Baird Investment Banking Pitch Book

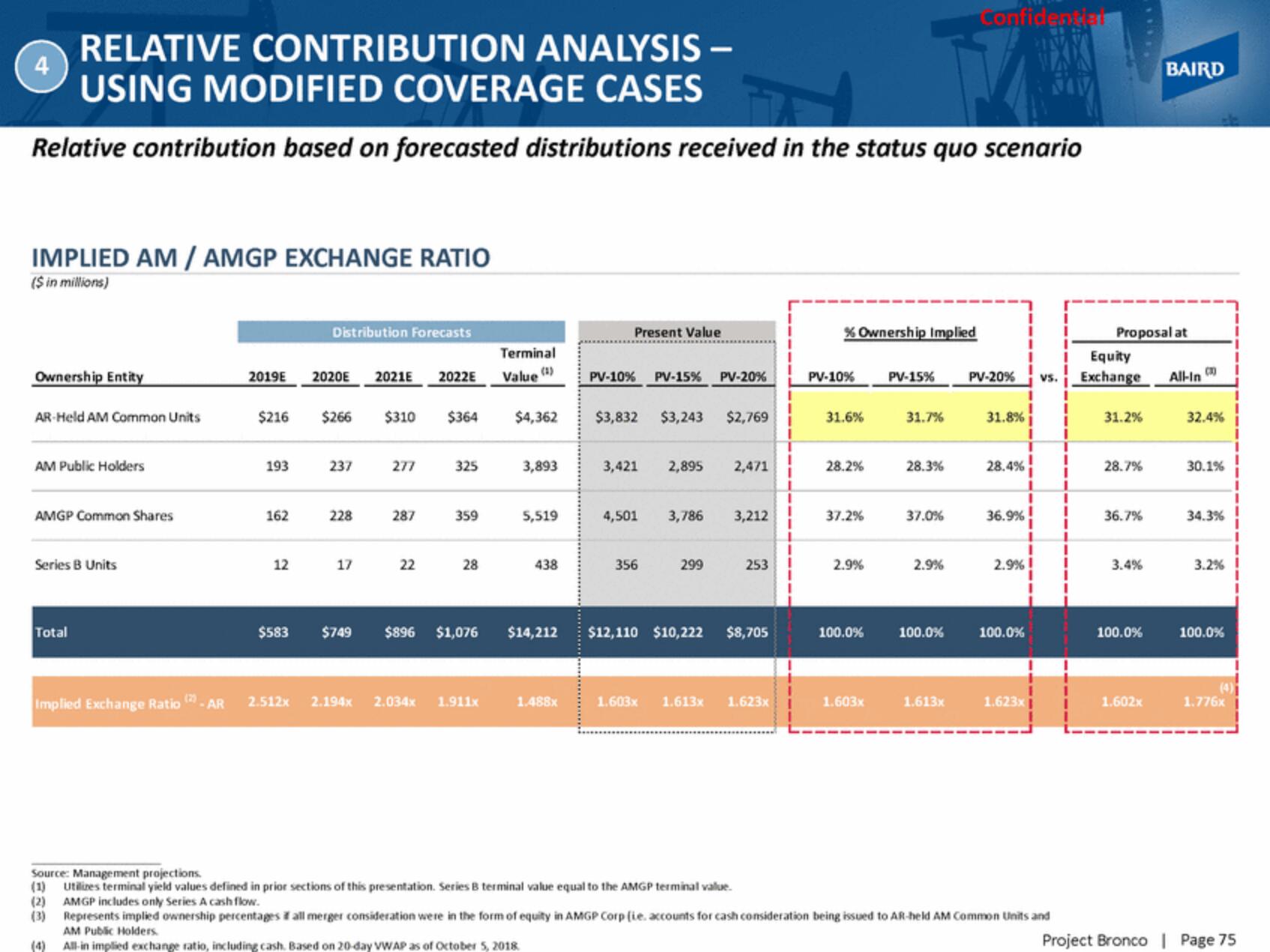

RELATIVE CONTRIBUTION ANALYSIS -

USING MODIFIED COVERAGE CASES

Relative contribution based on forecasted distributions received in the status quo scenario

4

IMPLIED AM / AMGP EXCHANGE RATIO

($ in millions)

Ownership Entity

AR-Held AM Common Units

AM Public Holders

AMGP Common Shares

Series B Units

Total

2019E

(2)

(3)

$216

(4)

193

162

12

$583

Distribution Forecasts

2020E 2021E 2022E

$266 $310 $364

237

228

17

277

287

22

325

359

28

Implied Exchange Ratio -AR 2.512x 2.194x 2.034x 1.911x

Terminal

Value (1)

$4,362

3,893

5,519

438

Present Value

1.488x

PV-10% PV-15% PV-20%

$3,832 $3,243 $2,769

3,421 2,895 2,471

4,501 3,786

356

$749 $896 $1,076 $14,212 $12,110 $10,222

299

3,212

253

$8,705

1.603x 1.613x 1.623x

1

% Ownership Implied

PV-10%

31.6%

28.2%

37.2%

2.9%

100.0%

1.603x

PV-15%

31.7%

28.3%

37.0%

2.9%

100.0%

Confidentiat

1.613x

PV-20%

31.8%

28.4%

36.9%

2.9%!

100.0%

1

1.623x

Source: Management projections.

(1) Utilizes terminal yield values defined in prior sections of this presentation. Series B terminal value equal to the AMGP terminal value.

AMGP includes only Series A cash flow.

Represents implied ownership percentages all merger consideration were in the form of equity in AMGP Corp (ie. accounts for cash consideration being issued to AR-held AM Common Units and

AM Public Holders

All-in implied exchange ratio, including cash. Based on 20-day VWAP as of October 5, 2018

VS.

Proposal at

Equity

Exchange

31.2%

28.7%

36.7%

3.4%

100.0%

BAIRD

1.602x

All-In

(1)

32.4%

30.1%

34.3%

3.2%

100.0%

(4)

1.776x

Project Bronco | Page 75View entire presentation