Baird Investment Banking Pitch Book

CASE STUDY: TALLGRASS SIMPLIFICATION (CONT.)

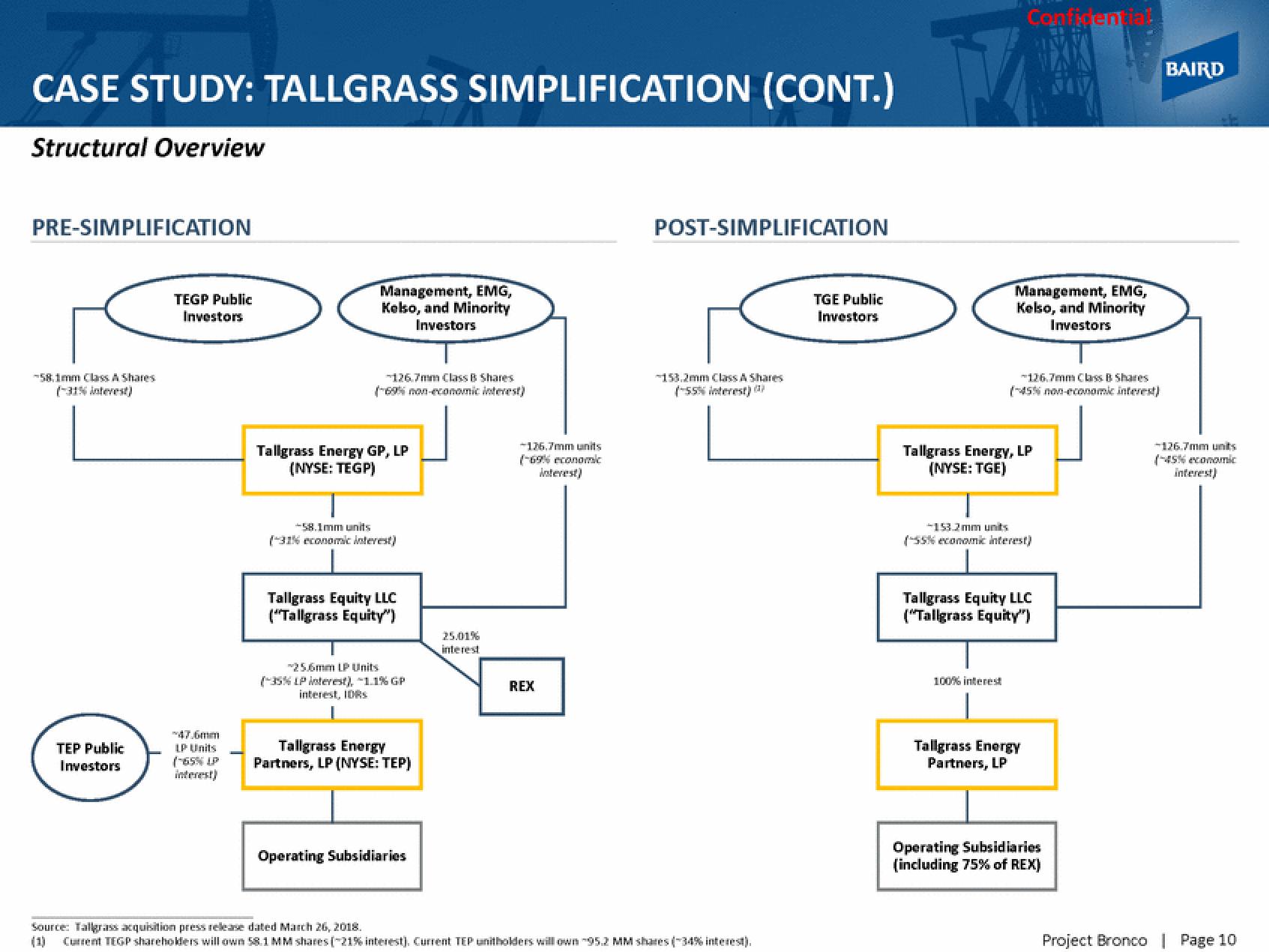

Structural Overview

PRE-SIMPLIFICATION

-58,1mm Class A Shares

(-31% interest)

TEP Public

Investors

TEGP Public

Investors

47.6mm

LP Units

(-65% LP

Management, EMG,

Kelso, and Minority

Investors

126.7mm Class B Shares

(69% non-economic interest)

Tallgrass Energy GP, LP

(NYSE: TEGP)

-58.1mm units

(31% economic interest)

Tallgrass Equity LLC

("Tallgrass Equity")

25.6mm LP Units

(-35% LP interest), 1.1% GP

interest, IDRS

Tallgrass Energy

Partners, LP (NYSE: TEP)

Operating Subsidiaries

25.01%

interest

+126,7mm units

(-69% economic

interest)

REX

POST-SIMPLIFICATION

-153.2mm Class & Shares

(-55% interest) (3)

Source: Tallgrass acquisition press release dated March 26, 2018.

Current TEGP shareholders will own 58.1 MM shares (-21% interest), Current TEP unitholders will own 95.2 MM shares (-34% interest).

TGE Public

Investors

Confidential

Management, EMG,

Kelso, and Minority

Investors

126,7mm Class B Shares

(-45% non-economic interest)

Tallgrass Energy, LP

(NYSE: TGE)

100% interes

-153.2mm units

(55% economic interest)

Tallgrass Equity LLC

("Tallgrass Equity")

Tallgrass Energy

Partners, LP

Operating Subsidiaries

(including 75% of REX)

BAIRD

126.7mm units

(-45% economic

interest)

Project Bronco | Page 10View entire presentation