Pershing Square Activist Presentation Deck

Platform Valuation Illustration

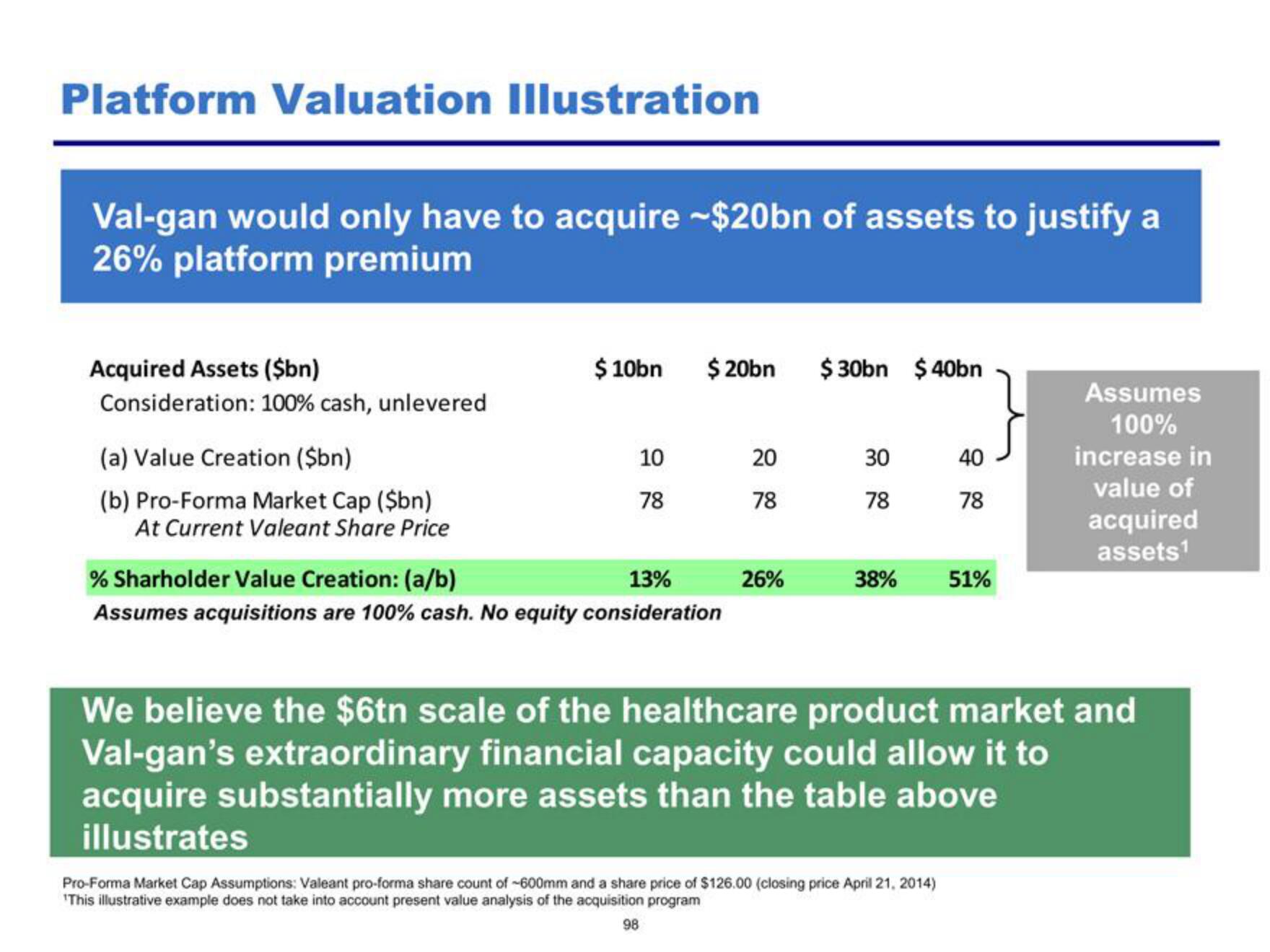

Val-gan would only have to acquire ~$20bn of assets to justify a

26% platform premium

Acquired Assets ($bn)

Consideration: 100% cash, unlevered

(a) Value Creation ($bn)

(b) Pro-Forma Market Cap ($bn)

At Current Valeant Share Price

$10bn

10

78

$ 20bn $ 30bn $40bn

% Sharholder Value Creation: (a/b)

13%

Assumes acquisitions are 100% cash. No equity consideration

20

78

26%

30

78

38%

40

78

Pro-Forma Market Cap Assumptions: Valeant pro-forma share count of -600mm and a share price of $126.00 (closing price April 21, 2014)

'This illustrative example does not take into account present value analysis of the acquisition program

98

51%

Assumes

100%

increase in

value of

acquired

assets¹

We believe the $6tn scale of the healthcare product market and

Val-gan's extraordinary financial capacity could allow it to

acquire substantially more assets than the table above

illustratesView entire presentation