Meyer Burger Investor Presentation

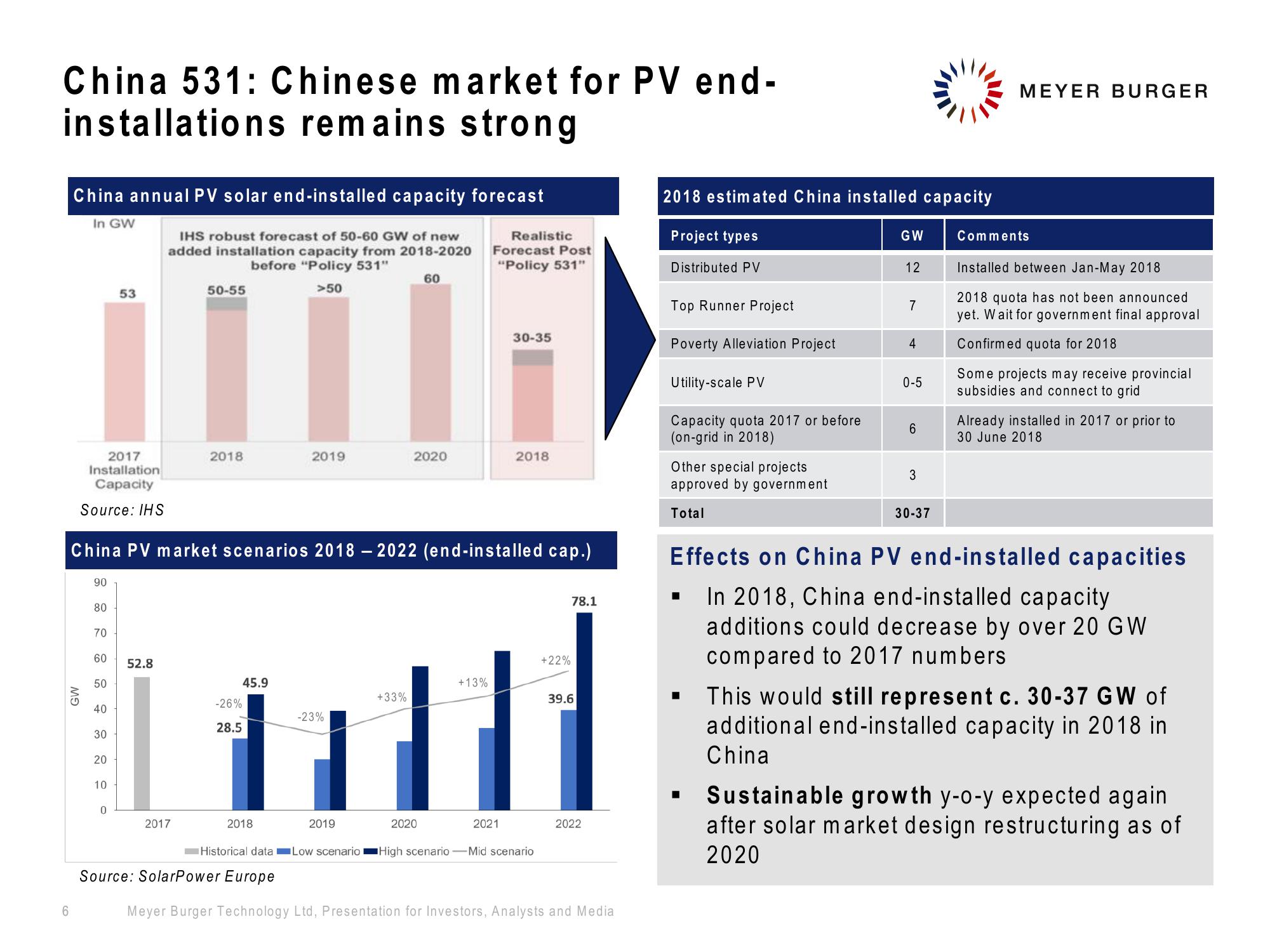

China 531: Chinese market for PV end-

installations remains strong

China annual PV solar end-installed capacity forecast

In GW

IHS robust forecast of 50-60 GW of new

added installation capacity from 2018-2020

before "Policy 531"

2018 estimated China installed capacity

Project types

6

MEYER BURGER

Realistic

Forecast Post

"Policy 531"

GW

Comments

Distributed PV

12

Installed between Jan-May 2018

60

53

50-55

>50

2018 quota has not been announced

Top Runner Project

7

yet. Wait for government final approval

30-35

Poverty Alleviation Project

4

Confirmed quota for 2018

Utility-scale PV

0-5

Some projects may receive provincial

subsidies and connect to grid

Capacity quota 2017 or before

(on-grid in 2018)

6

Already installed in 2017 or prior to

30 June 2018

2017

Installation

Capacity

2018

2019

2020

2018

Other special projects

3

approved by government

Source: IHS

China PV market scenarios 2018 – 2022 (end-installed cap.)

90

80

70

60

52.8

50

40

GW

50

30

+22%

45.9

+13%

+33%

39.6

-26%

-23%

28.5

30

20

10

0

2017

2018

2019

2020

2021

78.1

2022

Total

30-37

Effects on China PV end-installed capacities

In 2018, China end-installed capacity

additions could decrease by over 20 GW

compared to 2017 numbers

This would still represent c. 30-37 GW of

additional end-installed capacity in 2018 in

China

Sustainable growth y-o-y expected again

after solar market design restructuring as of

2020

Historical data Low scenario I High scenario-Mid scenario

Source: SolarPower Europe

Meyer Burger Technology Ltd, Presentation for Investors, Analysts and MediaView entire presentation