Pershing Square Activist Presentation Deck

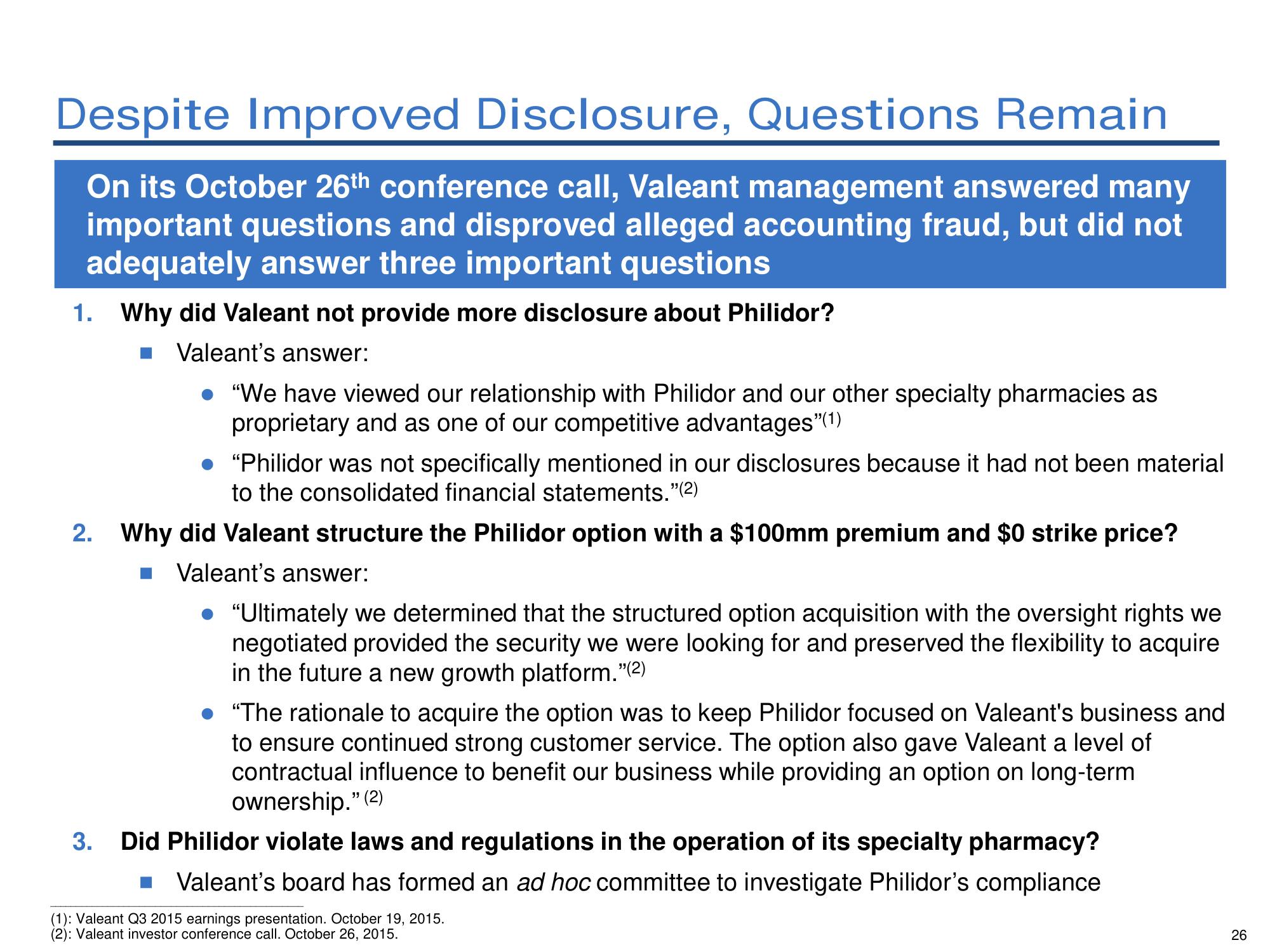

Despite Improved Disclosure, Questions Remain

On its October 26th conference call, Valeant management answered many

important questions and disproved alleged accounting fraud, but did not

adequately answer three important questions

1. Why did Valeant not provide more disclosure about Philidor?

Valeant's answer:

• "We have viewed our relationship with Philidor and our other specialty pharmacies as

proprietary and as one of our competitive advantages"(1)

"Philidor was not specifically mentioned in our disclosures because it had not been material

to the consolidated financial statements."(2)

2. Why did Valeant structure the Philidor option with a $100mm premium and $0 strike price?

Valeant's answer:

• "Ultimately we determined that the structured option acquisition with the oversight rights we

negotiated provided the security we were looking for and preserved the flexibility to acquire

in the future a new growth platform."(²)

"The rationale to acquire the option was to keep Philidor focused on Valeant's business and

to ensure continued strong customer service. The option also gave Valeant a level of

contractual influence to benefit our business while providing an option on long-term

ownership." (2)

3. Did Philidor violate laws and regulations in the operation of its specialty pharmacy?

Valeant's board has formed an ad hoc committee to investigate Philidor's compliance

(1): Valeant Q3 2015 earnings presentation. October 19, 2015.

(2): Valeant investor conference call. October 26, 2015.

26View entire presentation