OppFi SPAC Presentation Deck

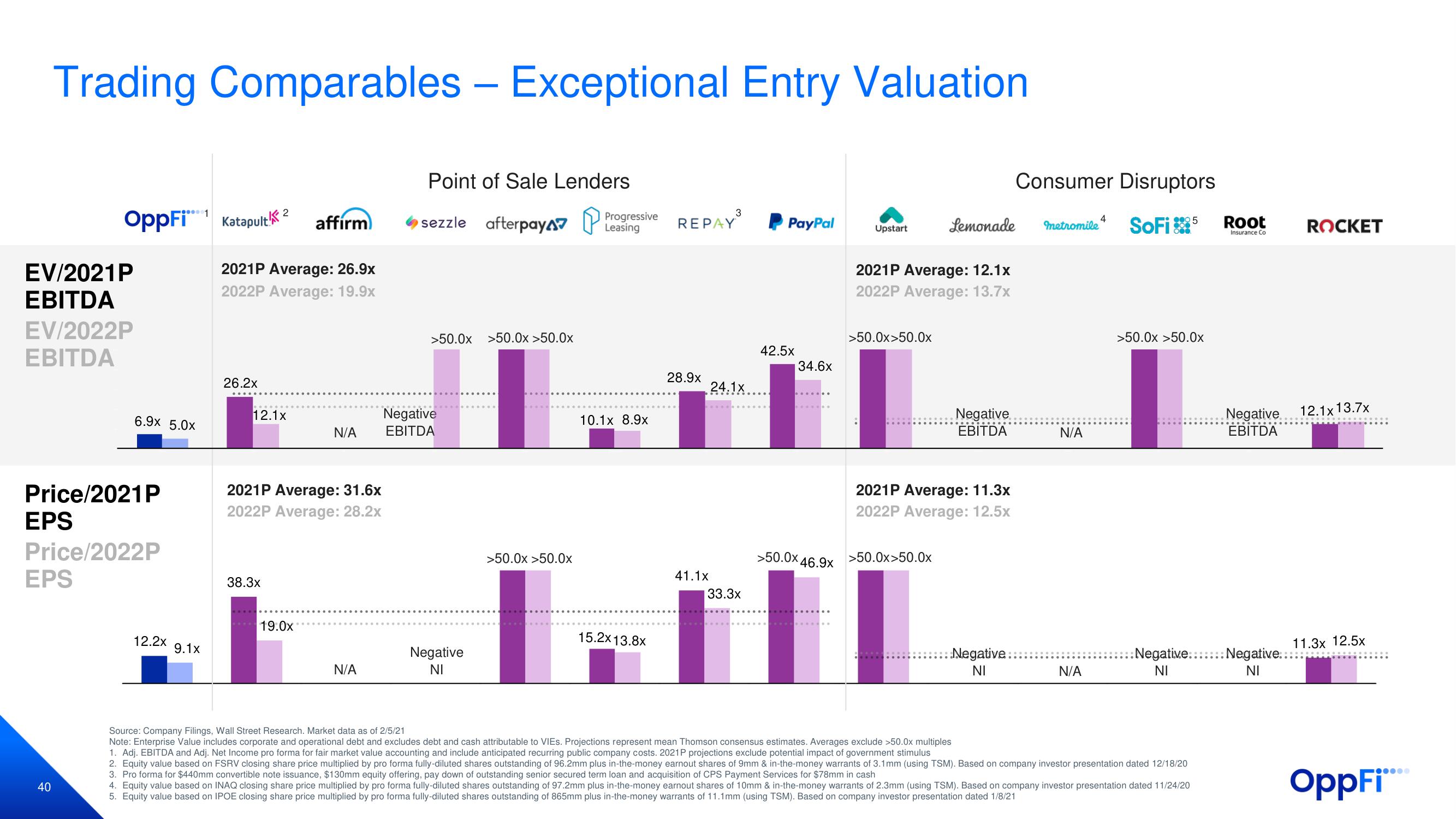

Trading Comparables - Exceptional Entry Valuation

EV/2021 P

EBITDA

EV/2022P

EBITDA

OppFi Katapult 2

EPS

40

Price/2021 P

EPS

Price/2022P

6.9x 5.0x

12.2x

9.1x

2021P Average: 26.9x

2022P Average: 19.9x

26.2x

....

12.1x

affirm

38.3x

2021P Average: 31.6x

2022P Average: 28.2x

19.0x

N/A

N/A

Point of Sale Lenders

sezzle afterpay

>50.0x >50.0x>50.0x

Negative

EBITDA

Negative

NI

>50.0x >50.0x

Progressive

Leasing

10.1x 8.9x

15.2×13.8x

REPAY

28.9x

3

41.1x

24.1x

33.3x

PayPal

42.5x

34.6x

>50.0x 46.9x

Upstart

2021P Average: 12.1x

2022P Average: 13.7x

>50.0x>50.0x

Lemonade metromile

>50.0x>50.0x

Negative

EBITDA

2021P Average: 11.3x

2022P Average: 12.5x

Consumer Disruptors

SoFi 5

::Negative::

NI

N/A

N/A

4

>50.0x >50.0x

Root

Insurance Co

Source: Company Filings, Wall Street Research. Market data as of 2/5/21

Note: Enterprise Value includes corporate and operational debt and excludes debt and cash attributable to VIEs. Projections represent mean Thomson consensus estimates. Averages exclude >50.0x multiples

1. Adj. EBITDA and Adj. Net Income pro forma for fair market value accounting and include anticipated recurring public company costs. 2021P projections exclude potential impact of government stimulus

2. Equity value based on FSRV closing share price multiplied by pro forma fully-diluted shares outstanding of 96.2mm plus in-the-money earnout shares of 9mm & in-the-money warrants of 3.1 mm (using TSM). Based on company investor presentation dated 12/18/20

3. Pro forma for $440mm convertible note issuance, $130mm equity offering, pay down of outstanding senior secured term loan and acquisition of CPS Payment Services for $78mm in cash

4. Equity value based on INAQ closing share price multiplied by pro forma fully-diluted shares outstanding of 97.2mm plus in-the-money earnout shares of 10mm & in-the-money warrants of 2.3mm (using TSM). Based on company investor presentation dated 11/24/20

5. Equity value based on IPOE closing share price multiplied by pro forma fully-diluted shares outstanding of 865mm plus in-the-money warrants of 11.1mm (using TSM). Based on company investor presentation dated 1/8/21

Negative

EBITDA

:Negative::::::: Negative.:::

NI

NI

ROCKET

12.1x 13.7x

11.3x 12.5x

OppFi****View entire presentation