Polestar Investor Presentation Deck

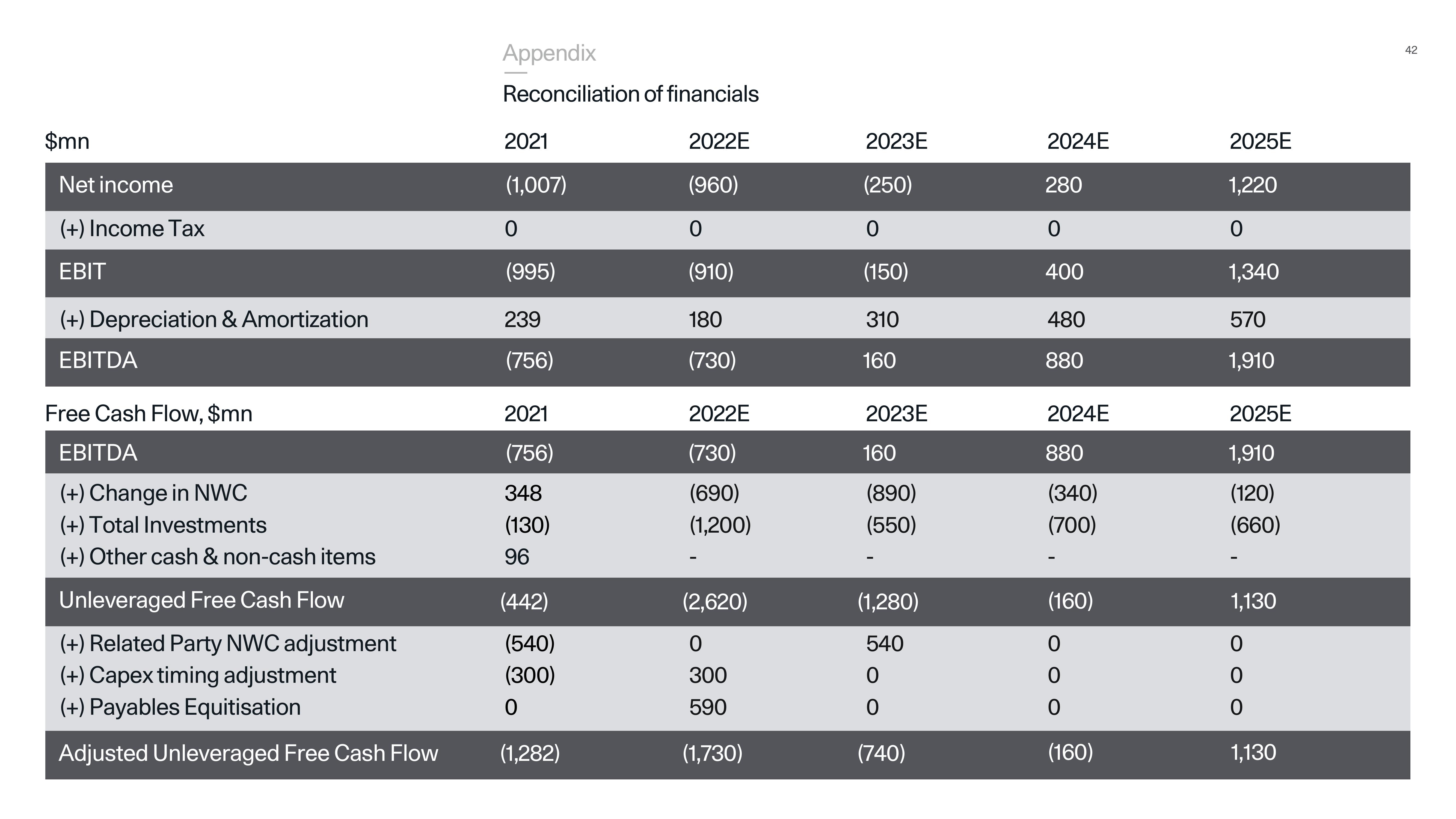

$mn

Net income

(+) Income Tax

EBIT

(+) Depreciation & Amortization

EBITDA

Free Cash Flow, $mn

EBITDA

(+) Change in NWC

(+) Total Investments

(+) Other cash & non-cash items

Unleveraged Free Cash Flow

(+) Related Party NWC adjustment

(+) Capex timing adjustment

(+) Payables Equitisation

Adjusted Unleveraged Free Cash Flow

Appendix

Reconciliation of financials

2022E

(960)

0

(910)

180

(730)

2021

(1,007)

0

(995)

239

(756)

2021

(756)

348

(130)

96

(442)

(540)

(300)

0

(1,282)

2022E

(730)

(690)

(1,200)

(2,620)

0

300

590

(1,730)

2023E

(250)

0

(150)

310

160

2023E

160

(890)

(550)

(1,280)

540

0

0

(740)

2024E

280

0

400

480

880

2024E

880

(340)

(700)

(160)

0

OO

0

0

(160)

2025E

1,220

0

1,340

570

1,910

2025E

1,910

(120)

(660)

1,130

OO

0

0

0

1,130

42View entire presentation