Pershing Square Activist Presentation Deck

Triarc's Offer: What's Really Happening...

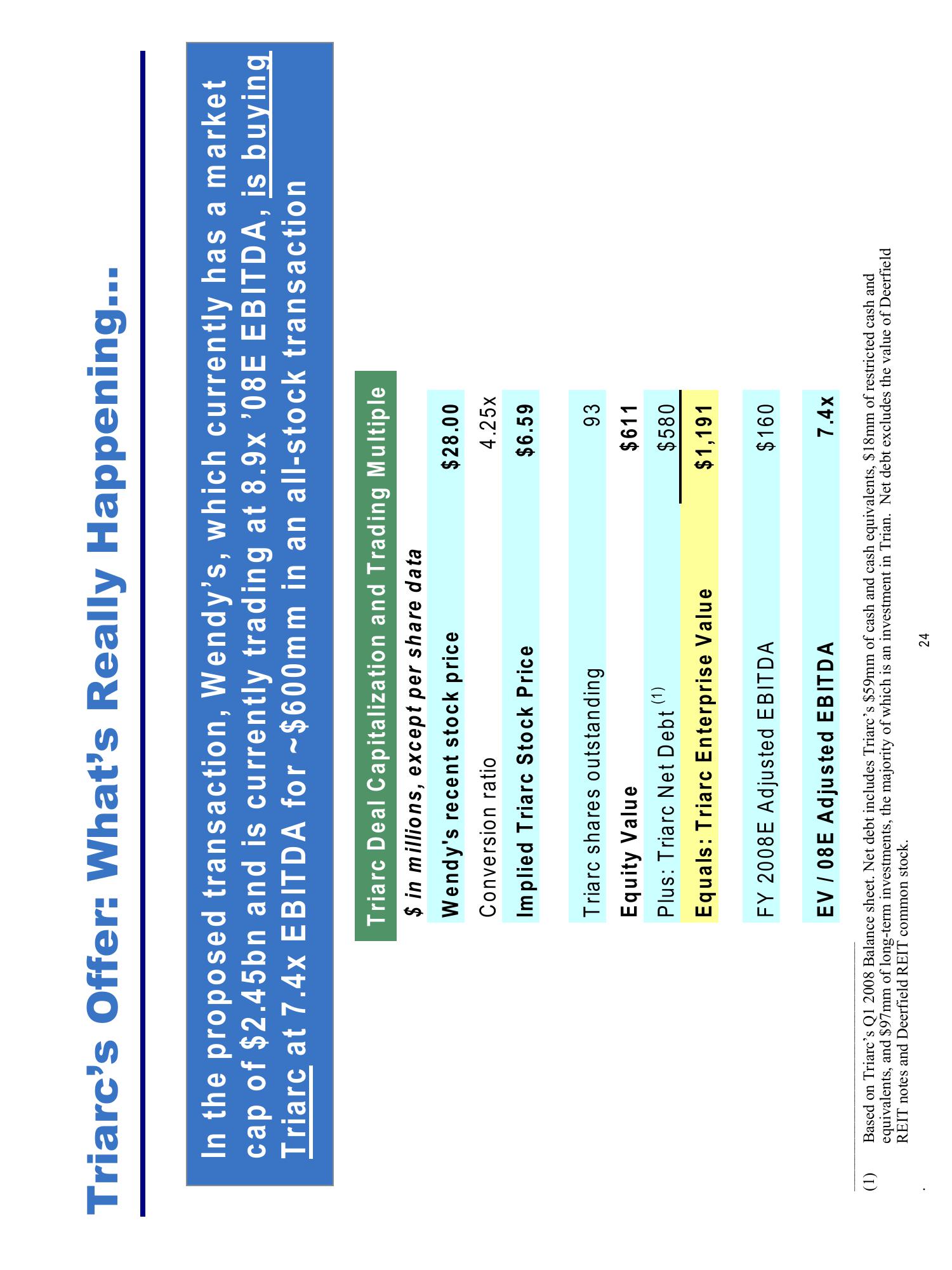

In the proposed transaction, Wendy's, which currently has a market

cap of $2.45bn and is currently trading at 8.9x '08E EBITDA, is buying

Triarc at 7.4x EBITDA for $600mm in an all-stock transaction

(1)

Triarc Deal Capitalization and Trading Multiple

$ in millions, except per share data

Wendy's recent stock price

Conversion ratio

Implied Triarc Stock Price

Triarc shares outstanding

Equity Value

Plus: Triarc Net Debt (¹)

Equals: Triarc Enterprise Value

FY 2008E Adjusted EBITDA

$28.00

24

4.25x

$6.59

93

$611

$580

$1,191

$160

EV / 08E Adjusted EBITDA

7.4x

Based on Triarc's Q1 2008 Balance sheet. Net debt includes Triarc's $59mm of cash and cash equivalents, $18mm of restricted cash and

equivalents, and $97mm of long-term investments, the majority of which is an investment in Trian. Net debt excludes the value of Deerfield

REIT notes and Deerfield REIT common stock.View entire presentation