Kore Results Presentation Deck

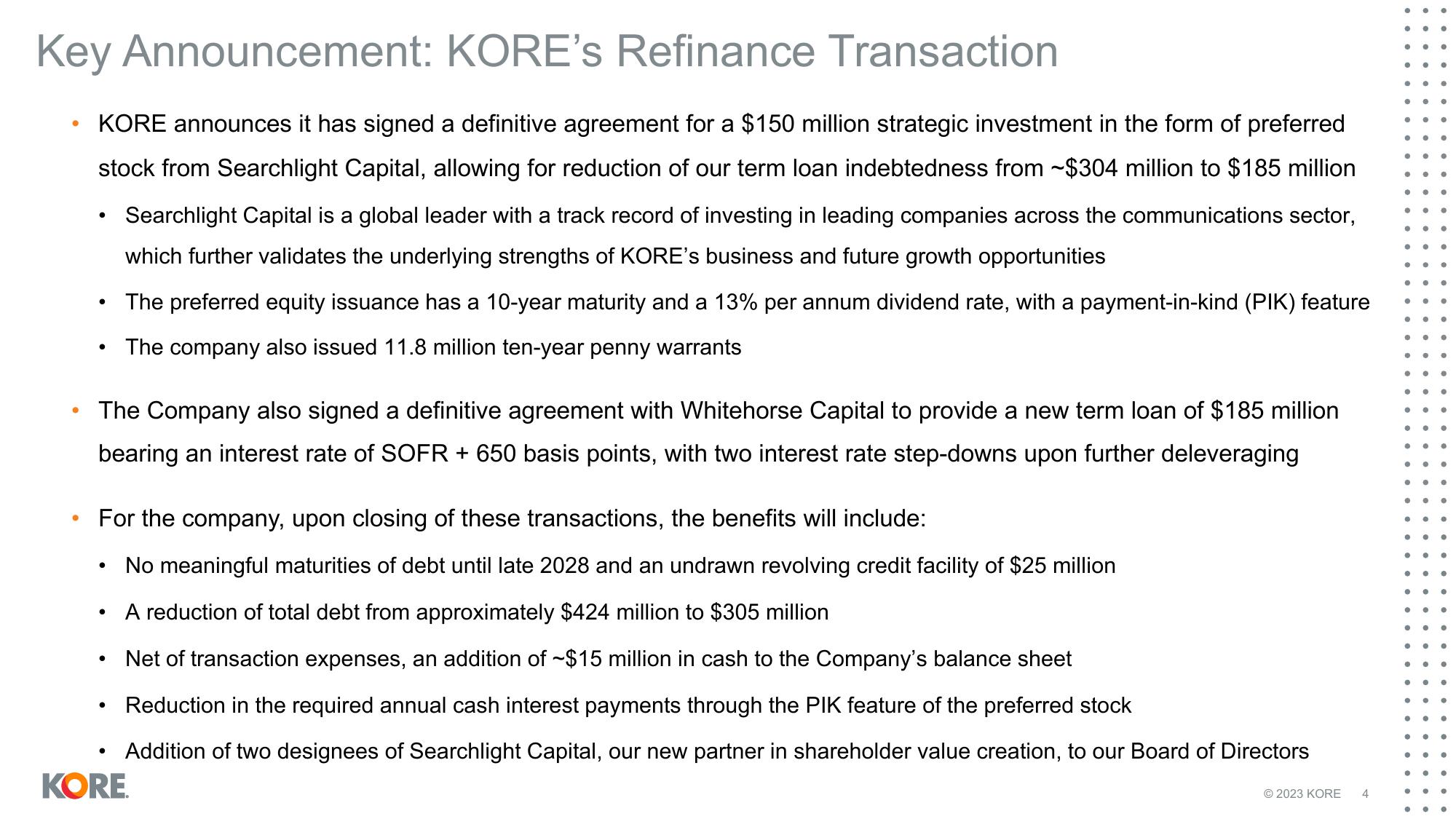

Key Announcement: KORE's Refinance Transaction

KORE announces it has signed a definitive agreement for a $150 million strategic investment in the form of preferred

stock from Searchlight Capital, allowing for reduction of our term loan indebtedness from ~$304 million to $185 million

●

Ⓡ

●

●

The Company also signed a definitive agreement with Whitehorse Capital to provide a new term loan of $185 million

bearing an interest rate of SOFR + 650 basis points, with two interest rate step-downs upon further deleveraging

For the company, upon closing of these transactions, the benefits will include:

No meaningful maturities of debt until late 2028 and an undrawn revolving credit facility of $25 million

A reduction of total debt from approximately $424 million to $305 million

Net of transaction expenses, an addition of ~$15 million in cash to the Company's balance sheet

Reduction in the required annual cash interest payments through the PIK feature of the preferred stock

Addition of two designees of Searchlight Capital, our new partner in shareholder value creation, to our Board of Directors

●

●

Searchlight Capital is a global leader with a track record of investing in leading companies across the communications sector,

which further validates the underlying strengths of KORE's business and future growth opportunities

The preferred equity issuance has a 10-year maturity and a 13% per annum dividend rate, with a payment-in-kind (PIK) feature

The company also issued 11.8 million ten-year penny warrants

.

●

KORE

© 2023 KORE

4

· ●

● ●

●

● 0

•

●

●

●

●

●

●

● ● ●

●

•

..

●

●

● ●

● ●

●

●

.

●

●

●

● ●

...

●View entire presentation