Third Quarter 2019 Results

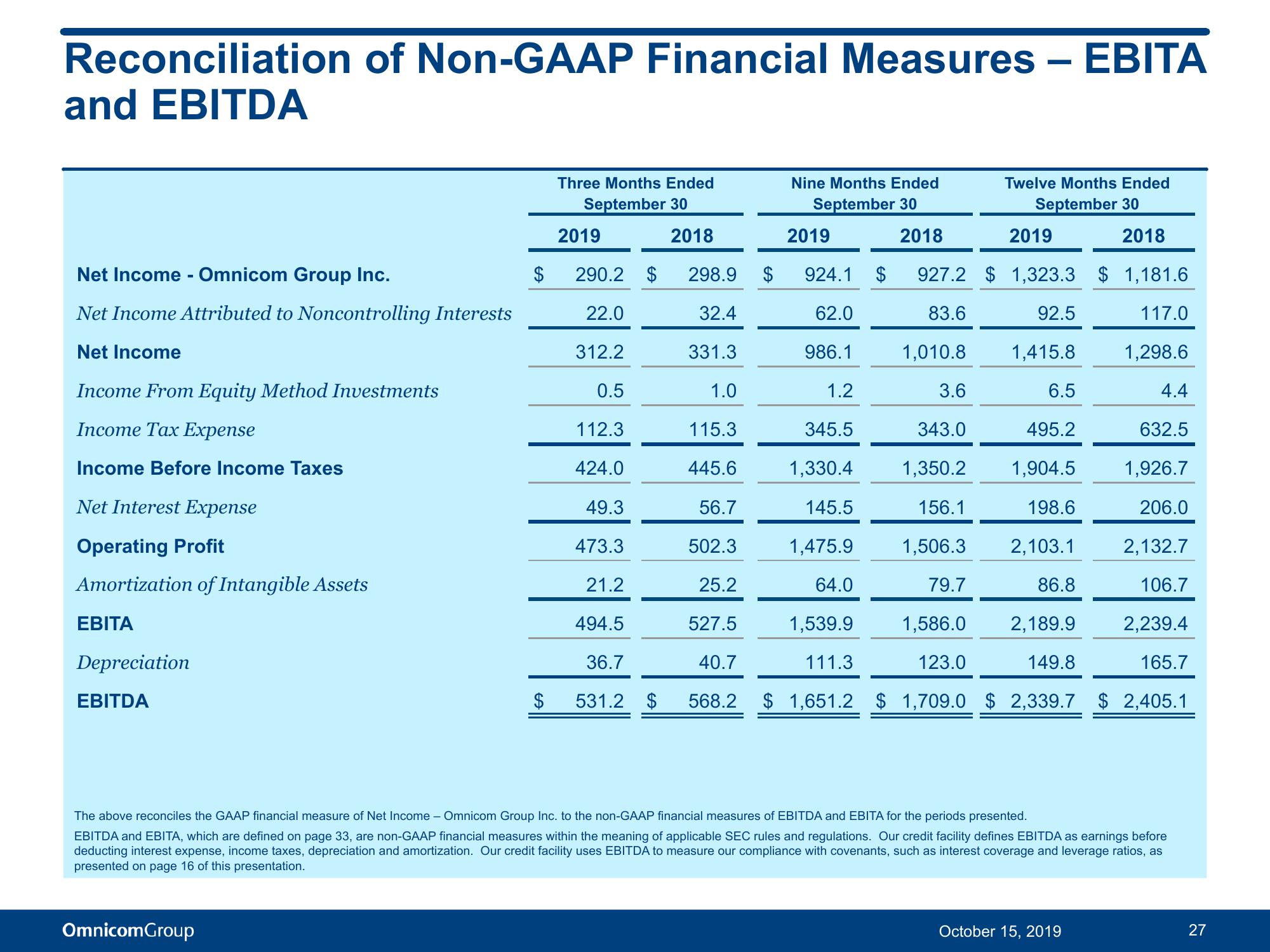

Reconciliation of Non-GAAP Financial Measures - EBITA

and EBITDA

Net Income - Omnicom Group Inc.

Net Income Attributed to Noncontrolling Interests

Net Income

Income From Equity Method Investments

Income Tax Expense

Income Before Income Taxes

Net Interest Expense

Operating Profit

Amortization of Intangible Assets

EBITA

Depreciation

EBITDA

$

OmnicomGroup

Three Months Ended

September 30

2019

2018

290.2 $ 298.9

22.0

32.4

312.2

331.3

1.0

112.3

115.3

424.0

445.6

49.3

56.7

473.3

502.3

21.2

25.2

494.5

527.5

36.7

40.7

$ 531.2 $ 568.2

0.5

Nine Months Ended

September 30

2018

2019

$ 924.1 $ 927.2

62.0

83.6

986.1

1.2

92.5

1,415.8

6.5

343.0

495.2

1,350.2 1,904.5

156.1

198.6

1,506.3

2,103.1

79.7

86.8

2,189.9

1,586.0

123.0

149.8

$1,651.2 $ 1,709.0 $2,339.7

345.5

1,330.4

145.5

1,475.9

64.0

1,539.9

111.3

1,010.8

Twelve Months Ended

September 30

2018

3.6

2019

$1,323.3 $ 1,181.6

117.0

1,298.6

4.4

October 15, 2019

632.5

1,926.7

206.0

2,132.7

106.7

2,239.4

165.7

The above reconciles the GAAP financial heasure of Net Income - Omnicom Group Inc. to the non-GAAP financial measures of EBITDA and EBITA for the periods presented.

EBITDA and EBITA, which are defined on page 33, are non-GAAP financial measures within the meaning of applicable SEC rules and regulations. Our credit facility defines EBITDA as earnings before

deducting interest expense, income taxes, depreciation and amortization. Our credit facility uses EBITDA to measure our compliance with covenants, such as interest coverage and leverage ratios, as

presented on page 16 of this presentation.

$2,405.1

27View entire presentation