Mondee Investor Update

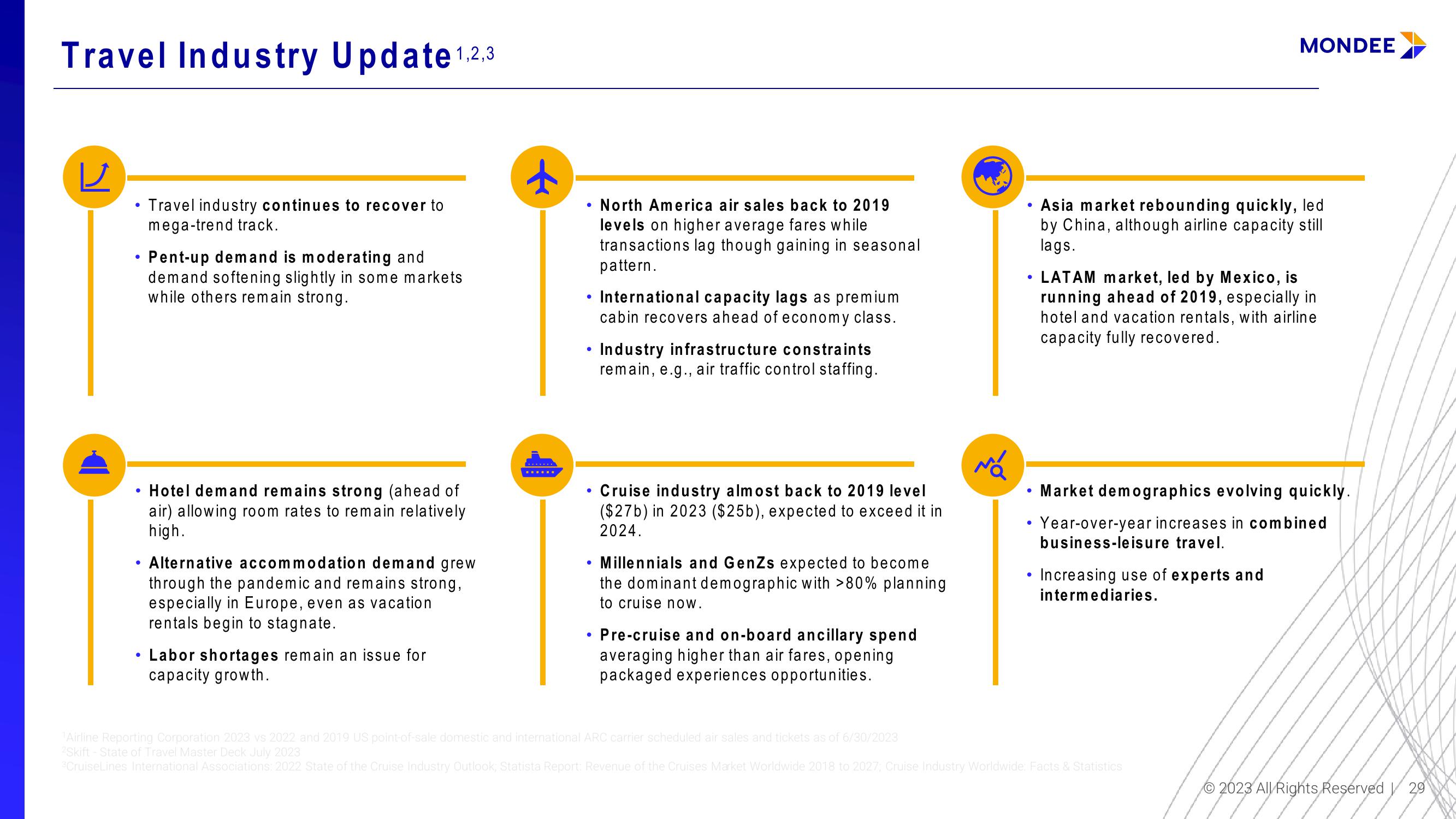

Travel Industry Update 1,2,3

ע

●

• Pent-up demand is moderating and

demand softening slightly in some markets

while others remain strong.

●

●

Travel industry continues to recover to

mega-trend track.

●

Hotel demand remains strong (ahead of

air) allowing room rates to remain relatively

high.

Alternative accommodation demand grew

through the pandemic and remains strong,

especially in Europe, even as vacation

rentals begin to stagnate.

Labor shortages remain an issue for

capacity growth.

+

▪▪▪▪▪▪

●

• International capacity lags as premium

cabin recovers ahead of economy class.

• Industry infrastructure constraints

remain, e.g., air traffic control staffing.

●

North America air sales back to 2019

levels on higher average fares while

transactions lag though gaining in seasonal

pattern.

●

●

Cruise industry almost back to 2019 level

($27b) in 2023 ($25b), expected to exceed it in

2024.

Millennials and GenZs expected to become

the dominant demographic with >80% planning

to cruise now.

Pre-cruise and on-board ancillary spend

averaging higher than air fares, opening

packaged experiences opportunities.

Na

●

●

●

●

Asia market rebounding quickly, led

by China, although airline capacity still

lags.

MONDEE

LATAM market, led by Mexico, is

running ahead of 2019, especially in

hotel and vacation rentals, with airline

capacity fully recovered.

Market demographics evolving quickly.

Year-over-year increases in combined

business-leisure travel.

Increasing use of experts and

intermediaries.

Airline Reporting Corporation 2023 vs 2022 and 2019 US point-of-sale domestic and international ARC carrier scheduled air sales and tickets as of 6/30/2023

2Skift - State of Travel Master Deck July 2023

Cruise Lines International Associations: 2022 State of the Cruise Industry Outlook, Statista Report: Revenue of the Cruises Market Worldwide 2018 to 2027, Cruise Industry Worldwide: Facts & Statistics

O2023 All Rights Reserved 29View entire presentation