BlackRock Global Long/Short Credit Absolute Return Credit

Long and Short Expression of Credit Opportunities

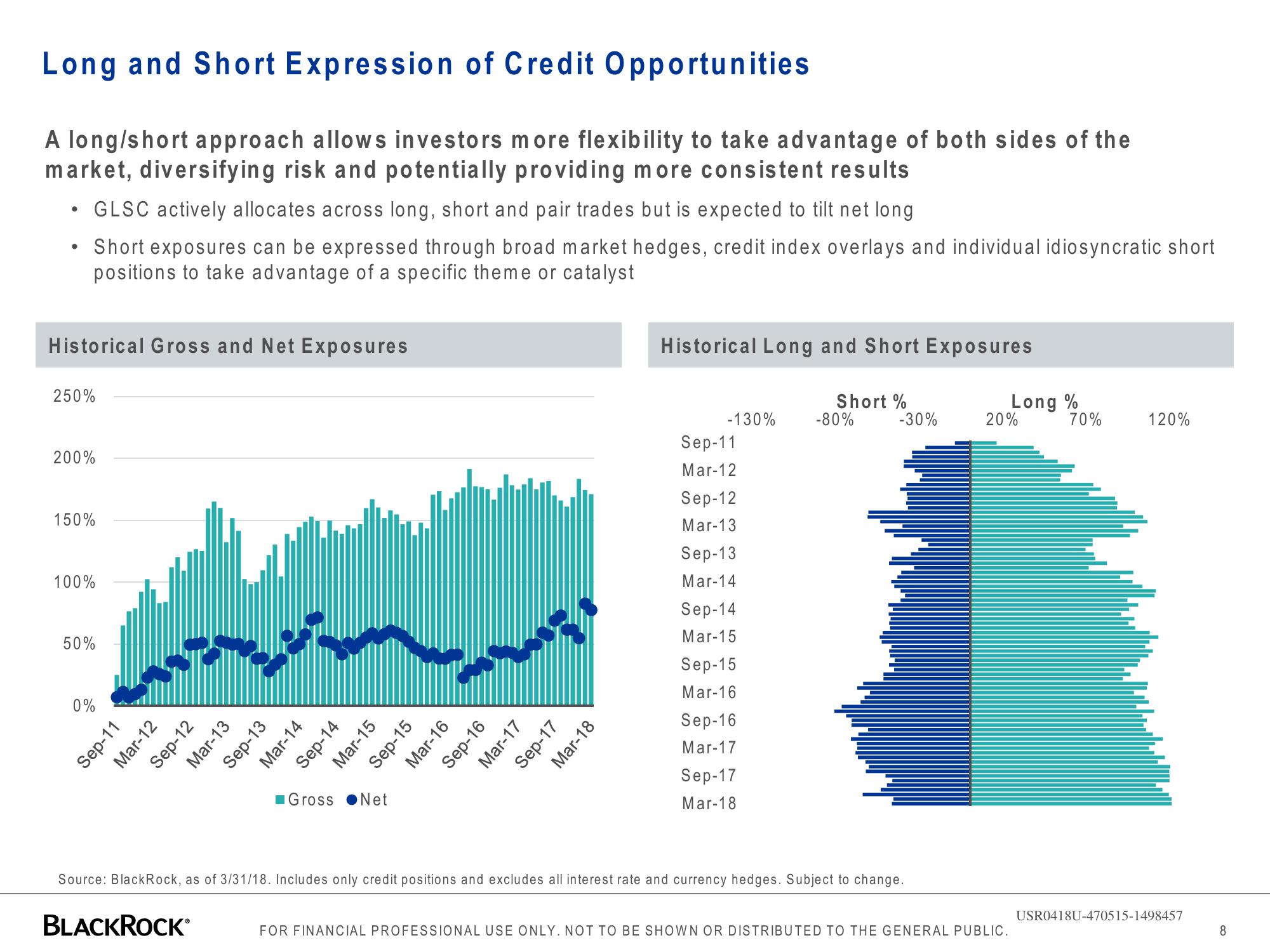

A long/short approach allows investors more flexibility to take advantage of both sides of the

market, diversifying risk and potentially providing more consistent results

GLSC actively allocates across long, short and pair trades but is expected to tilt net long

• Short exposures can be expressed through broad market hedges, credit index overlays and individual idiosyncratic short

positions to take advantage of a specific theme or catalyst

●

Historical Gross and Net Exposures

250%

200%

150%

100%

50%

0%

Sep-11

Mar-12

Sep-12

Mar-13

Sep-13

BLACKROCK

Mar-14

Sep-14

Mar-15

Gross Net

Sep-15

Mar-16

Sep-16

Mar-17

Sep-17

Mar-18

Historical Long and Short Exposures

Short %

-80%

-130%

Sep-11

Mar-12

Sep-12

Mar-13

Sep-13

Mar-14

Sep-14

Mar-15

Sep-15

Mar-16

Sep-16

Mar-17

Sep-17

Mar-18

-30%

Source: BlackRock, as of 3/31/18. Includes only credit positions and excludes all interest rate and currency hedges. Subject to change.

Long %

70%

20%

FOR FINANCIAL PROFESSIONAL USE ONLY. NOT TO BE SHOWN OR DISTRIBUTED TO THE GENERAL PUBLIC.

120%

USR0418U-470515-1498457

8View entire presentation