jetBlue Results Presentation Deck

Focused on Managing Liquidity and Earnings Risk

120%

100%

80%

60%

40%

20%

0%

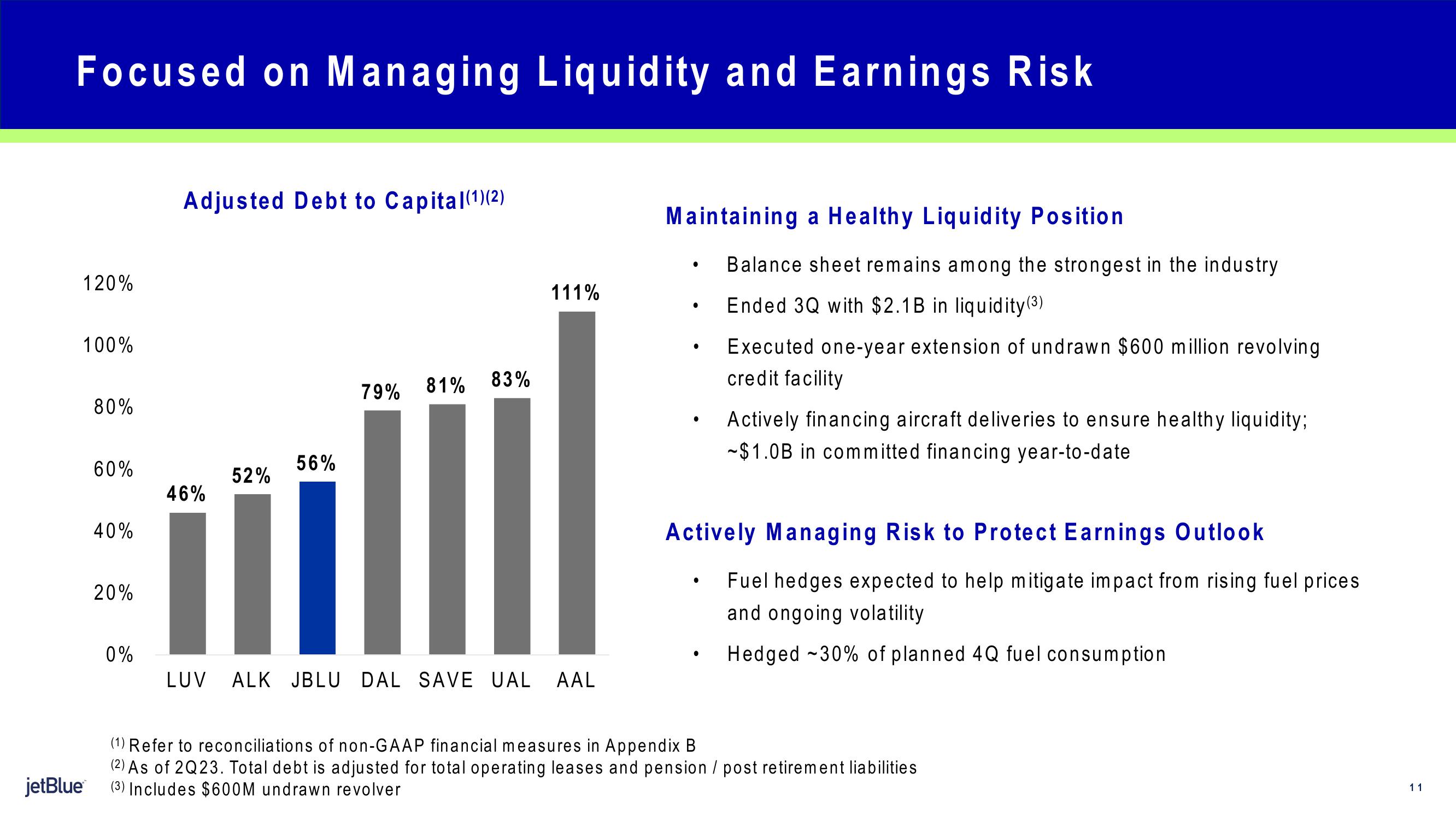

Adjusted Debt to Capital (¹)(2)

46%

52%

56%

79%

81% 83%

111%

LUV ALK JBLU DAL SAVE UAL AAL

jetBlue (3) Includes $600M undrawn revolver

Maintaining a Healthy Liquidity Position

●

Balance sheet remains among the strongest in the industry

Ended 3Q with $2.1B in liquidity (³)

●

Executed one-year extension of undrawn $600 million revolving

credit facility

Actively financing aircraft deliveries to ensure healthy liquidity;

-$1.0B in committed financing year-to-date

Actively Managing Risk to Protect Earnings Outlook

Fuel hedges expected to help mitigate impact from rising fuel prices

and ongoing volatility

Hedged -30% of planned 4Q fuel consumption

(1) Refer to reconciliations of non-GAAP financial measures in Appendix B

(2) As of 2Q23. Total debt is adjusted for total operating leases and pension / post retirement liabilities

11View entire presentation