Amplitude Results Presentation Deck

(8

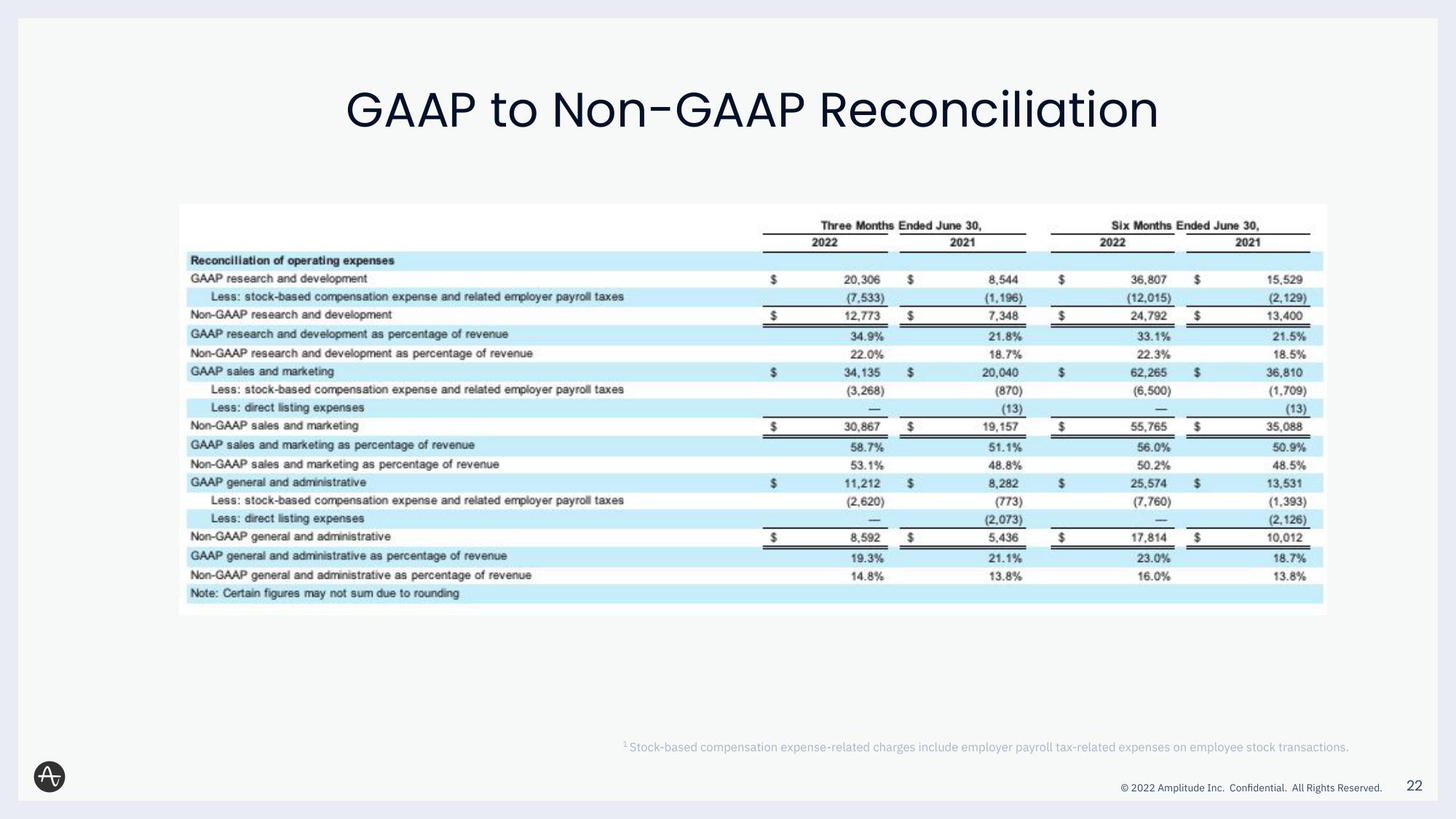

GAAP to Non-GAAP Reconciliation

Reconciliation of operating expenses

GAAP research and development

Less: stock-based compensation expense and related employer payroll taxes

Non-GAAP research and development

GAAP research and development as percentage of revenue

Non-GAAP research and development as percentage of revenue

GAAP sales and marketing

Less: stock-based compensation expense and related employer payroll taxes

Less: direct listing expenses

Non-GAAP sales and marketing

GAAP sales and marketing as percentage of revenue

Non-GAAP sales and marketing as percentage of revenue

GAAP general and administrative

Less: stock-based compensation expense and related employer payroll taxes

Less: direct listing expenses

Non-GAAP general and administrative

GAAP general and administrative as percentage of revenue

Non-GAAP general and administrative as percentage of revenue

Note: Certain figures may not sum due to rounding

$

$

$

$

$

$

Three Months Ended June 30,

2022

2021

20,306

(7.533)

12,773

34.9%

22.0%

34,135

(3,268)

$

8,592

19.3%

14.8%

$

30,867 $

58.7%

53.1%

11,212

(2,620)

$

$

8,544

(1,196)

7,348

21.8%

18.7%

20,040

(870)

(13)

19,157

51.1%

48.8%

8,282

(773)

(2,073)

5,436

21.1%

13.8%

$

$

$

$

$

$

Six Months Ended June 30,

2022

2021

36,807

(12,015)

24,792

33.1%

22.3%

62,265 $

(6,500)

55,765

56.0%

50.2%

25,574

(7,760)

17,814

23.0%

16.0%

$

$

$

$

15,529

(2,129)

13,400

21.5%

18.5%

36,810

(1,709)

(13)

35,088

50.9%

48.5%

13,531

(1,393)

(2,126)

10,012

18.7%

13.8%

¹Stock-based compensation expense-related charges include employer payroll tax-related expenses on employee stock transactions.

Ⓒ2022 Amplitude Inc. Confidential. All Rights Reserved.

22View entire presentation