Flutter Results Presentation Deck

Financial Review

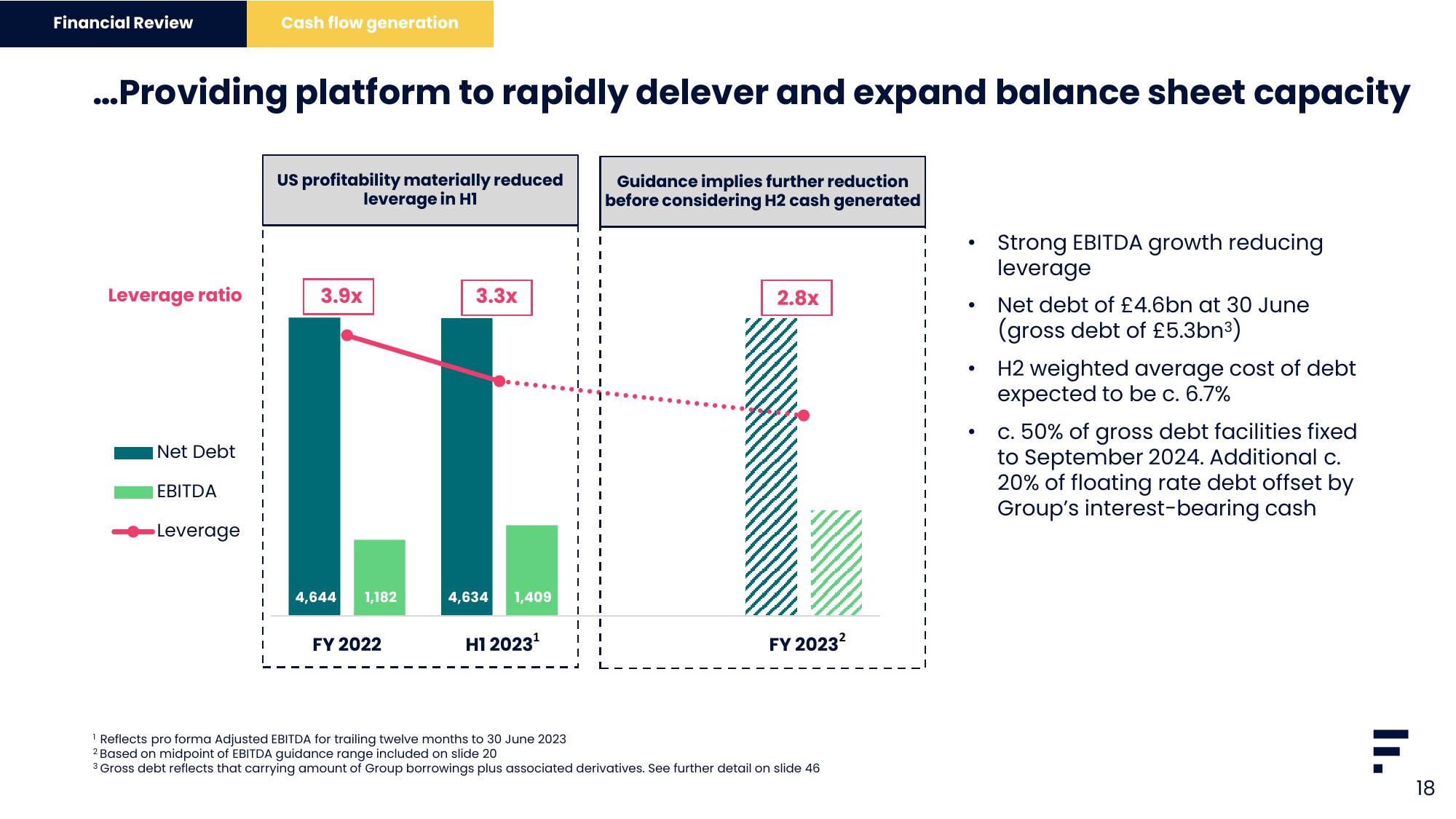

...Providing platform to rapidly delever and expand balance sheet capacity

Leverage ratio

Net Debt

EBITDA

Cash flow generation

-Leverage

US profitability materially reduced

leverage in H1

3.9x

4,644 1,182

FY 2022

3.3x

4,634 1,409

H1 20231

I

1

1

1

I

T

I

11

I

T

T

I

I

I

T

I

T

I

1

I

I

Guidance implies further reduction

before considering H2 cash generated

2.8x

FY 2023²

¹ Reflects pro forma Adjusted EBITDA for trailing twelve months to 30 June 2023

2 Based on midpoint of EBITDA guidance range included on slide 20

3 Gross debt reflects that carrying amount of Group borrowings plus associated derivatives. See further detail on slide 46

I

I

I

●

●

●

Strong EBITDA growth reducing

leverage

Net debt of £4.6bn at 30 June

(gross debt of £5.3bn³)

H2 weighted average cost of debt

expected to be c. 6.7%

c. 50% of gross debt facilities fixed

to September 2024. Additional c.

20% of floating rate debt offset by

Group's interest-bearing cash

II.

F

18View entire presentation