Grab SPAC Presentation Deck

12445

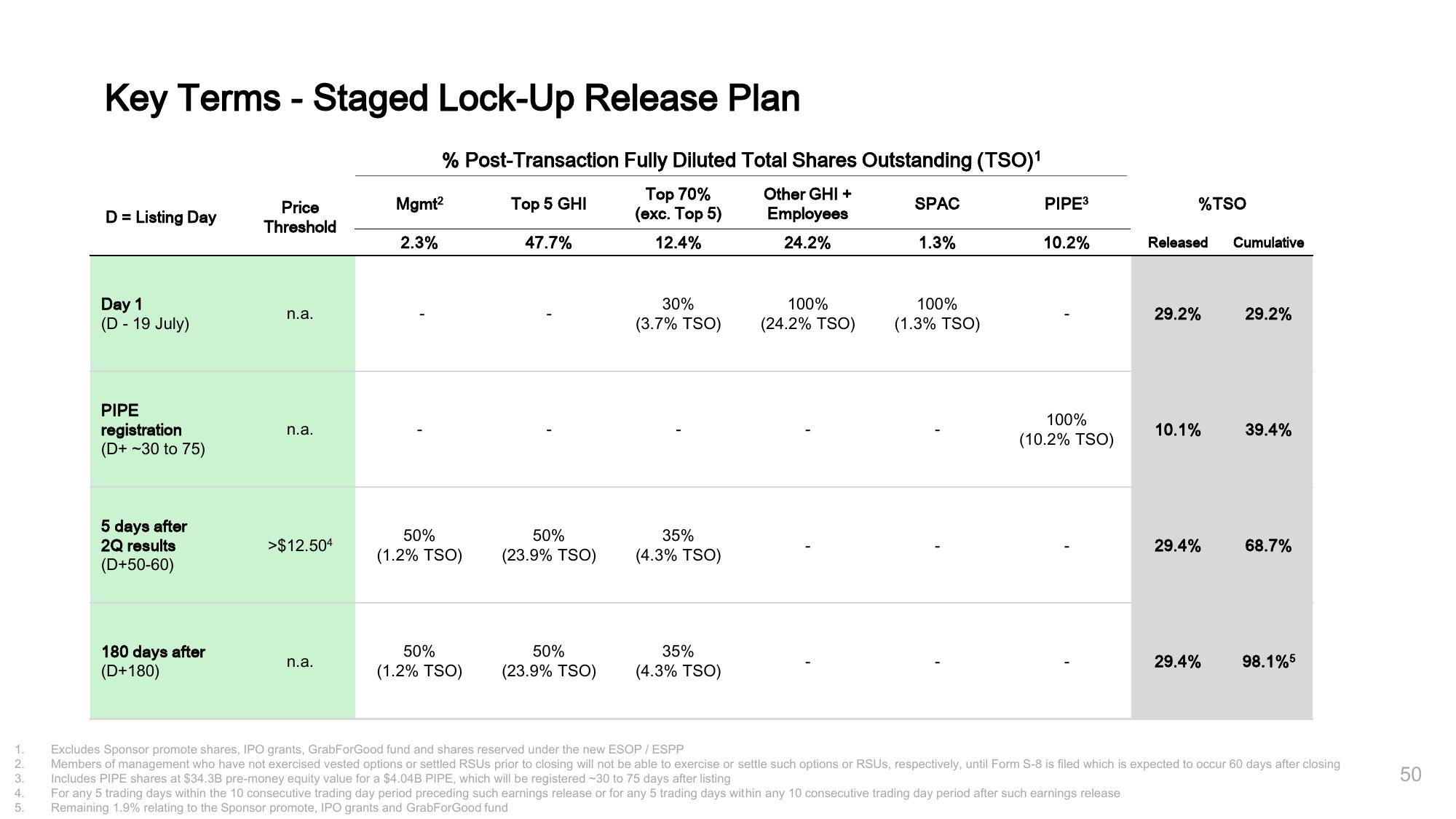

Key Terms - Staged Lock-Up Release Plan

D = Listing Day

Day 1

(D - 19 July)

PIPE

registration

(D+ -30 to 75)

5 days after

2Q results

(D+50-60)

180 days after

(D+180)

Price

Threshold

n.a.

n.a.

>$12.504

n.a.

% Post-Transaction Fully Diluted Total Shares Outstanding (TSO)¹

Top 5 GHI

47.7%

Top 70%

(exc. Top 5)

12.4%

Other GHI +

Employees

24.2%

Mgmt²

2.3%

50%

(1.2% TSO)

50%

(1.2% TSO)

50%

(23.9% TSO)

50%

(23.9% TSO)

30%

(3.7% TSO)

35%

(4.3% TSO)

35%

(4.3% TSO)

100%

(24.2% TSO)

SPAC

1.3%

100%

(1.3% TSO)

PIPE3

10.2%

100%

(10.2% TSO)

%TSO

Released Cumulative

29.2%

10.1%

29.4%

29.4%

29.2%

39.4%

68.7%

98.1%5

Excludes Sponsor promote shares, IPO grants, GrabForGood fund and shares reserved under the new ESOP / ESPP

Members of management who have not exercised vested options or settled RSUS prior to closing will not be able to exercise or settle such options or RSUS, respectively, until Form S-8 is filed which is expected to occur 60 days after closing

Includes PIPE shares at $34.3B pre-money equity value for a $4.04B PIPE, which will be registered -30 to 75 days after listing

For any 5 trading days within the 10 consecutive trading day period preceding such earnings release or for any 5 trading days within any 10 consecutive trading day period after such earnings release

Remaining 1.9% relating to the Sponsor promote, IPO grants and GrabForGood fund

50View entire presentation