination, the 2020

Convertible Notes will convert if Proterra's common stock price exceeds -$9.89 per share for 20 consecutive trading days after at least six months following the closing of the business combination.

Amounts also exclude (1) outstanding out-of-the-money equity awards and outstanding unvested equity awards rolling over in the transaction and (2) the impact of any equity awards issued at or after

the closing of the business combination

$10.00

240.4

$2,404

41

(180)

(648)

$1,617

439

3.7x

$MM

$278

415

1,649

63

$2,404

$MM

$648

1,649

45

63

$2,404

64View entire presentation