BlackRock Investor Day Presentation Deck

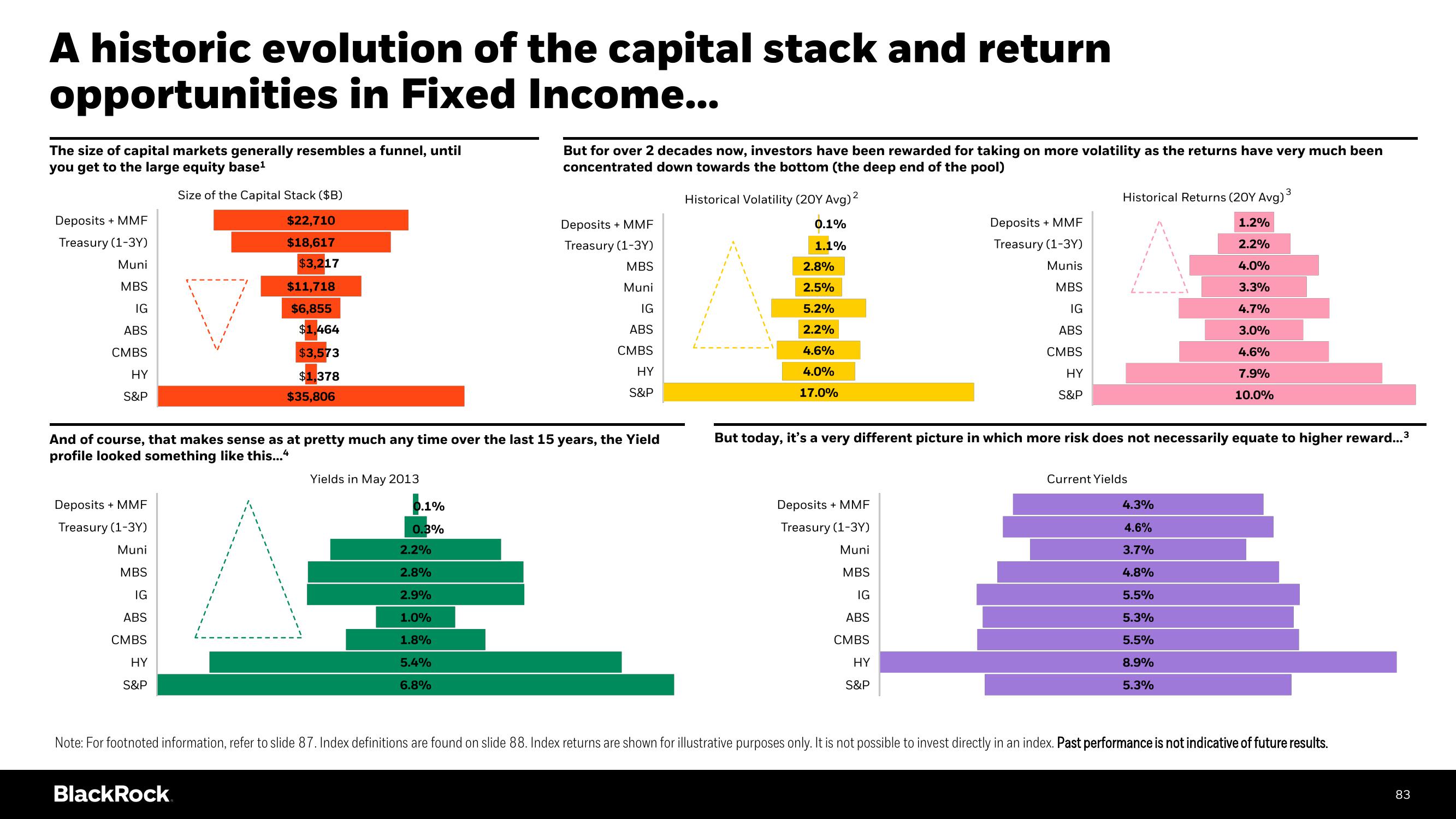

A historic evolution of the capital stack and return

opportunities in Fixed Income...

The size of capital markets generally resembles a funnel, until

you get to the large equity base¹

Size of the Capital Stack ($B)

$22,710

$18,617

$3,217

$11,718

$6,855

$1,464

$3,573

$1,378

Deposits + MMF

Treasury (1-3Y)

Muni

MBS

IG

ABS

CMBS

HY

S&P

Deposits + MMF

Treasury (1-3Y)

Muni

MBS

IG

ABS

CMBS

HY

S&P

v

$35,806

BlackRock

And of course, that makes sense as at pretty much any time over the last 15 years, the Yield

profile looked something like this...4

Yields in May 2013

0.1%

0.3%

But for over 2 decades now, investors have been rewarded for taking on more volatility as the returns have very much been

concentrated down towards the bottom (the deep end of the pool)

2.2%

2.8%

2.9%

1.0%

1.8%

5.4%

6.8%

Deposits + MMF

Treasury (1-3Y)

MBS

Muni

IG

ABS

CMBS

HY

S&P

Historical Volatility (20Y Avg) ²

0.1%

1.1%

2.8%

2.5%

5.2%

2.2%

4.6%

4.0%

17.0%

Deposits + MMF

Treasury (1-3Y)

Muni

MBS

IG

ABS

CMBS

Deposits + MMF

Treasury (1-3Y)

Munis

MBS

IG

ABS

CMBS

HY

S&P

HY

S&P

Historical Returns (20Y Avg) ³

But today, it's a very different picture in which more risk does not necessarily equate to higher reward...³

Current Yields

1.2%

2.2%

4.0%

3.3%

4.7%

3.0%

4.6%

7.9%

10.0%

4.3%

4.6%

3.7%

4.8%

5.5%

5.3%

5.5%

8.9%

5.3%

Note: For footnoted information, refer to slide 87. Index definitions are found on slide 88. Index returns are shown for illustrative purposes only. It is not possible to invest directly in an index. Past performance is not indicative of future results.

83View entire presentation