SoftBank Results Presentation Deck

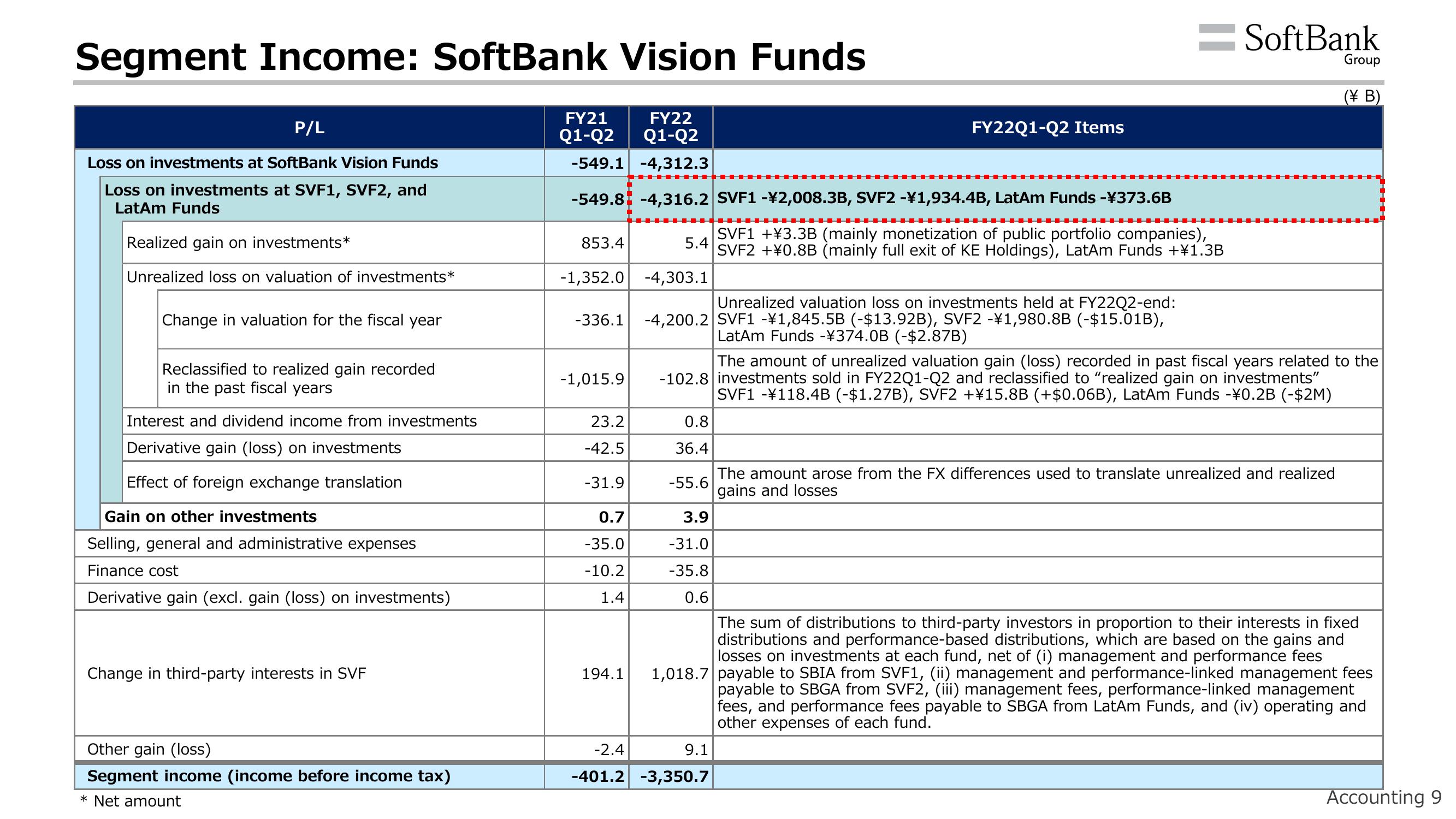

Segment Income: SoftBank Vision Funds

P/L

Loss on investments at SoftBank Vision Funds

Loss on investments at SVF1, SVF2, and

LatAm Funds

Realized gain on investments*

Unrealized loss on valuation of investments*

Change in valuation for the fiscal year

Reclassified to realized gain recorded

in the past fiscal years

Interest and dividend income from investments

Derivative gain (loss) on investments

Effect of foreign exchange translation

Gain on other investments

Selling, general and administrative expenses

Finance cost

Derivative gain (excl. gain (loss) on investments)

Change in third-party interests in SVF

Other gain (loss)

Segment income (income before income tax)

* Net amount

FY22

FY21

Q1-Q2 Q1-Q2

-549.1 -4,312.3

-549.8

853.4

-1,352.0 -4,303.1

-1,015.9

23.2

-42.5

-31.9

Unrealized valuation loss on investments held at FY22Q2-end:

-336.1 -4,200.2 SVF1 -¥1,845.5B (-$13.92B), SVF2 -¥1,980.8B (-$15.01B),

LatAm Funds -¥374.0B (-$2.87B)

0.7

-35.0

-10.2

1.4

5.4

194.1

-4,316.2 SVF1 -¥2,008.3B, SVF2 -¥1,934.4B, LatAm Funds -¥373.6B

SVF1 +¥3.3B (mainly monetization of public portfolio companies),

SVF2 +¥0.8B (mainly full exit of KE Holdings), LatAm Funds +¥1.3B

0.8

36.4

-55.6

FY22Q1-Q2 Items

The amount of unrealized valuation gain (loss) recorded in past fiscal years related to the

-102.8 investments sold in FY22Q1-Q2 and reclassified to "realized gain on investments"

SVF1 -¥118.4B (-$1.27B), SVF2 +¥15.8B (+$0.06B), LatAm Funds -¥0.2B (-$2M)

3.9

-31.0

-35.8

0.6

=SoftBank

9.1

-2.4

-401.2 -3,350.7

Group

(B)

The amount arose from the FX differences used to translate unrealized and realized

gains and losses

The sum of distributions to third-party investors in proportion to their interests in fixed

distributions and performance-based distributions, which are based on the gains and

losses on investments at each fund, net of (i) management and performance fees

1,018.7 payable to SBIA from SVF1, (ii) management and performance-linked management fees

payable to SBGA from SVF2, (iii) management fees, performance-linked management

fees, and performance fees payable to SBGA from LatAm Funds, and (iv) operating and

other expenses of each fund.

Accounting 9View entire presentation