Hydrafacial Investor Day Presentation Deck

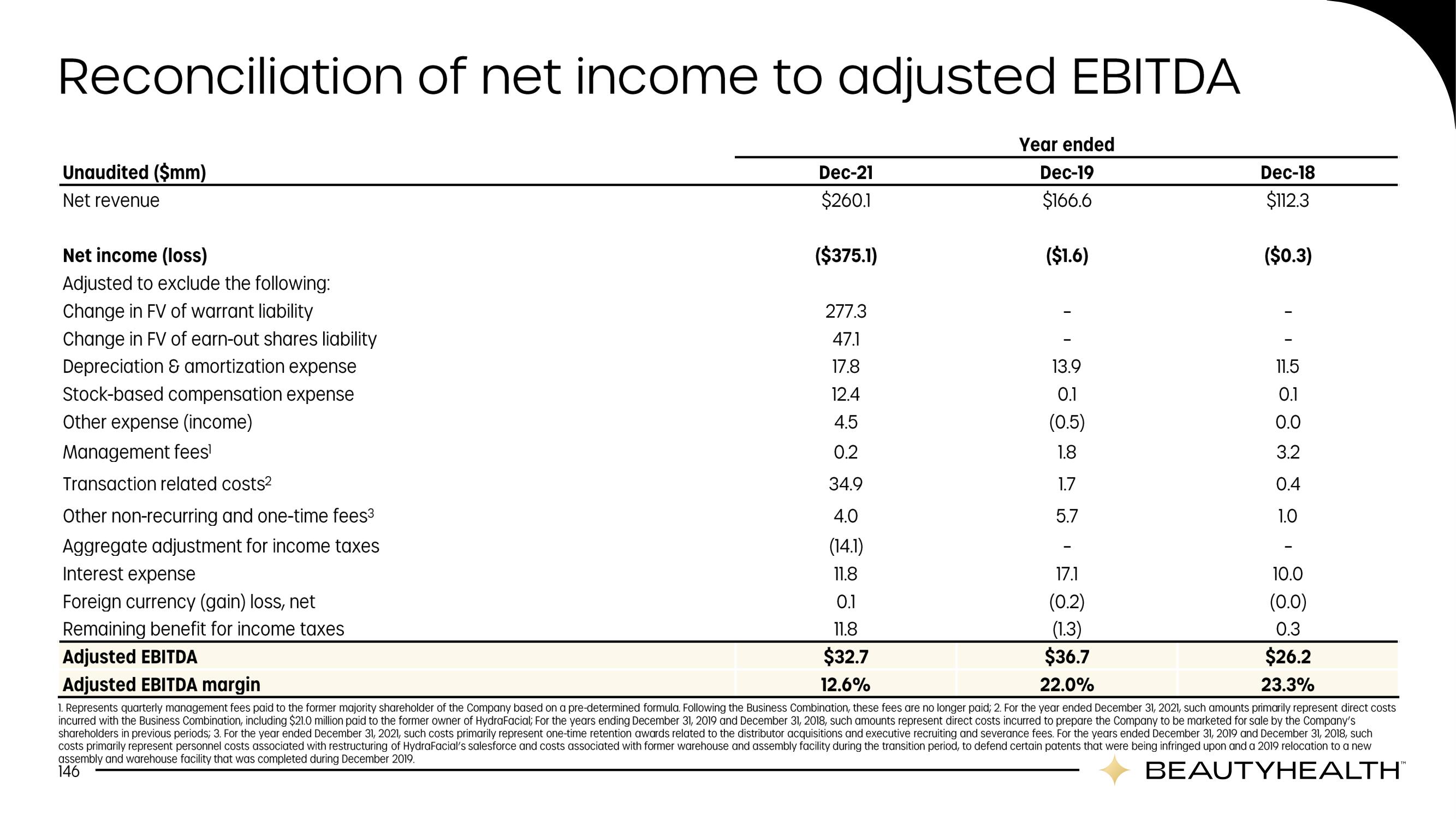

Reconciliation of net income to adjusted EBITDA

Unaudited ($mm)

Net revenue

Net income (loss)

Adjusted to exclude the following:

Change in FV of warrant liability

Change in FV of earn-out shares liability

Depreciation & amortization expense

Stock-based compensation expense

Other expense (income)

Management fees¹

Transaction related costs²

Dec-21

$260.1

($375.1)

277.3

47.1

17.8

12.4

4.5

0.2

34.9

4.0

(14.1)

11.8

0.1

11.8

$32.7

12.6%

Year ended

Dec-19

$166.6

($1.6)

13.9

0.1

(0.5)

1.8

1.7

5.7

Dec-18

$112.3

($0.3)

11.5

0.1

0.0

3.2

0.4

1.0

Other non-recurring and one-time fees³

Aggregate adjustment for income taxes

Interest expense

17.1

Foreign currency (gain) loss, net

(0.2)

Remaining benefit for income taxes

(1.3)

Adjusted EBITDA

$36.7

Adjusted EBITDA margin

22.0%

1. Represents quarterly management fees paid to the former majority shareholder of the Company based on a pre-determined formula. Following the Business Combination, these fees are no longer paid; 2. For the year ended December 31, 2021, such amounts primarily represent direct costs

incurred with the Business Combination, including $21.0 million paid to the former owner of HydraFacial; For the years ending December 31, 2019 and December 31, 2018, such amounts represent direct costs incurred to prepare the Company to be marketed for sale by the Company's

shareholders in previous periods; 3. For the year ended December 31, 2021, such costs primarily represent one-time retention awards related to the distributor acquisitions and executive recruiting and severance fees. For the years ended December 31, 2019 and December 31, 2018, such

costs primarily represent personnel costs associated with restructuring of HydraFacial's salesforce and costs associated with former warehouse and assembly facility during the transition period, to defend certain patents that were being infringed upon and a 2019 relocation to a new

assembly and warehouse facility that was completed during December 2019.

146

BEAUTYHEALTH™

10.0

(0.0)

0.3

$26.2

23.3%View entire presentation