Bed Bath & Beyond Results Presentation Deck

COVID-19 RESPONSE

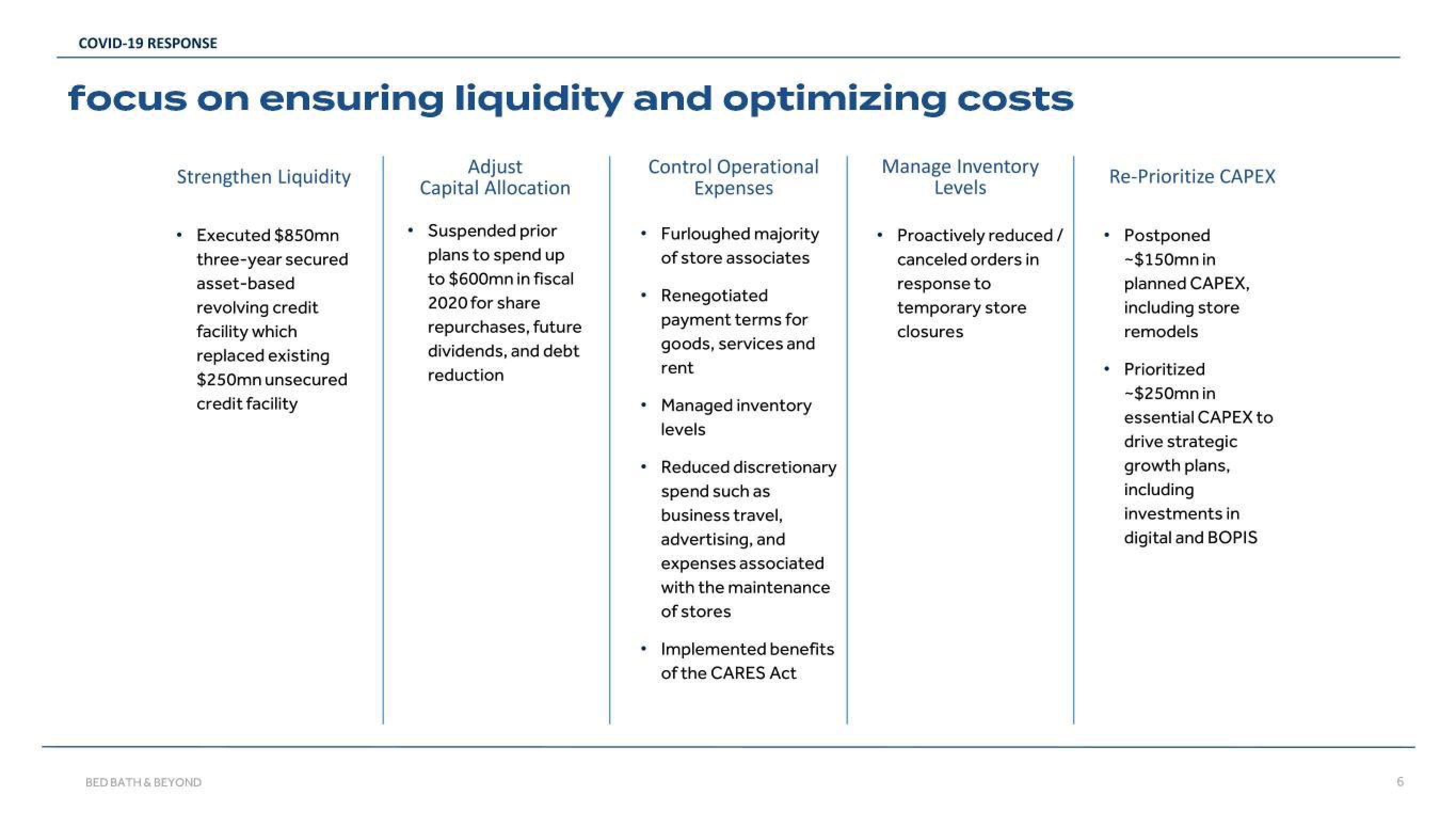

focus on ensuring liquidity and optimizing costs

Strengthen Liquidity

.

Executed $850mn

three-year secured

asset-based

revolving credit

facility which

replaced existing

$250mn unsecured

credit facility

BED BATH & BEYOND

Adjust

Capital Allocation

Suspended prior

plans to spend up

to $600mn in fiscal

2020 for share

repurchases, future

dividends, and debt

reduction

·

M

♥

•

Control Operational

Expenses

Furloughed majority

of store associates

Renegotiated

payment terms for

goods, services and

rent

Managed inventory

levels

Reduced discretionary

spend such as

business travel,

advertising, and

expenses associated

with the maintenance

of stores

Implemented benefits

of the CARES Act

Manage Inventory

Levels

Proactively reduced /

canceled orders in

response to

temporary store

closures

Re-Prioritize CAPEX

Postponed

-$150mn in

planned CAPEX,

including store

remodels

Prioritized

-$250mn in

essential CAPEX to

drive strategic

growth plans,

including

investments in

digital and BOPISView entire presentation