Pershing Square Activist Presentation Deck

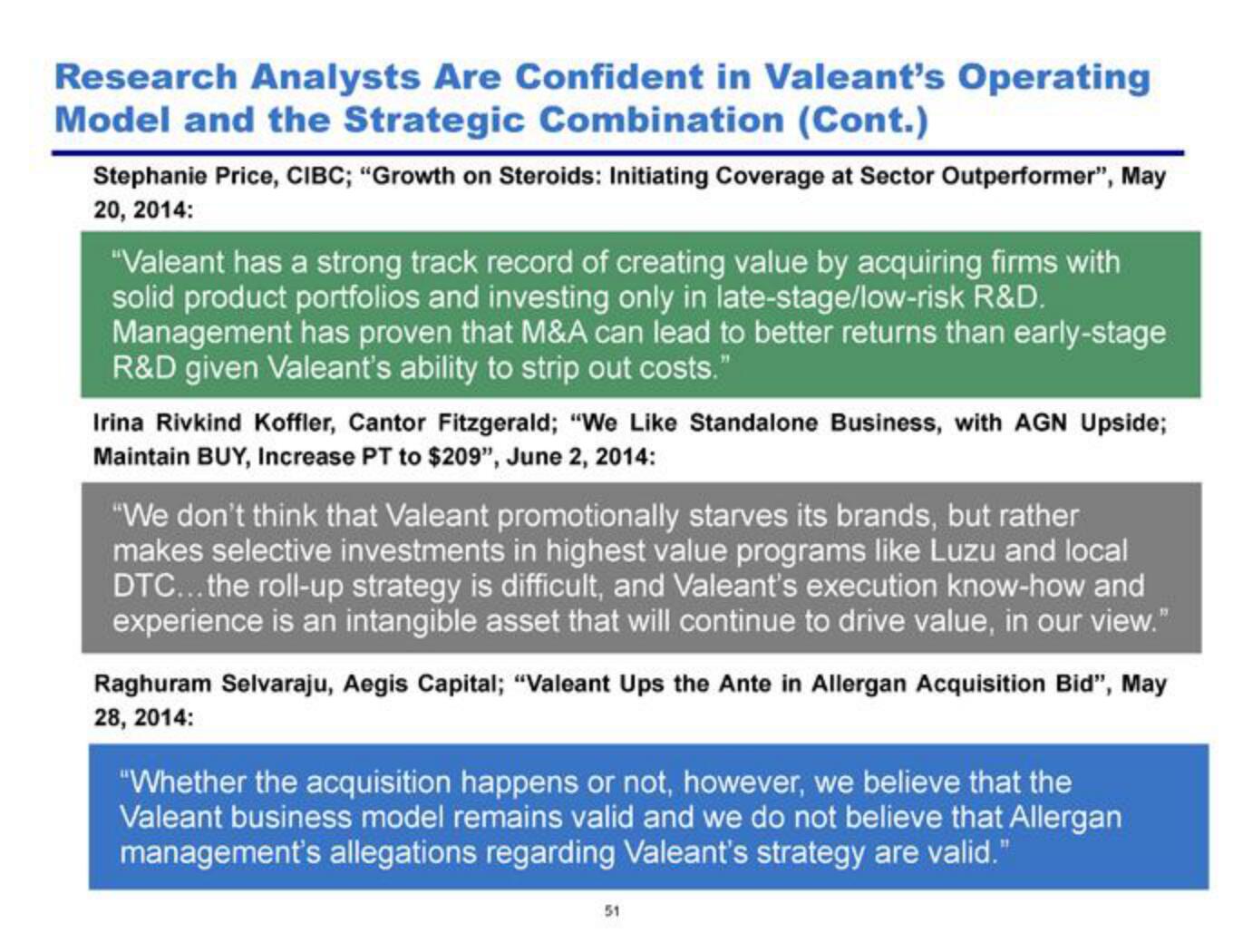

Research Analysts Are Confident in Valeant's Operating

Model and the Strategic Combination (Cont.)

Stephanie Price, CIBC; "Growth on Steroids: Initiating Coverage at Sector Outperformer", May

20, 2014:

"Valeant has a strong track record of creating value by acquiring firms with

solid product portfolios and investing only in late-stage/low-risk R&D.

Management has proven that M&A can lead to better returns than early-stage

R&D given Valeant's ability to strip out costs."

Irina Rivkind Koffler, Cantor Fitzgerald; "We Like Standalone Business, with AGN Upside;

Maintain BUY, Increase PT to $209", June 2, 2014:

"We don't think that Valeant promotionally starves its brands, but rather

makes selective investments in highest value programs like Luzu and local

DTC...the roll-up strategy is difficult, and Valeant's execution know-how and

experience is an intangible asset that will continue to drive value, in our view."

Raghuram Selvaraju, Aegis Capital; “Valeant Ups the Ante in Allergan Acquisition Bid”, May

28, 2014:

"Whether the acquisition happens or not, however, we believe that the

Valeant business model remains valid and we do not believe that Allergan

management's allegations regarding Valeant's strategy are valid."

51View entire presentation