Baird Investment Banking Pitch Book

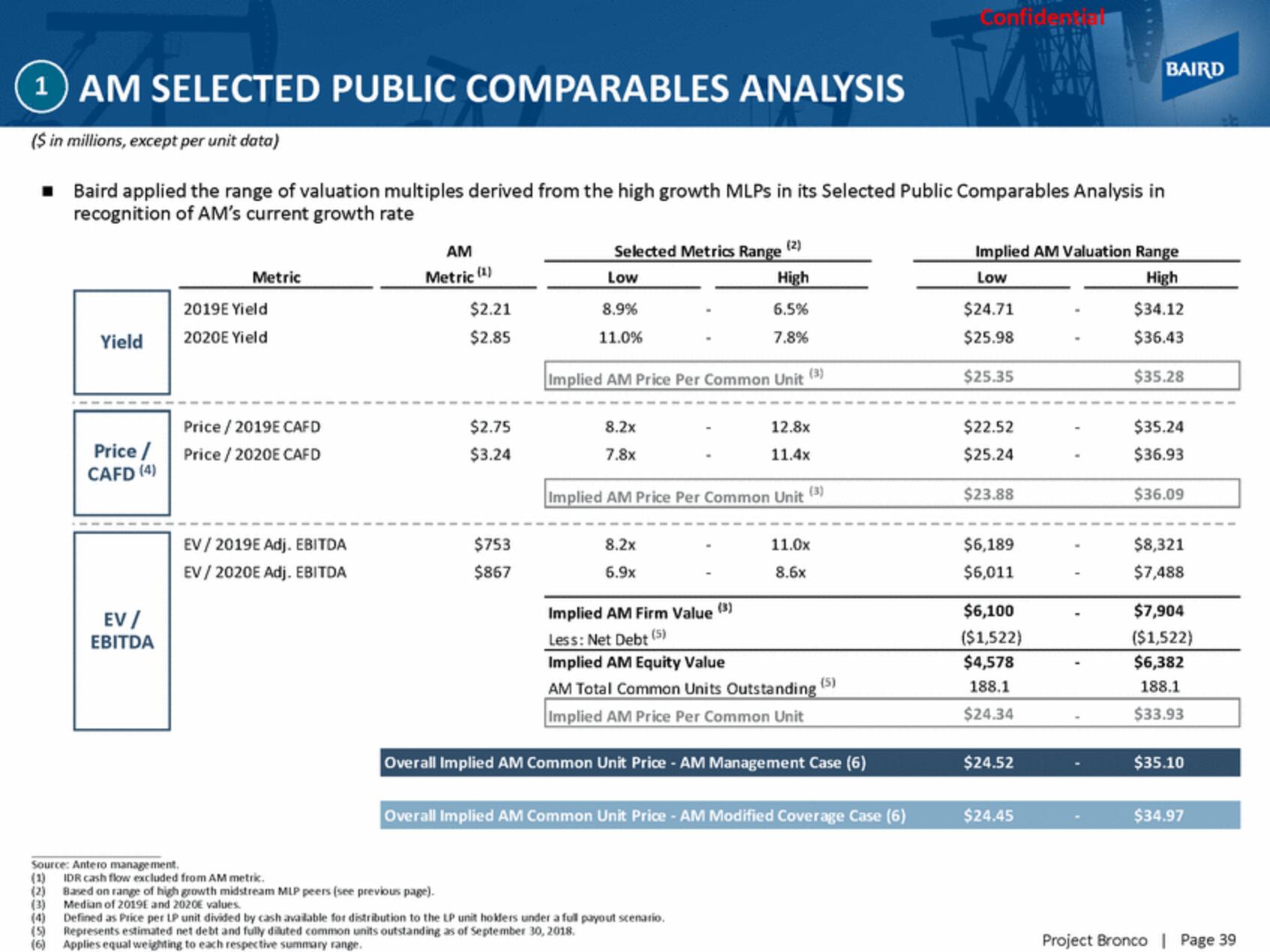

AM SELECTED PUBLIC COMPARABLES ANALYSIS

($ in millions, except per unit data)

■

Baird applied the range of valuation multiples derived from the high growth MLPs in its Selected Public Comparables Analysis in

recognition of AM's current growth rate

(1)

(2)

(3)

(4)

Yield

(5)

(6)

Price /

CAFD (4)

Source: Antero management.

EV/

EBITDA

Metric

2019E Yield

2020E Yield

Price / 2019E CAFD

Price / 2020E CAFD

EV/2019E Adj. EBITDA

EV/ 2020E Adj. EBITDA

AM

Metric (1)

$2.21

$2.85

$2.75

$3.24

IDR cash flow excluded from AM metric.

Based on range of high growth midstream MLP peers (see previous page).

Median of 2019E and 2020E values.

$753

$867

Selected Metrics Range (2)

Low

High

6.5%

7.8%

8.9%

11.0%

Implied AM Price Per Common Unit

(3)

8.2x

7.8x

Implied AM Price Per Common Unit

(3)

8.2x

6.9x

12.8x

11.4x

Implied AM Firm Value

Less: Net Debt (5)

Implied AM Equity Value

AM Total Common Units Outstanding

Implied AM Price Per Common Unit

Overall Implied AM Common Unit Price - AM Management Case (6)

11.0x

8.6x

Defined as Price per LP unit divided by cash available for distribution to the LP unit holders under a full payout scenario.

Represents estimated net debt and fully diluted common units outstanding as of September 30, 2018.

Applies equal weighting to each respective summary range.

Overall Implied AM Common Unit Price - AM Modified Coverage Case (6)

(5)

Confidential

Implied AM Valuation Range

Low

High

$24.71

$25.98

$25.35

$22.52

$25.24

$23.88

$6,189

$6,011

$6,100

($1,522)

$4,578

188.1

$24.34

$24.52

BAIRD

$24.45

$34.12

$36.43

$35.28

$35.24

$36.93

$36.09

$8,321

$7,488

$7,904

($1,522)

$6,382

188.1

$33.93

$35.10

$34.97

Project Bronco | Page 39View entire presentation