Bed Bath & Beyond Results Presentation Deck

FISCAL 2022

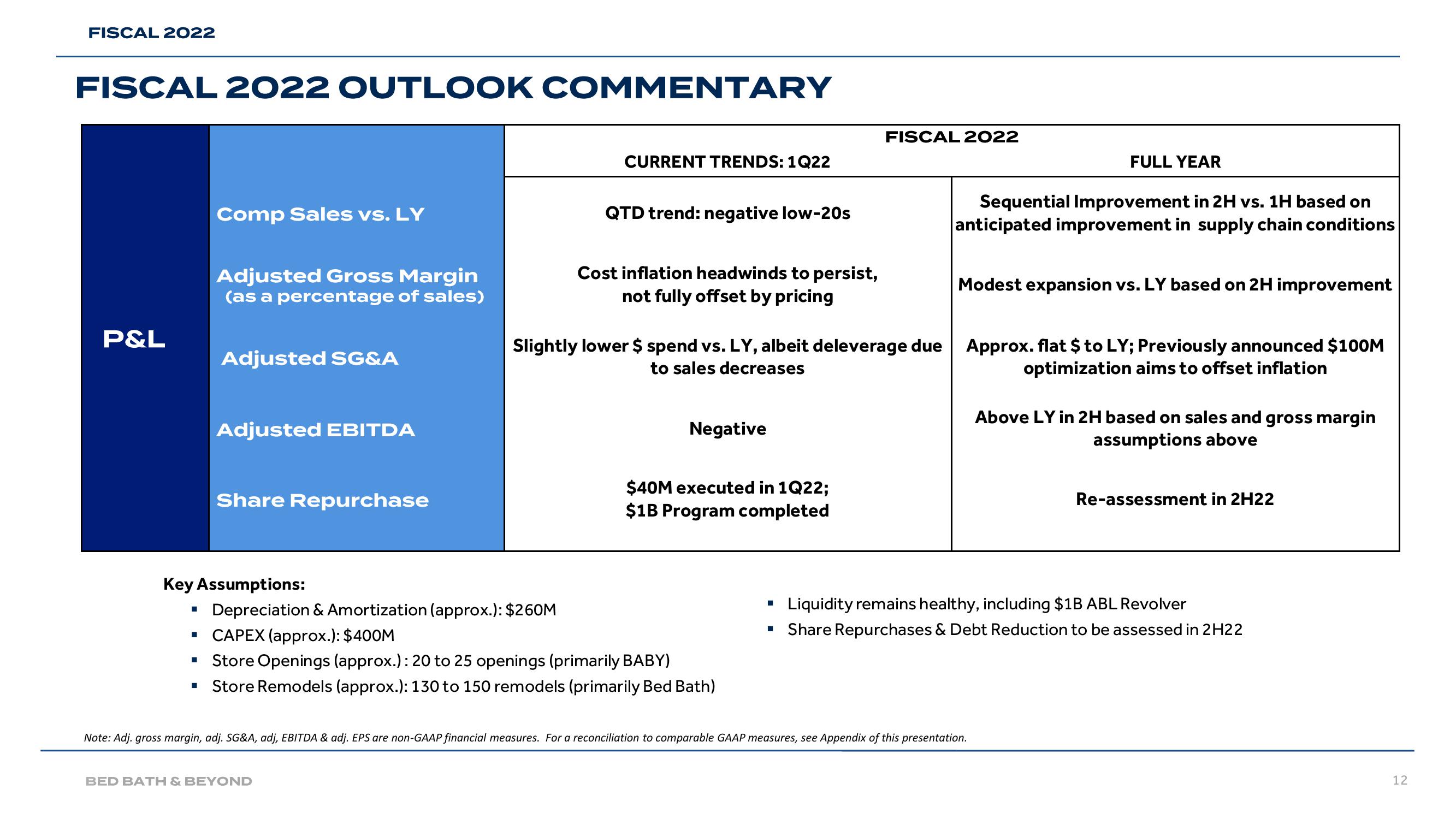

FISCAL 2022 OUTLOOK COMMENTARY

P&L

Comp Sales vs. LY

■

Adjusted Gross Margin

(as a percentage of sales)

■

Adjusted SG&A

Adjusted EBITDA

Key Assumptions:

Share Repurchase

CURRENT TRENDS: 1Q22

QTD trend: negative low-20s

BED BATH & BEYOND

Cost inflation headwinds to persist,

not fully offset by pricing

Depreciation & Amortization (approx.): $260M

▪ CAPEX (approx.): $400M

▪ Store Openings (approx.): 20 to 25 openings (primarily BABY)

Store Remodels (approx.): 130 to 150 remodels (primarily Bed Bath)

Slightly lower $ spend vs. LY, albeit deleverage due

to sales decreases

Negative

$40M executed in 1Q22;

$1B Program completed

I

FISCAL 2022

■

FULL YEAR

Sequential Improvement in 2H vs. 1H based on

anticipated improvement in supply chain conditions

Modest expansion vs. LY based on 2H improvement

Approx. flat $ to LY; Previously announced $100M

optimization aims to offset inflation

Note: Adj. gross margin, adj. SG&A, adj, EBITDA & adj. EPS are non-GAAP financial measures. For a reconciliation to comparable GAAP measures, see Appendix of this presentation.

Above LY in 2H based on sales and gross margin

assumptions above

Re-assessment in 2H22

Liquidity remains healthy, including $1B ABL Revolver

Share Repurchases & Debt Reduction to be assessed in 2H22

12View entire presentation