Baird Investment Banking Pitch Book

3.00x

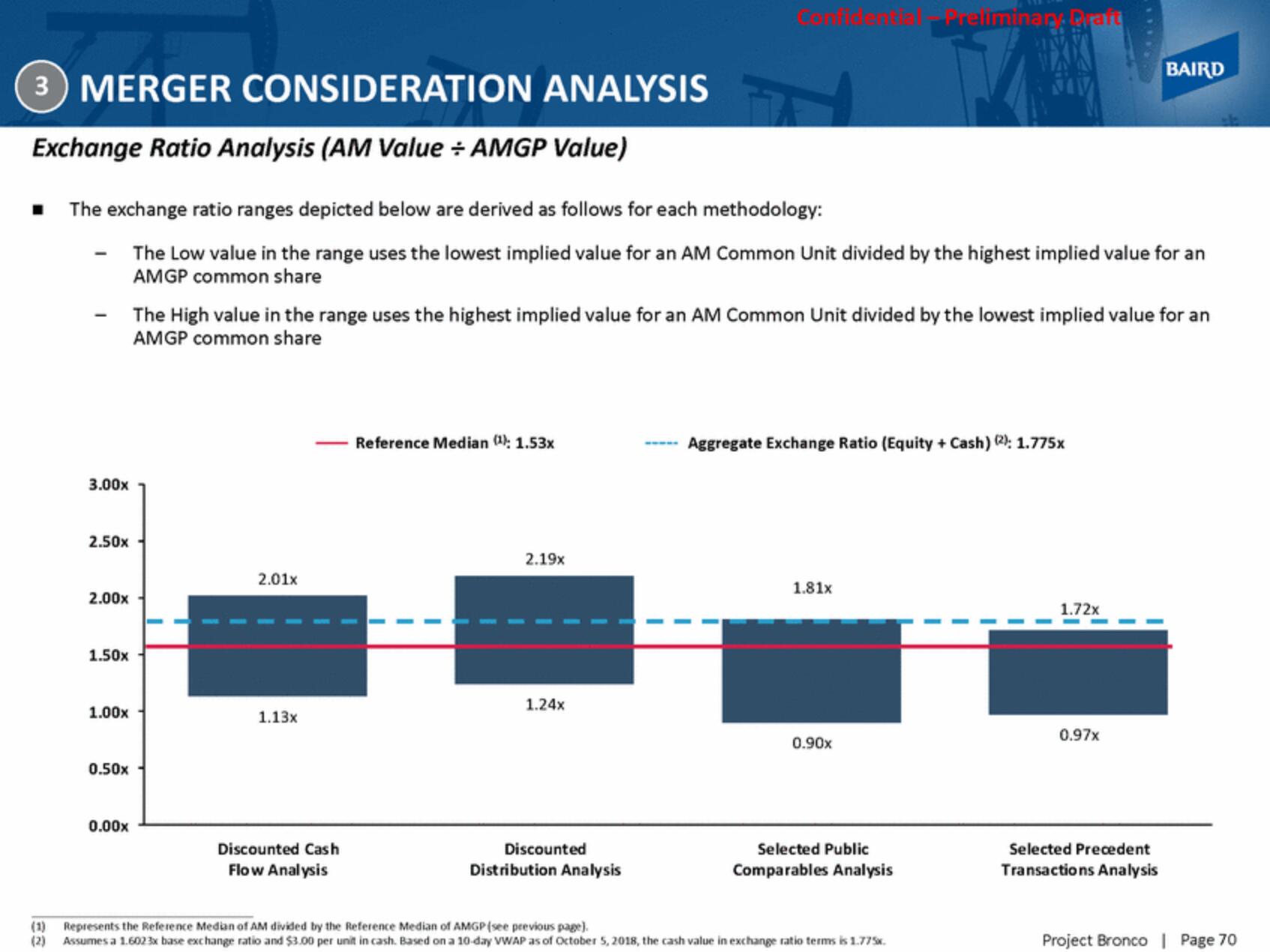

3) MERGER CONSIDERATION ANALYSIS

Exchange Ratio Analysis (AM Value ÷ AMGP Value)

■ The exchange ratio ranges depicted below are derived as follows for each methodology:

The Low value in the range uses the lowest implied value for an AM Common Unit divided by the highest implied value for an

AMGP common share

2.50x

2.00x

1.50x

1.00x

0.50x

0.00x

2.01x

The High value in the range uses the highest implied value for an AM Common Unit divided by the lowest implied value for an

AMGP common share

1.13x

Discounted Cash

Flow Analysis

Reference Median (¹): 1.53x

2.19x

1.24x

Discounted

Distribution Analysis

Aggregate Exchange Ratio (Equity + Cash) (2): 1.775x

1.81x

Treliminar Draft

0.90x

Selected Public

Comparables Analysis

(1) Represents the Reference Median of AM divided by the Reference Median of AMGP (see previous page).

(2) Assumes a 1.602 3x base exchange ratio and $3.00 per unit in cash. Based on a 10-day VWAP as of October 5, 2018, the cash value in exchange ratio terms is 1.775x.

1.72x

BAIRD

0.97x

Selected Precedent

Transactions Analysis

Project Bronco | Page 70View entire presentation