Hydrafacial Investor Presentation Deck

APPENDIX-SUPPLEMENTAL

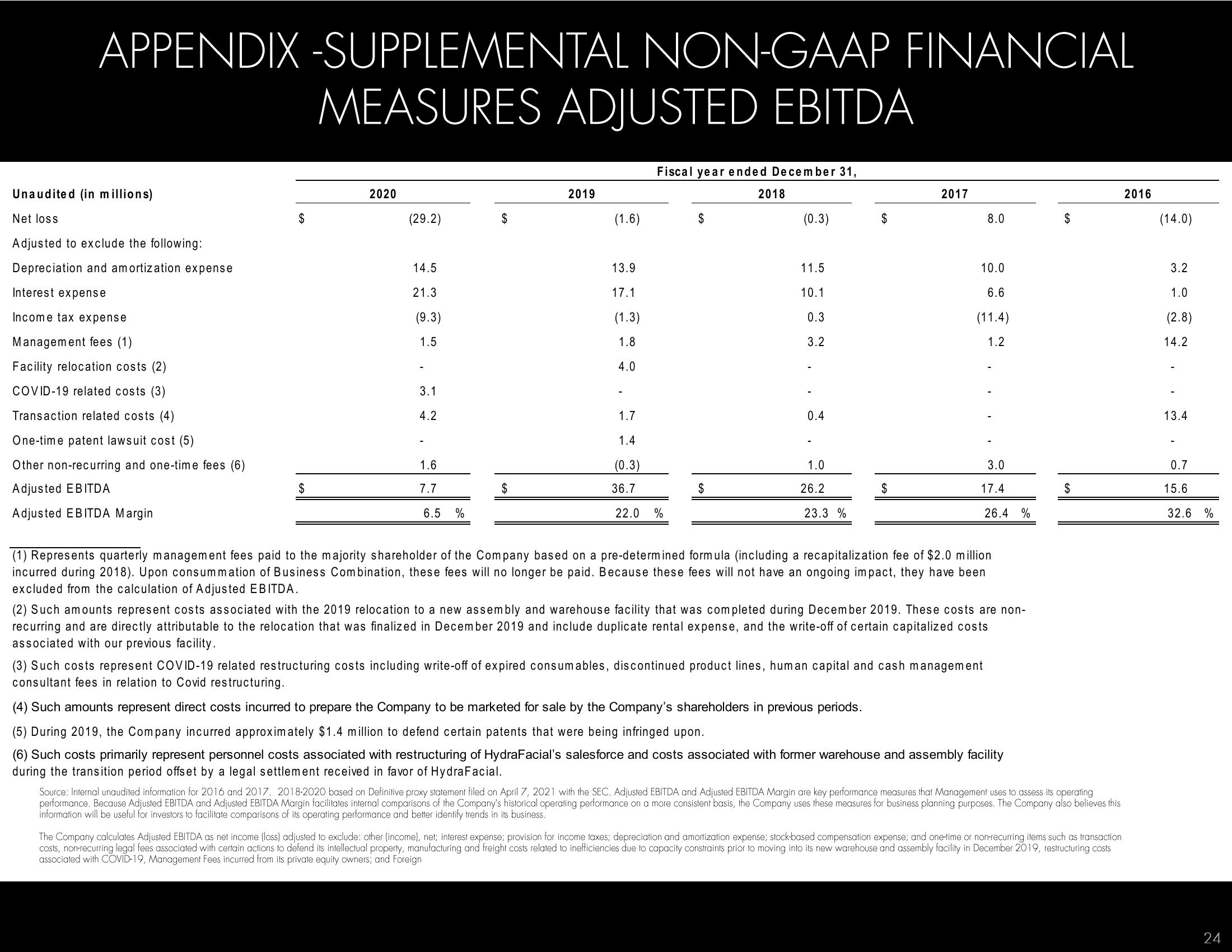

Unaudited (in millions)

Net loss

Adjusted to exclude the following:

Depreciation and amortization expense

Interest expense

Income tax expense

Management fees (1)

Facility relocation costs (2)

COVID-19 related costs (3)

Transaction related costs (4)

One-time patent lawsuit cost (5)

Other non-recurring and one-time fees (6)

Adjusted EBITDA

Adjusted EBITDA Margin

$

$

MEASURES ADJUSTED EBITDA

2020

(29.2)

14.5

21.3

(9.3)

1.5

3.1

4.2

1.6

7.7

6.5 %

$

$

2019

(1.6)

NON-GAAP FINANCIAL

13.9

17.1

(1.3)

1.8

4.0

Fiscal year ended December 31,

1.7

1.4

(0.3)

36.7

22.0 %

$

$

2018

(0.3)

11.5

10.1

0.3

3.2

0.4

1.0

26.2

23.3%

$

$

2017

8.0

10.0

6.6

(11.4)

1.2

3.0

17.4

26.4 %

(1) Represents quarterly management fees paid to the majority shareholder of the Company based on a pre-determined formula (including a recapitalization fee of $2.0 million

incurred during 2018). Upon consummation of Business Combination, these fees will no longer be paid. Because these fees will not have an ongoing impact, they have been

excluded from the calculation of Adjusted EBITDA.

(2) Such amounts represent costs associated with the 2019 relocation to a new assembly and warehouse facility that was completed during December 2019. These costs are non-

recurring and are directly attributable to the relocation that was finalized in December 2019 and include duplicate rental expense, and the write-off of certain capitalized costs

associated with our previous facility.

(3) Such costs represent COVID-19 related restructuring costs including write-off of expired consumables, discontinued product lines, human capital and cash management

consultant fees in relation to Covid restructuring.

(4) Such amounts represent direct costs incurred to prepare the Company to be marketed for sale by the Company's shareholders in previous periods.

(5) During 2019, the Company incurred approximately $1.4 million to defend certain patents that were being infringed upon.

(6) Such costs primarily represent personnel costs associated with restructuring of HydraFacial's salesforce and costs associated with former warehouse and assembly facility

during the transition period offset by a legal settlement received in favor of HydraFacial.

$

$

Source: Internal unaudited information for 2016 and 2017. 2018-2020 based on Definitive proxy statement filed on April 7, 2021 with the SEC. Adjusted EBITDA and Adjusted EBITDA Margin are key performance measures that Management uses to assess its operating

performance. Because Adjusted EBITDA and Adjusted EBITDA Margin facilitates internal comparisons of the Company's historical operating performance on a more consistent basis, the Company uses these measures for business planning purposes. The Company also believes this

information will be useful for investors to facilitate comparisons of its operating performance and better identify trends in its business.

The Company calculates Adjusted EBITDA as net income (loss) adjusted to exclude: other (income), net; interest expense; provision for income taxes; depreciation and amortization expense; stock-based compensation expense; and one-time or non-recurring items such as transaction

costs, non-recurring legal fees associated with certain actions to defend its intellectual property, manufacturing and freight costs related to inefficiencies due to capacity constraints prior to moving into its new warehouse and assembly facility in December 2019, restructuring costs

associated with COVID-19, Management Fees incurred from its private equity owners; and Foreign

2016

(14.0)

3.2

1.0

(2.8)

14.2

13.4

0.7

15.6

32.6 %

24View entire presentation