Karat IPO Presentation Deck

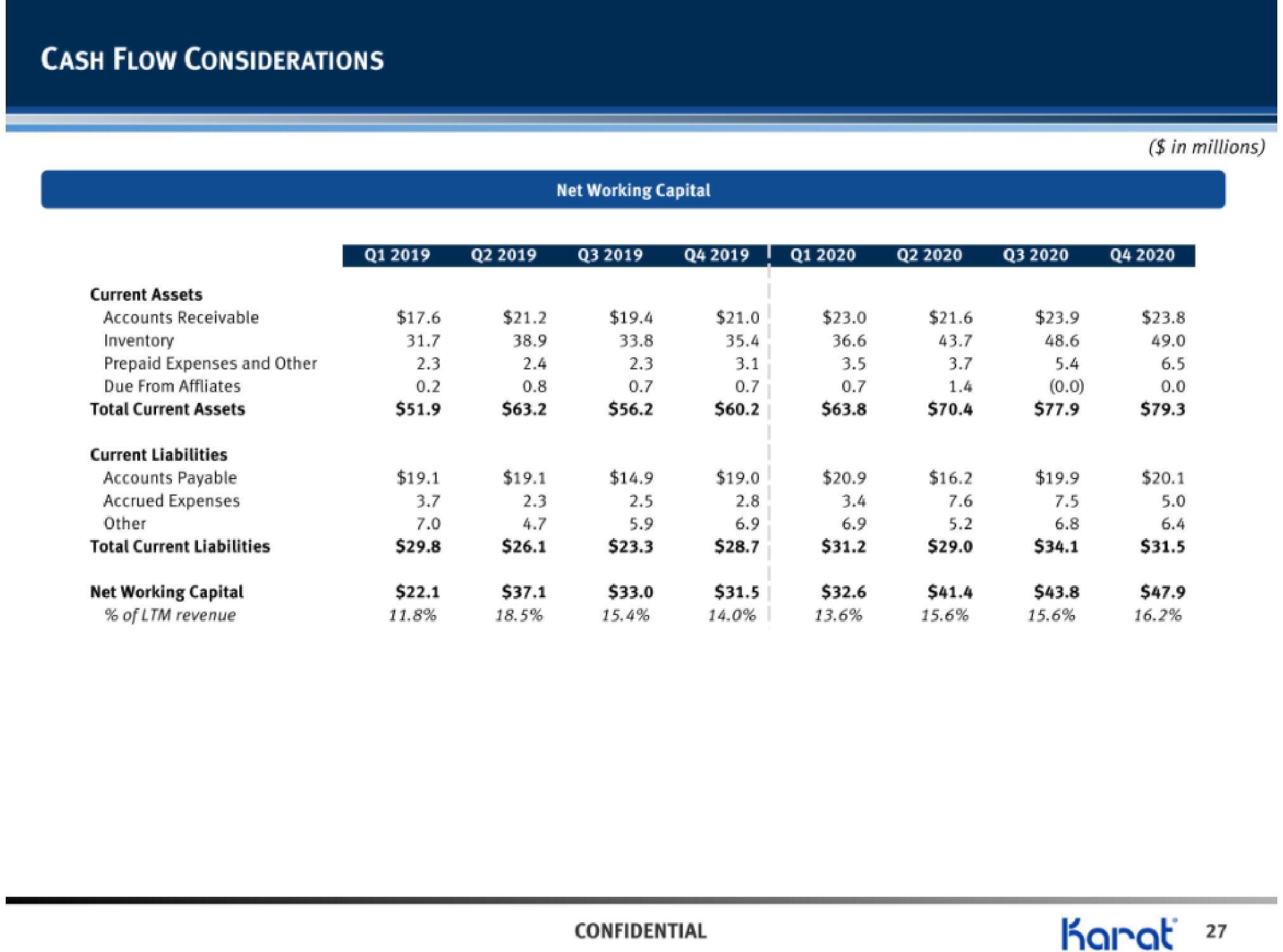

CASH FLOW CONSIDERATIONS

Current Assets

Accounts Receivable

Inventory

Prepaid Expenses and Other

Due From Affliates

Total Current Assets

Current Liabilities

Accounts Payable

Accrued Expenses

Other

Total Current Liabilities

Net Working Capital

% of LTM revenue

Q1 2019

$17.6

31.7

2.3

0.2

$51.9

$19.1

3.7

7.0

$29.8

$22.1

11.8%

Q2 2019

$21.2

38.9

2.4

0.8

$63.2

$19.1

2.3

4.7

$26.1

$37.1

18.5%

Net Working Capital

Q3 2019

$19.4

33.8

2.3

0.7

$56.2

$14.9

2.5

5.9

$23.3

$33.0

15.4%

Q4 2019

CONFIDENTIAL

$21.0

35.4

3.1

0.7

$60.2

$19.0

2.8

6.9

$28.7

$31.5

14.0%

Q1 2020

$23.0

36.6

3.5

0.7

$63.8

$20.9

3.4

6.9

$31.2

$32.6

13.6%

Q2 2020

$21.6

43.7

3.7

1.4

$70.4

$16.2

7.6

5.2

$29.0

$41.4

15.6%

Q3 2020

$23.9

48.6

5.4

(0.0)

$77.9

$19.9

7.5

6.8

$34.1

$43.8

15.6%

($ in millions)

Q4 2020

$23.8

49.0

6.5

0.0

$79.3

$20.1

5.0

6.4

$31.5

$47.9

16.2%

Karat 27View entire presentation