Liberty Global Results Presentation Deck

RECONCILIATIONS

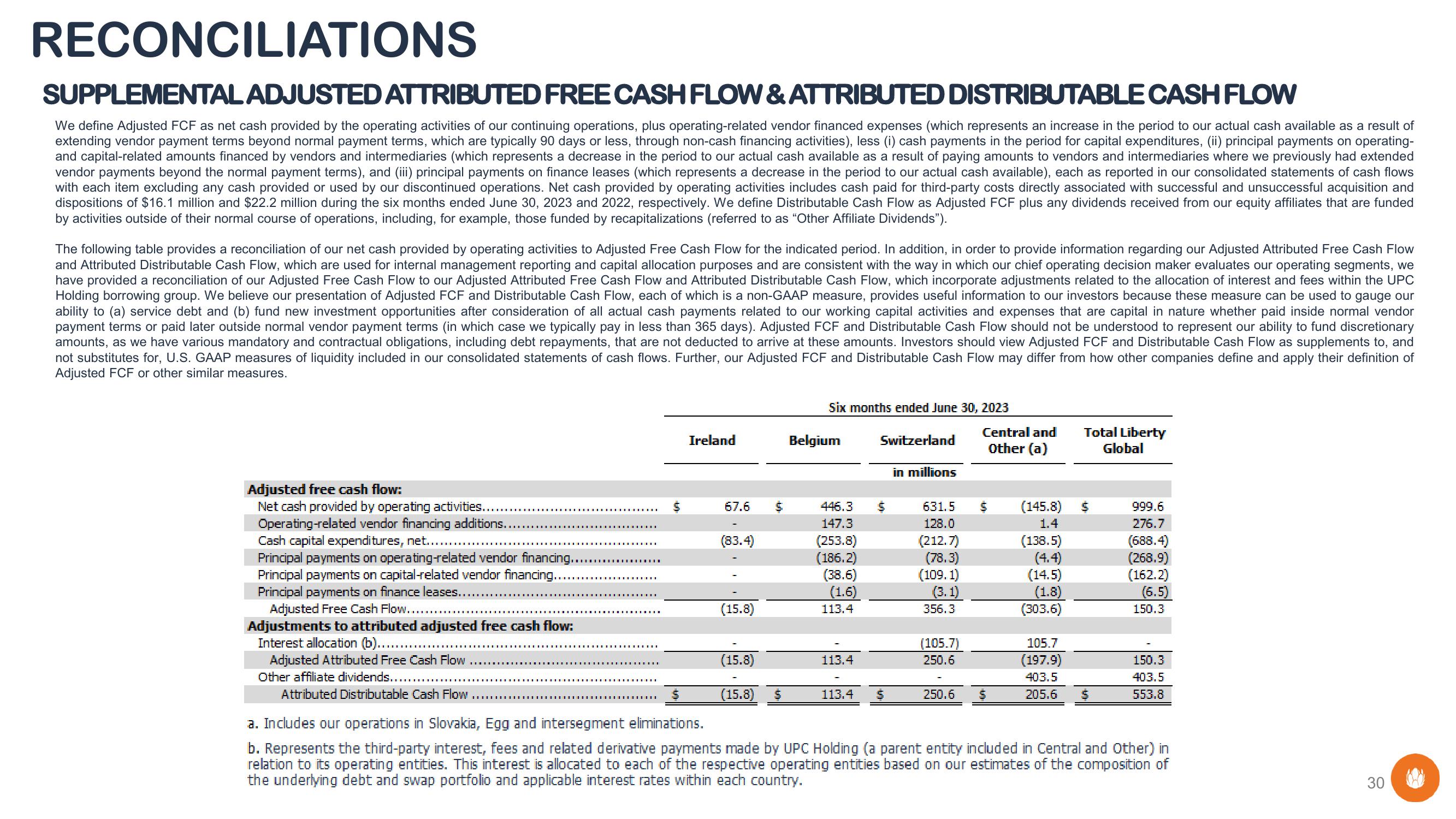

SUPPLEMENTAL ADJUSTED ATTRIBUTED FREE CASH FLOW & ATTRIBUTED DISTRIBUTABLE CASH FLOW

We define Adjusted FCF as net cash provided by the operating activities of our continuing operations, plus operating-related vendor financed expenses (which represents an increase in the period to our actual cash available as a result of

