Snap Inc Results Presentation Deck

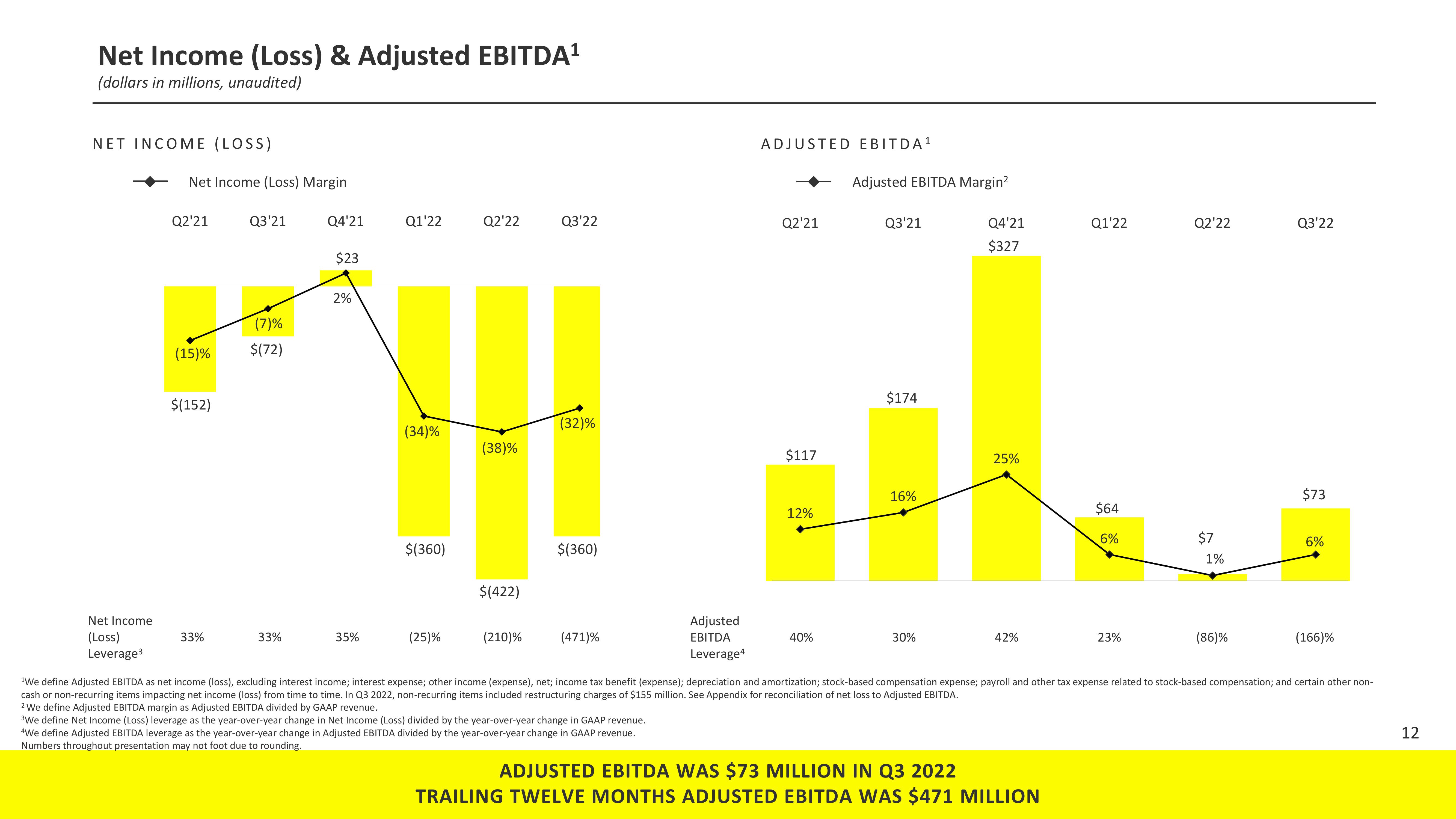

Net Income (Loss) & Adjusted EBITDA¹

(dollars in millions, unaudited)

NET INCOME (LOSS)

Net Income (Loss) Margin

Q2'21

(15)%

$(152)

Q3'21

33%

(7)%

$(72)

Q4'21

33%

$23

2%

Q1'22

35%

I

(34)%

$(360)

Q2'22

(25)%

(38)%

$(422)

Q3'22

(210)%

(32)%

$(360)

(471)%

Adjusted

EBITDA

Leverage4

"We define Adjusted EBITDA leverage as the year-over-year change in Adjusted EBITDA divided by the year-over-year change in GAAP revenue.

Numbers throughout presentation may not foot due to rounding.

ADJUSTED EBITDA ¹

Q2'21

$117

12%

Adjusted EBITDA Margin²

40%

Q3'21

$174

16%

Q4'21

$327

30%

25%

Net Income

(Loss)

Leverage³

¹We define Adjusted EBITDA as net income (loss), excluding interest income; interest expense; other income (expense), net; income tax benefit (expense); depreciation and amortization; stock-based compensation expense; payroll and other tax expense related to stock-based compensation; and certain other non-

cash or non-recurring items impacting net income (loss) from time to time. In Q3 2022, non-recurring items included restructuring charges of $155 million. See Appendix for reconciliation of net loss to Adjusted EBITDA.

2 We define Adjusted EBITDA margin as Adjusted EBITDA divided by GAAP revenue.

3We define Net Income (Loss) leverage as the year-over-year change in Net Income (Loss) divided by the year-over-year change in GAAP revenue.

42%

Q1'22

ADJUSTED EBITDA WAS $73 MILLION IN Q3 2022

TRAILING TWELVE MONTHS ADJUSTED EBITDA WAS $471 MILLION

$64

6%

Q2'22

23%

$7

1%

Q3'22

(86)%

$73

6%

(166)%

12View entire presentation