Meyer Burger Investor Presentation

Consolidated cash flow statement

in CHF T

Result

Non-cash effective adjustments

Decrease/increase) of net working capital

Cash flow from operating activities

Investments in property, plant and equipment

Investment subsidies received

Sale of property, plant and equipment

Sale of investment property

Investments in intangible assets

Decrease of deposits with limited availability

Increase of bank deposits with limited availability

Cash flow from investment activities

Borrowing of (current) financial liabilities

Repayment of (current) financial liabilities

Borrowing of (non-current) financial liabilities

Borrowing cost of financial liabilities

1.1.-30.6.

2022

1.1.-30.6.

2021

Movement

-41 009

14 291

-37 228

7 779

-19 236

-45 954

4 241

-25 208

-3 781

6 512

-24 525

-21794

-70 417

-52 484

1490

470

1174

555

1698

-17 933

1490

-85

-524

-382

-1164

782

864

8 603

-7 739

-4806

-3 191

-1615

-71 607

-45 983

-25 624

0

265

265

-123

123

55 318

55 318

55 583

-3 117

-13

-3253

3117

13

58 836

Costs of increase in share capital

Cash flow from financing activities

Change in cash and cash equivalents

-61 978

Cash and cash equivalents at beginning of period

CTA on cash and cash equivalents

231 391

-74 444

139 739

11 418

-2 340

1209

Cash and cash equivalents end of the period

167 073

66 504

MEYER BURGER

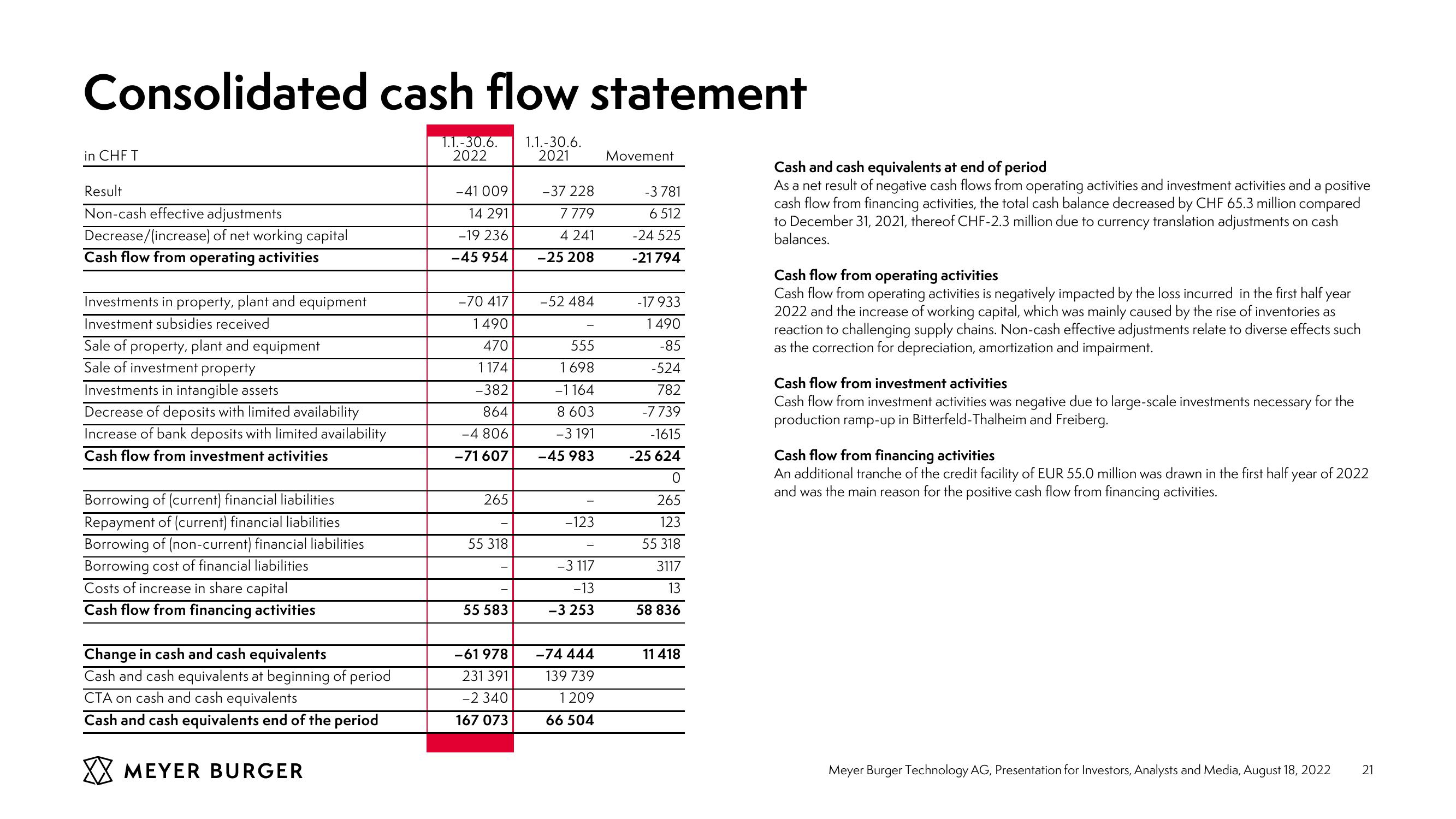

Cash and cash equivalents at end of period

As a net result of negative cash flows from operating activities and investment activities and a positive

cash flow from financing activities, the total cash balance decreased by CHF 65.3 million compared

to December 31, 2021, thereof CHF-2.3 million due to currency translation adjustments on cash

balances.

Cash flow from operating activities

Cash flow from operating activities is negatively impacted by the loss incurred in the first half year

2022 and the increase of working capital, which was mainly caused by the rise of inventories as

reaction to challenging supply chains. Non-cash effective adjustments relate to diverse effects such

as the correction for depreciation, amortization and impairment.

Cash flow from investment activities

Cash flow from investment activities was negative due to large-scale investments necessary

production ramp-up in Bitterfeld-Thalheim and Freiberg.

Cash flow from financing activities

for the

An additional tranche of the credit facility of EUR 55.0 million was drawn in the first half year of 2022

and was the main reason for the positive cash flow from financing activities.

Meyer Burger Technology AG, Presentation for Investors, Analysts and Media, August 18, 2022

21View entire presentation