Pershing Square Activist Presentation Deck

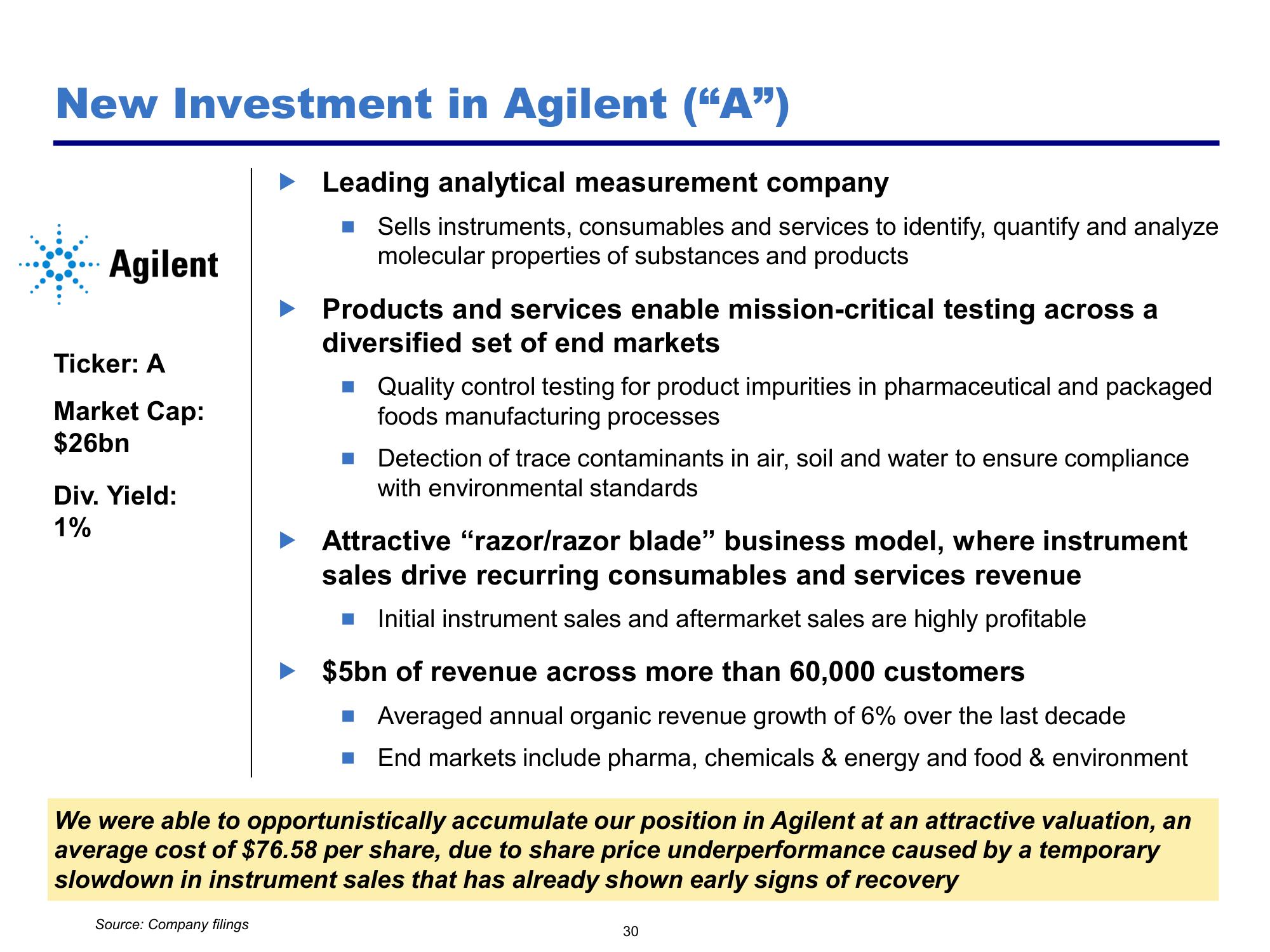

New Investment in Agilent ("A")

Agilent

Ticker: A

Market Cap:

$26bn

Div. Yield:

1%

Leading analytical measurement company

■ Sells instruments, consumables and services to identify, quantify and analyze

molecular properties of substances and products

Source: Company filings

Products and services enable mission-critical testing across a

diversified set of end markets

■ Quality control testing for product impurities in pharmaceutical and packaged

foods manufacturing processes

Detection of trace contaminants in air, soil and water to ensure compliance

with environmental standards

► Attractive "razor/razor blade" business model, where instrument

sales drive recurring consumables and services revenue

Initial instrument sales and aftermarket sales are highly profitable

$5bn of revenue across more than 60,000 customers

Averaged annual organic revenue growth of 6% over the last decade

End markets include pharma, chemicals & energy and food & environment

We were able to opportunistically accumulate our position in Agilent at an attractive valuation, an

average cost of $76.58 per share, due to share price underperformance caused by a temporary

slowdown in instrument sales that has already shown early signs of recovery

30View entire presentation