UBS Shareholder Engagement Presentation Deck

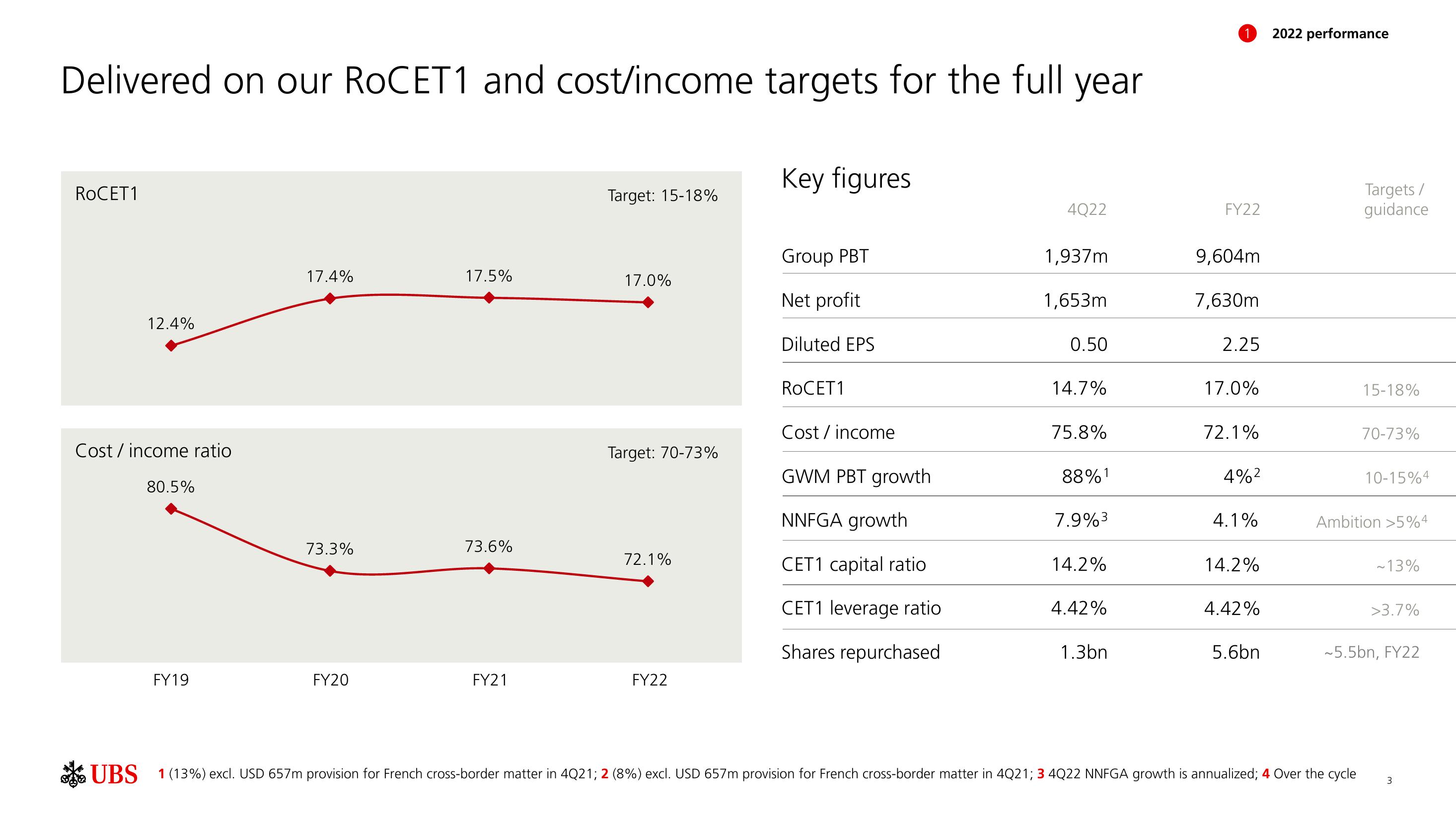

Delivered on our ROCET1 and cost/income targets for the full year

RoCET1

12.4%

Cost/ income ratio

80.5%

FY19

17.4%

73.3%

FY20

17.5%

73.6%

FY21

Target: 15-18%

17.0%

Target: 70-73%

72.1%

FY22

Key figures

Group PBT

Net profit

Diluted EPS

RoCET1

Cost / income

GWM PBT growth

NNFGA growth

CET1 capital ratio

CET1 leverage ratio

Shares repurchased

4Q22

1,937m

1,653m

0.50

14.7%

75.8%

88% 1

7.9%³

14.2%

4.42%

1.3bn

1 2022 performance

FY22

9,604m

7,630m

2.25

17.0%

72.1%

4%²

4.1%

14.2%

4.42%

5.6bn

Targets /

guidance

15-18%

UBS 1(13%) excl. USD 657m provision for French cross-border matter in 4Q21; 2 (8%) excl. USD 657m provision for French cross-border matter in 4Q21; 3 4Q22 NNFGA growth is annualized; 4 Over the cycle

70-73%

10-15%4

Ambition >5%4

~13%

>3.7%

~5.5bn, FY22

3View entire presentation