extending vendor payment terms beyond normal payment terms, which are typically 90 days or less, through non-cash financing activities), less (i) cash payments in the period for capital expenditures, (ii) principal payments on operating-

and capital-related amounts financed by vendors and intermediaries (which represents a decrease in the period to our actual cash available as a result of paying amounts to vendors and intermediaries where we previously had extended

vendor payments beyond the normal payment terms), and (iii) principal payments on finance leases (which represents a decrease in the period to our actual cash available), each as reported in our consolidated statements of cash flows

with each item excluding any cash provided or used by our discontinued operations. Net cash provided by operating activities includes cash paid for third-party costs directly associated with successful and unsuccessful acquisition and

dispositions of $16.1 million and $22.2 million during the six months ended June 30, 2023 and 2022, respectively. We define Distributable Cash Flow as Adjusted FCF plus any dividends received from our equity affiliates that are funded

by activities outside of their normal course of operations, including, for example, those funded by recapitalizations (referred to as "Other Affiliate Dividends").

The following table provides a reconciliation of our net cash provided by operating activities to Adjusted Free Cash Flow for the indicated period. In addition, in order to provide information regarding our Adjusted Attributed Free Cash Flow

and Attributed Distributable Cash Flow, which are used for internal management reporting and capital allocation purposes and are consistent with the way in which our chief operating decision maker evaluates our operating segments, we

have provided a reconciliation of our Adjusted Free Cash Flow to our Adjusted Attributed Free Cash Flow and Attributed Distributable Cash Flow, which incorporate adjustments related to the allocation of interest and fees within the UPC

Holding borrowing group. We believe our presentation of Adjusted FCF and Distributable Cash Flow, each of which is a non-GAAP measure, provides useful information to our investors because these measure can be used to gauge our

ability to (a) service debt and (b) fund new investment opportunities after consideration of all actual cash payments related to our working capital activities and expenses that are capital in nature whether paid inside normal vendor

payment terms or paid later outside normal vendor payment terms (in which case we typically pay in less than 365 days). Adjusted FCF and Distributable Cash Flow should not be understood to represent our ability to fund discretionary

amounts, as we have various mandatory and contractual obligations, including debt repayments, that are not deducted to arrive at these amounts. Investors should view Adjusted FCF and Distributable Cash Flow as supplements to, and

not substitutes for, U.S. GAAP measures of liquidity included in our consolidated statements of cash flows. Further, our Adjusted FCF and Distributable Cash Flow may differ from how other companies define and apply their definition of

Adjusted FCF or other similar measures.

Adjusted free cash flow:

Net cash provided by operating activities....

Operating-related vendor financing additions.

Cash capital expenditures, net........

Principal payments on operating-related vendor financing...

Principal payments on capital-related vendor financing...

Principal payments on finance leases.....

Adjusted Free Cash Flow.........

Adjustments to attributed adjusted free cash flow:

Interest allocation (b)............

Adjusted Attributed Free Cash Flow

Other affiliate dividends...

Attributed Distributable Cash Flow

………………………***

****

5

Ireland

67.6

(83.4)

(15.8)

(15.8)

S

(15.8) $

Six months ended June 30, 2023

Belgium

446.3

147.3

(253.8)

(186.2)

(38.6)

(1.6)

113.4

113.4

Switzerland

5

113.4 $

in millions

631.5

128.0

(212.7)

(78.3)

(109.1)

(3.1)

356.3

(105.7)

250.6

Central and

Other (a)

250.6 S

(145.8)

1.4

(138.5)

(4.4)

(14.5)

(1.8)

(303.6)

Total Liberty

Global

in

105.7

(197.9)

403.5

205.6 $

999.6

276.7

(688.4)

(268.9)

(162.2)

(6.5)

150.3

150.3

403.5

553.8

a. Includes our operations in Slovakia, Egg and intersegment eliminations.

b. Represents the third-party interest, fees and related derivative payments made by UPC Holding (a parent entity included in Central and Other) in

relation to its operating entities. This interest is allocated to each of the respective operating entities based on our estimates of the composition of

the underlying debt and swap portfolio and applicable interest rates within each country.

30

(View entire presentation