Owens&Minor Investor Conference Presentation Deck

●

■

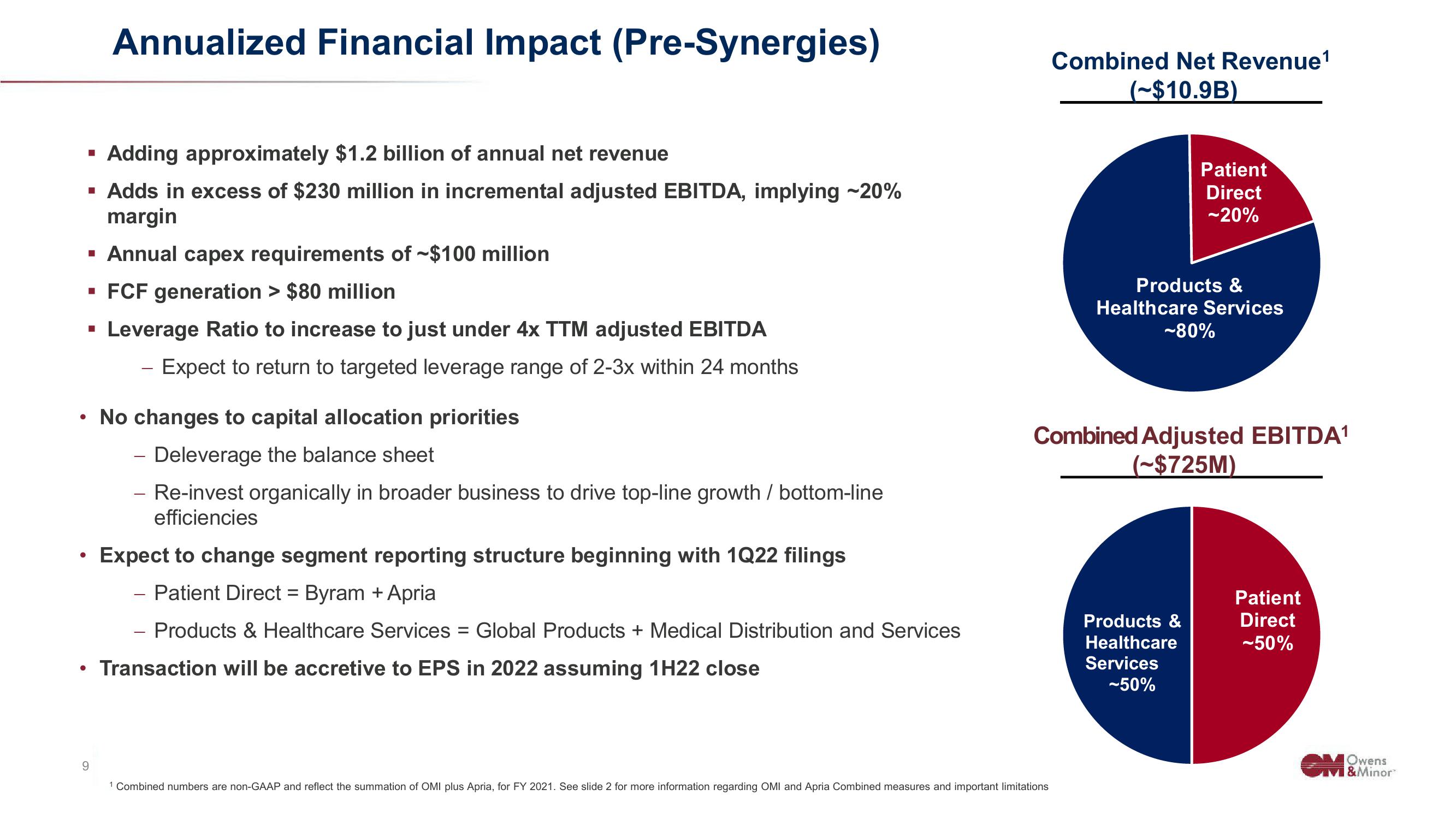

Adding approximately $1.2 billion of annual net revenue

▪ Adds in excess of $230 million in incremental adjusted EBITDA, implying -20%

margin

Annualized Financial Impact (Pre-Synergies)

▪ Annual capex requirements of ~$100 million

▪ FCF generation > $80 million

Leverage Ratio to increase to just under 4x TTM adjusted EBITDA

Expect to return to targeted leverage range of 2-3x within 24 months

■

• No changes to capital allocation priorities

Deleverage the balance sheet

- Re-invest organically in broader business to drive top-line growth / bottom-line

efficiencies

9

Expect to change segment reporting structure beginning with 1Q22 filings

- Patient Direct = Byram + Apria

Products & Healthcare Services = Global Products + Medical Distribution and Services

Transaction will be accretive to EPS in 2022 assuming 1H22 close

-

Combined Net Revenue ¹

(~$10.9B)

1 Combined numbers are non-GAAP and reflect the summation of OMI plus Apria, for FY 2021. See slide 2 for more information regarding OMI and Apria Combined measures and important limitations

Patient

Direct

-20%

Products &

Healthcare Services

-80%

Combined Adjusted EBITDA¹

(~$725M)

Products &

Healthcare

Services

~50%

Patient

Direct

-50%

Owens

VI & MinorView entire presentation