Bausch+Lomb Investor Conference Presentation Deck

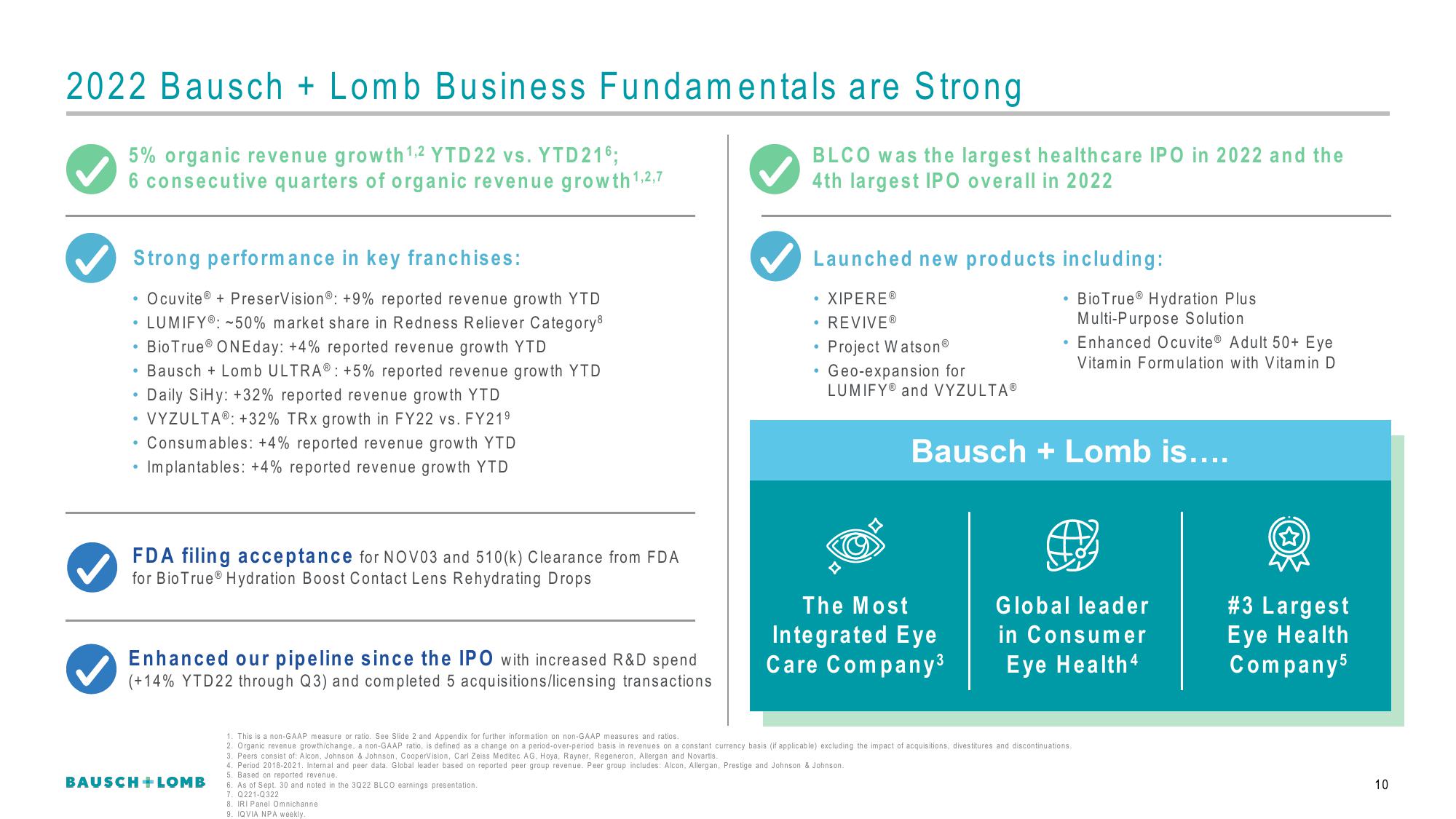

2022 Bausch + Lomb Business Fundamentals are Strong

5% organic revenue growth ¹,2 YTD 22 vs. YTD216;

6 consecutive quarters of organic revenue growth ¹,2,7

Strong performance in key franchises:

Ocuvite® + PreserVision®: +9% reported revenue growth YTD

• LUMIFY®: -50% market share in Redness Reliever Category

Bio True ONEday: +4% reported revenue growth YTD

Bausch+Lomb ULTRA®: +5% reported revenue growth YTD

Daily SiHy: +32% reported revenue growth YTD

VYZULTA®: +32% TRx growth in FY22 vs. FY21⁹

• Consumables: +4% reported revenue growth YTD

Implantables: +4% reported revenue growth YTD

●

.

FDA filing acceptance for NOV03 and 510(k) Clearance from FDA

for Bio True® Hydration Boost Contact Lens Rehydrating Drops

Enhanced our pipeline since the IPO with increased R&D spend

(+14% YTD22 through Q3) and completed 5 acquisitions/licensing transactions

BAUSCH + LOMB

BLCO was the largest healthcare IPO in 2022 and the

4th largest IPO overall in 2022

Launched new products including:

• XIPEREⓇ

• REVIVEⓇ

Project Watson®

Geo-expansion for

LUMIFY® and VYZULTAⓇ

The Most

Integrated Eye

Care Company³

3. Peers consist of: Alcon, Johnson & Johnson, CooperVision, Carl Zeiss Meditec AG. Hoya, Rayner, Regeneron, Allergan and Novartis.

4. Period 2018-2021. Internal and peer data. Global leader based on reported peer group revenue. Peer group includes: Alcon. Allergan, Prestige and Johnson & Johnson.

5. Based on reported revenue.

6. As of Sept. 30 and noted in the 3022 BLCO earnings presentation.

7. Q221-Q322

8. IRI Panel Omnichanne

9. IQVIA NPA weekly.

Bio True® Hydration Plus

Multi-Purpose Solution

• Enhanced Ocuvite® Adult 50+ Eye

Vitamin Formulation with Vitamin D

Bausch + Lomb is....

1. This is a non-GAAP measure or ratio. See Slide 2 and Appendix for further information on non-GAAP measures and ratios.

2. Organic revenue growth/change, a non-GAAP ratio, is defined as a change on a period-over-period basis in revenues on a constant currency basis (if applicable) excluding the impact of acquisitions, divestitures and discontinuations.

Global leader

in Consumer

Eye Health 4

#3 Largest

Eye Health

Company5

10View entire presentation