Second Quarter 2017 Conference Call

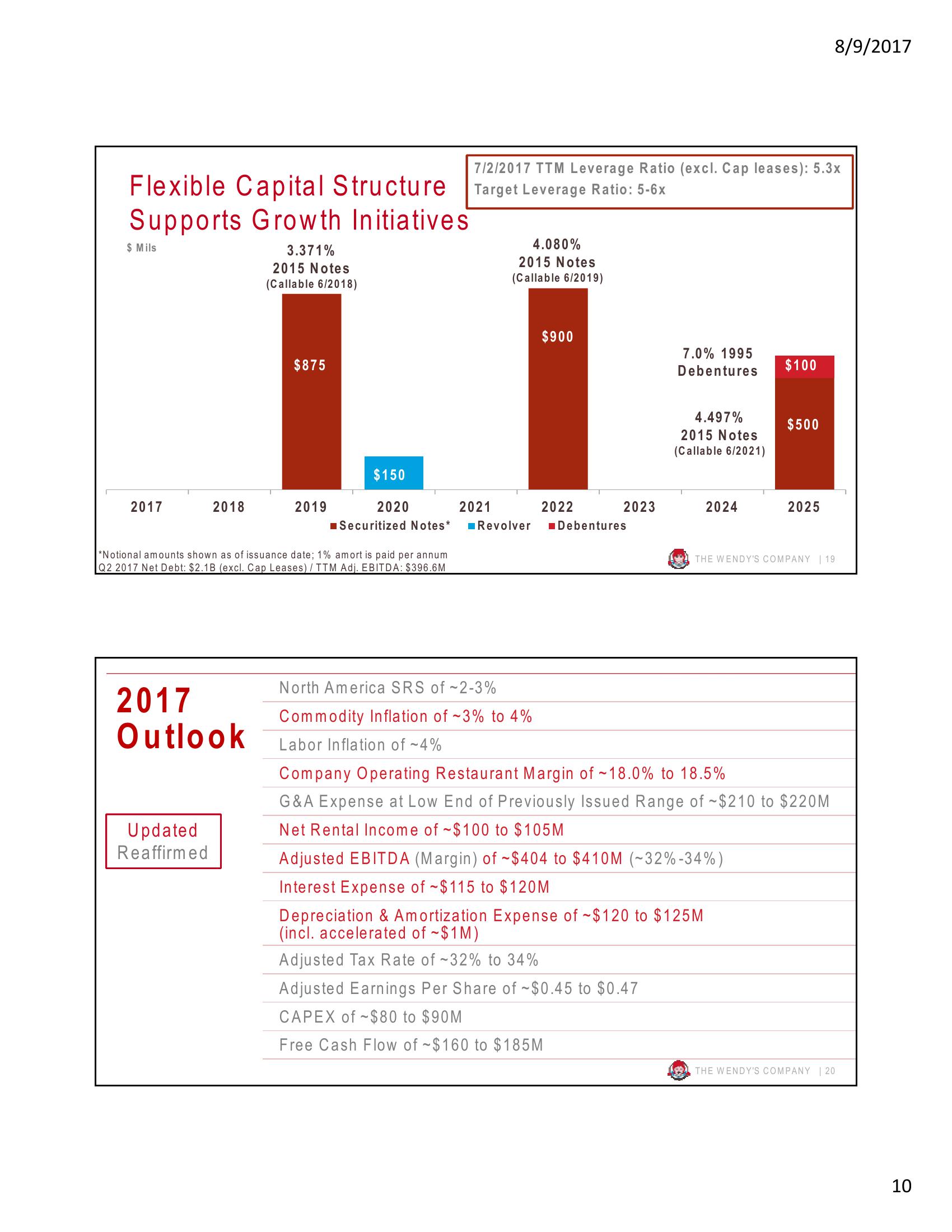

Flexible Capital Structure

Supports Growth Initiatives

3.371%

2015 Notes

(Callable 6/2018)

$ Mils

2017

2018

2017

Outlook

Updated

Reaffirmed

$875

2019

*Notional amounts shown as of issuance date; 1% amort is paid per annum

Q2 2017 Net Debt: $2.1B (excl. Cap Leases) / TTM Adj. EBITDA: $396.6M

$150

2020

■ Securitized Notes*

7/2/2017 TTM Leverage Ratio (excl. Cap leases): 5.3x

Target Leverage Ratio: 5-6x

2021

4.080%

2015 Notes

(Callable 6/2019)

$900

North America SRS of ~2-3%

Commodity Inflation of ~3% to 4%

Labor Inflation of ~4%

2022

2023

Revolver Debentures

7.0% 1995

Debentures

4.497%

2015 Notes

(Callable 6/2021)

2024

$100

$500

Adjusted EBITDA (Margin) of ~$404 to $410M (~32% -34%)

Interest Expense of ~$115 to $120M

Depreciation & Amortization Expense of ~$120 to $125M

(incl. accelerated of ~$1M)

Adjusted Tax Rate of -32% to 34%

Adjusted Earnings Per Share of ~$0.45 to $0.47

CAPEX of $80 to $90M

Free Cash Flow of $160 to $185M

2025

8/9/2017

THE WENDY'S COMPANY 19

Company Operating Restaurant Margin of ~18.0% to 18.5%

G&A Expense at Low End of Previously Issued Range of $210 to $220M

Net Rental Income of ~$100 to $105M

THE WENDY'S COMPANY | 20

10View entire presentation