Telia Company Results Presentation Deck

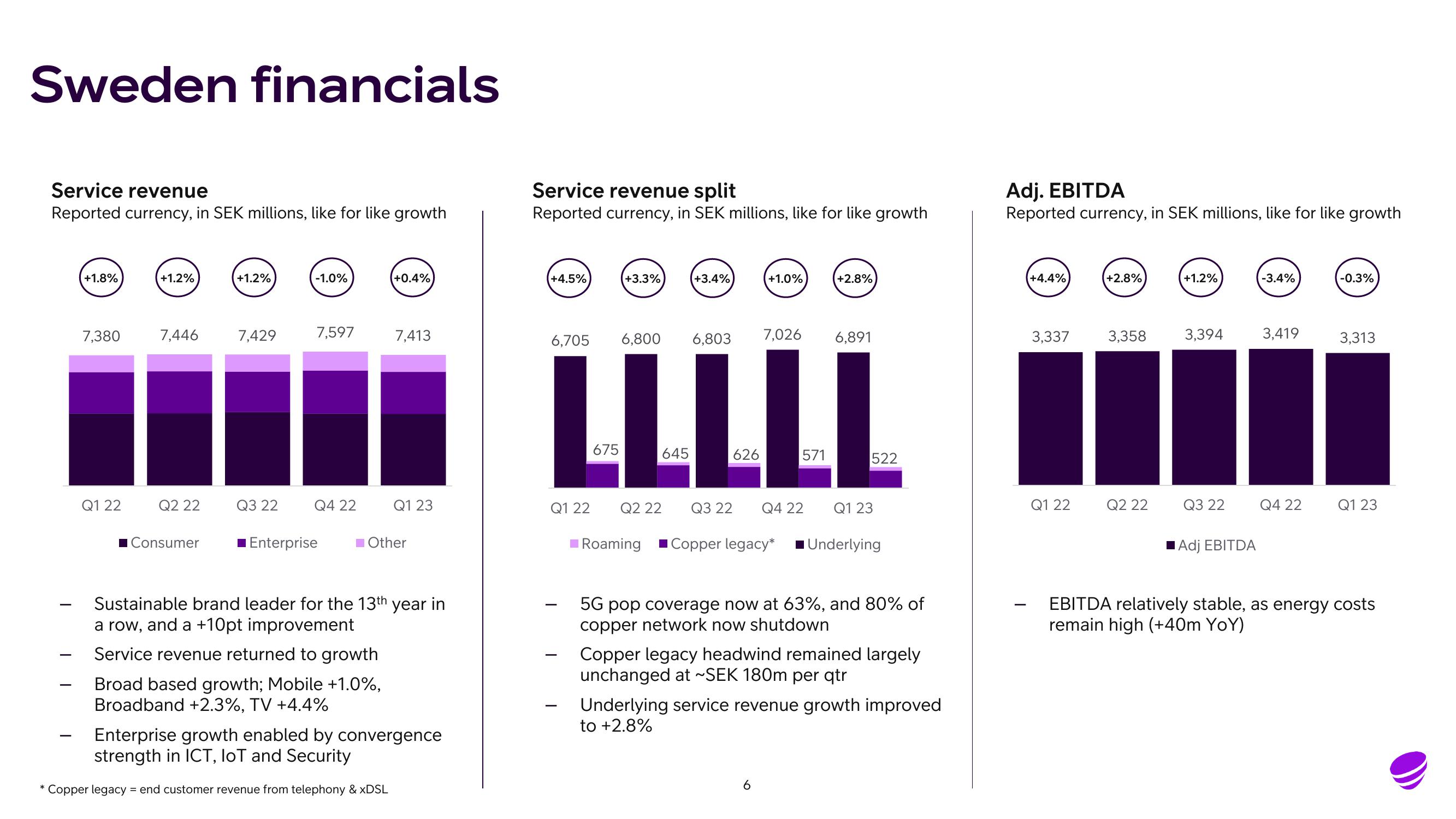

Sweden financials

Service revenue

Reported currency, in SEK millions, like for like growth

+1.8%

7,380

Q1 22

+1.2%

7,446

Q2 22

■Consumer

+1.2%

7,429

Q3 22

-1.0%

7,597

Q4 22

+0.4%

Broad based growth; Mobile +1.0%,

Broadband +2.3%, TV +4.4%

7,413

■ Enterprise ■ Other

Q1 23

Sustainable brand leader for the 13th year in

a row, and a +10pt improvement

Service revenue returned to growth

Copper legacy = end customer revenue from telephony & xDSL

Enterprise growth enabled by convergence

strength in ICT, IoT and Security

Service revenue split

Reported currency, in SEK millions, like for like growth

+4.5%

6,705

+3.3%

Q1 22

6,800

Q2 22

+3.4%

6,803

LLLLL

Q3 22

Roaming

+1.0%

7,026

+2.8%

Q4 22

6,891

522

Q1 23

Copper legacy* ■Underlying

5G pop coverage now at 63%, and 80% of

copper network now shutdown

Copper legacy headwind remained largely

unchanged at ~SEK 180m per qtr

Underlying service revenue growth improved

to +2.8%

Adj. EBITDA

Reported currency, in SEK millions, like for like growth

+4.4%

3,337

Q1 22

+2.8%

3,358

Q2 22

+1.2%

3,394

Q3 22

Adj EBITDA

-3.4%

3,419

Q4 22

-0.3%

3,313

Q1 23

EBITDA relatively stable, as energy costs

remain high (+40m YoY)View entire presentation