Pershing Square Activist Presentation Deck

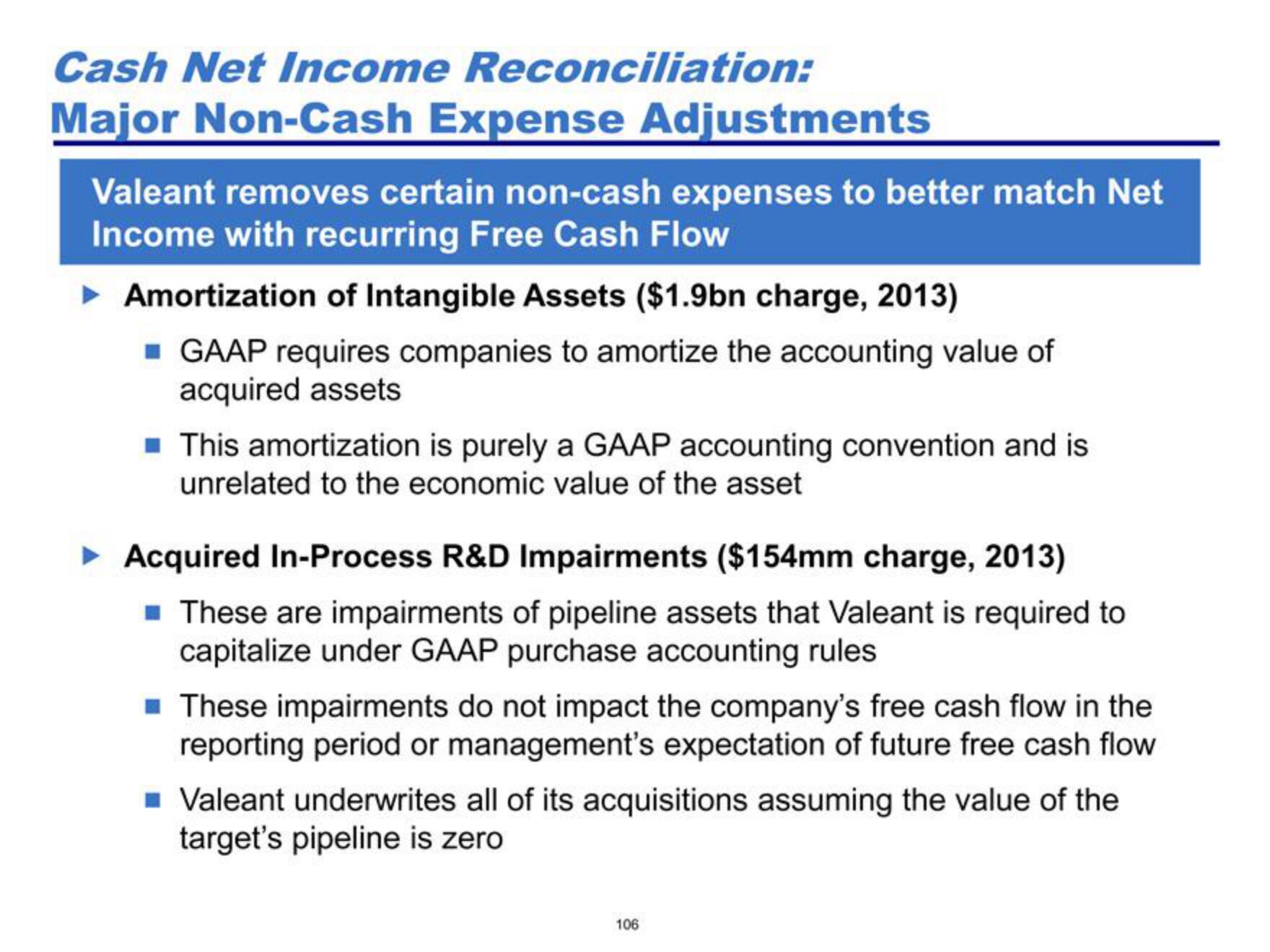

Cash Net Income Reconciliation:

Major Non-Cash Expense Adjustments

Valeant removes certain non-cash expenses to better match Net

Income with recurring Free Cash Flow

▸ Amortization of Intangible Assets ($1.9bn charge, 2013)

■ GAAP requires companies to amortize the accounting value of

acquired assets

■ This amortization is purely a GAAP accounting convention and is

unrelated to the economic value of the asset

► Acquired In-Process R&D Impairments ($154mm charge, 2013)

■ These are impairments of pipeline assets that Valeant is required to

capitalize under GAAP purchase accounting rules

■ These impairments do not impact the company's free cash flow in the

reporting period or management's expectation of future free cash flow

■ Valeant underwrites all of its acquisitions assuming the value of the

target's pipeline is zero

106View entire presentation