Karat IPO Presentation Deck

DEBT PRE-DEAL AND POST-DEAL

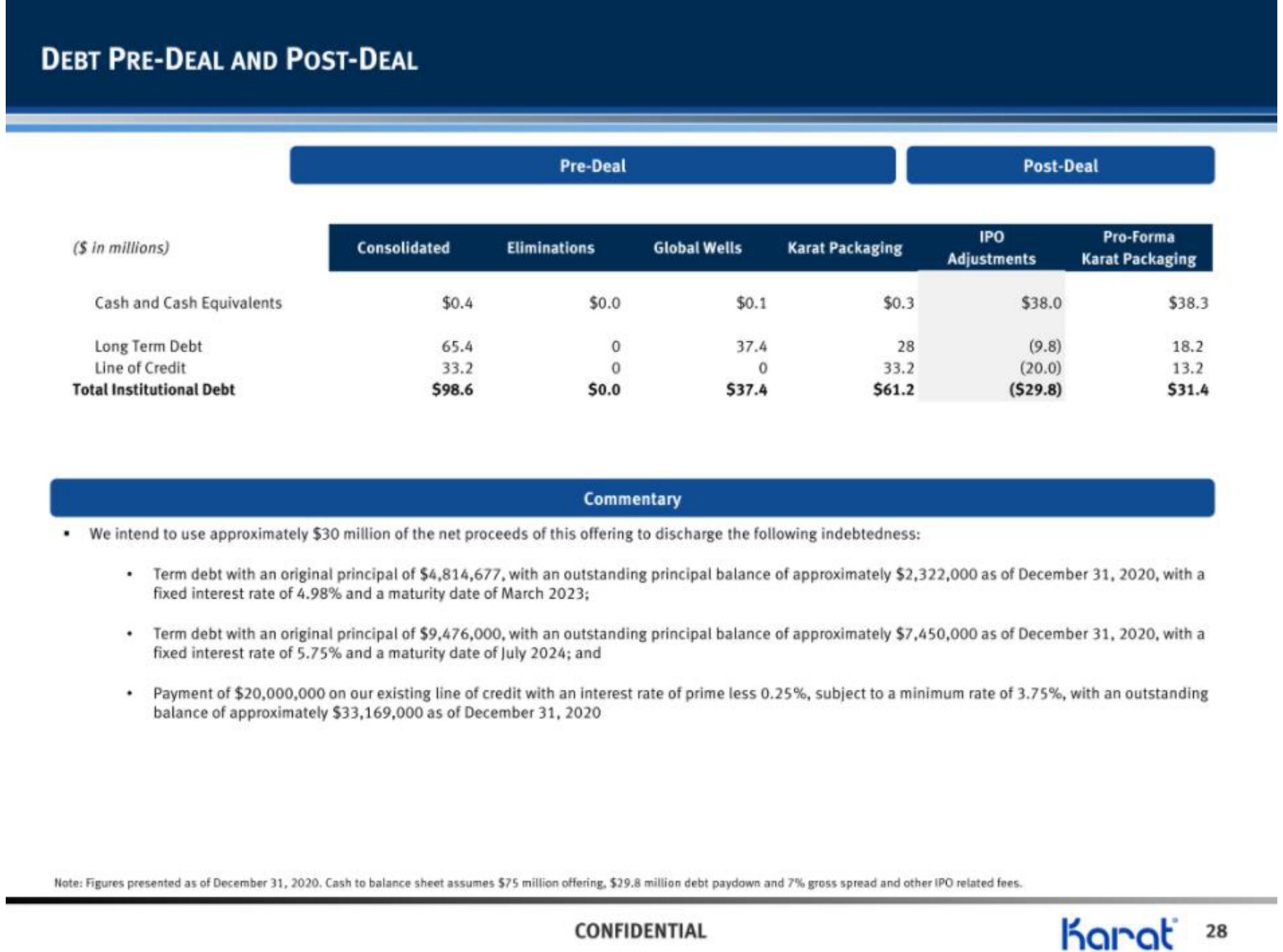

($ in millions)

Cash and Cash Equivalents

Long Term Debt

Line of Credit

Total Institutional Debt

Consolidated

.

$0.4

65.4

33.2

$98.6

Pre-Deal

Eliminations

$0.0

0

0

$0.0

Global Wells

$0.1

37.4

0

$37.4

Karat Packaging

$0.3

Commentary

We intend to use approximately $30 million of the net proceeds of this offering to discharge the following indebtedness:

28

33.2

$61.2

CONFIDENTIAL

Post-Deal

IPO

Adjustments

$38.0

(9.8)

(20.0)

($29.8)

Pro-Forma

Karat Packaging

Note: Figures presented as of December 31, 2020, Cash to balance sheet assumes $75 million offering, $29.8 million debt paydown and 7% gross spread and other IPO related fees.

$38.3

Term debt with an original principal of $4,814,677, with an outstanding principal balance of approximately $2,322,000 as of December 31, 2020, with a

fixed interest rate of 4.98% and a maturity date of March 2023;

18.2

13.2

$31.4

Term debt with an original principal of $9,476,000, with an outstanding principal balance of approximately $7,450,000 as of December 31, 2020, with a

fixed interest rate of 5.75% and a maturity date of July 2024; and

Payment of $20,000,000 on our existing line of credit with an interest rate of prime less 0.25%, subject to a minimum rate of 3.75%, with an outstanding

balance of approximately $33,169,000 as of December 31, 2020

Karat 28View entire presentation