Baird Investment Banking Pitch Book

SUMMARY FIRM TRANSPORT ("FT") COMMITMENTS

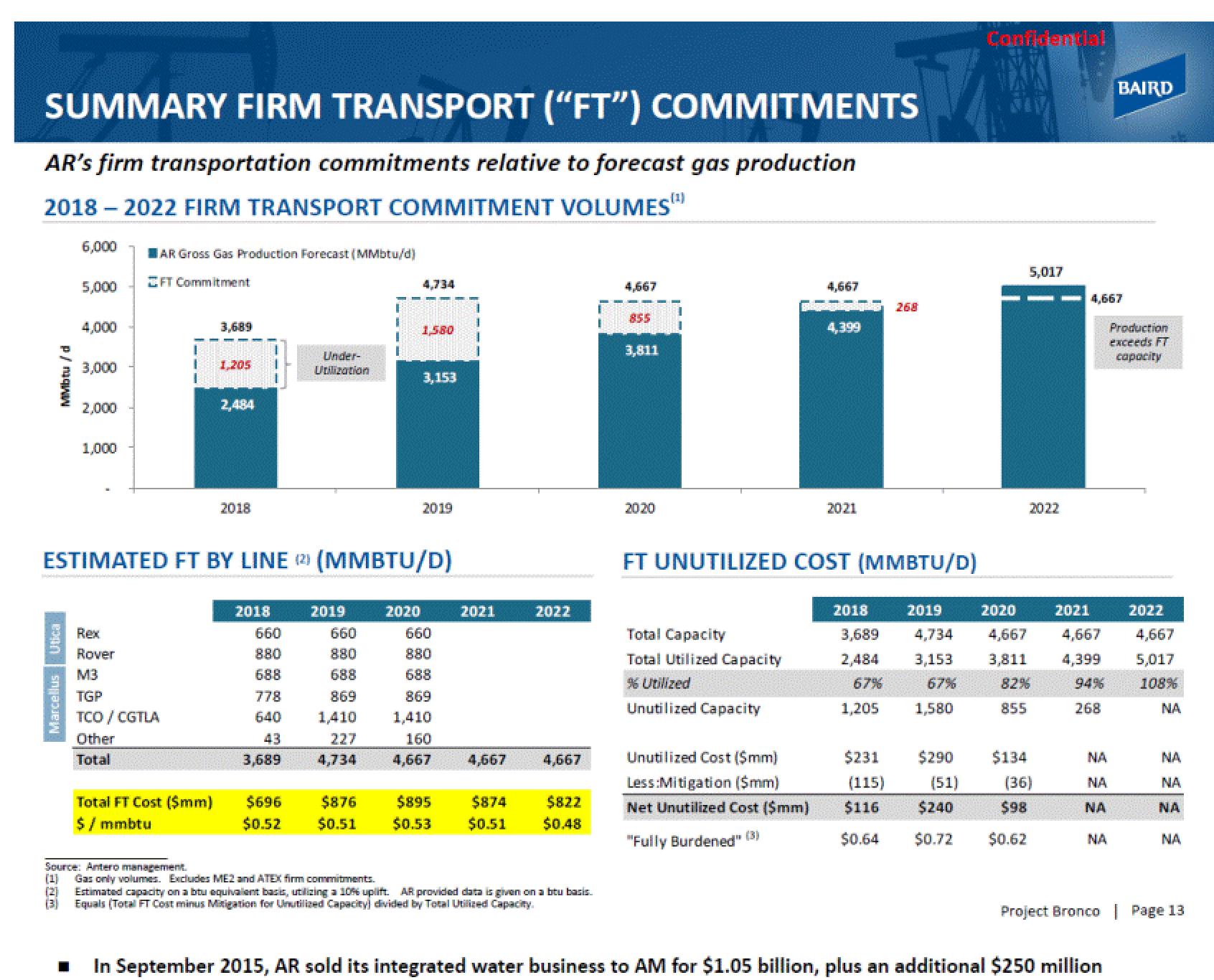

AR's firm transportation commitments relative to forecast gas production

2018-2022 FIRM TRANSPORT COMMITMENT VOLUMES¹¹

MMbtu / d

Marcellus Utica

6,000

5,000

4,000

I

3,000

2,000

1,000

AR Gross Gas Production Forecast (MMbtu/d)

EFT Commitment

Rex

Rover

M3

TGP

TCO/CGTLA

Other

Total

Total FT Cost ($mm)

$/mmbtu

Source: Antero management.

3,689

1,205

2,484

2018

ESTIMATED FT BY LINE (2) (MMBTU/D)

2018

660

880

688

778

640

43

3,689

Under-

Utilization

$696

$0.52

2019

660

880

688

869

1,410

227

4,734

$876

$0.51

Gas only volumes. Excludes ME2 and ATEX firm commitments.

4,734

2020

1,580

3,153

2019

660

880

688

869

1,410

160

4,667

$895

$0.53

2021

2022

4,667 4,667

$874 $822

$0.51 $0.48

(1)

(2) Estimated capacity on a btu equivalent basis, utilizing a 10% uplift. AR provided data is given on a btu basis.

(3)

Equals (Total FT Cost minus Mitigation for Unutilized Capacity) divided by Total Utilized Capacity.

4,667

855

3,811

2020

Total Capacity

Total Utilized Capacity

96 Utilized

Unutilized Capacity

4,667

Unutilized Cost ($mm)

Less:Mitigation ($mm)

Net Unutilized Cost ($mm)

"Fully Burdened" (3)

4,399

2021

FT UNUTILIZED COST (MMBTU/D)

2018

268

3,689

2,484

67%

1,205

2019

1,580

$290

$231

(115)

$116

$240

$0.64 $0.72

Confidential

4,734

4,667

3,153 3,811

67%

82%

855

(51)

2020

$134

5,017

2022

$98

$0.62

(36)

2021

4,667

4,667

4,399

94%

268

NA

ΝΑ

NA

NA

BAIRD

In September 2015, AR sold its integrated water business to AM for $1.05 billion, plus an additional $250 million

Production

exceeds FT

capacity

2022

4,667

5,017

108%

NA

NA

NA

NA

NA

Project Bronco | Page 13View entire presentation