Investor Presentation

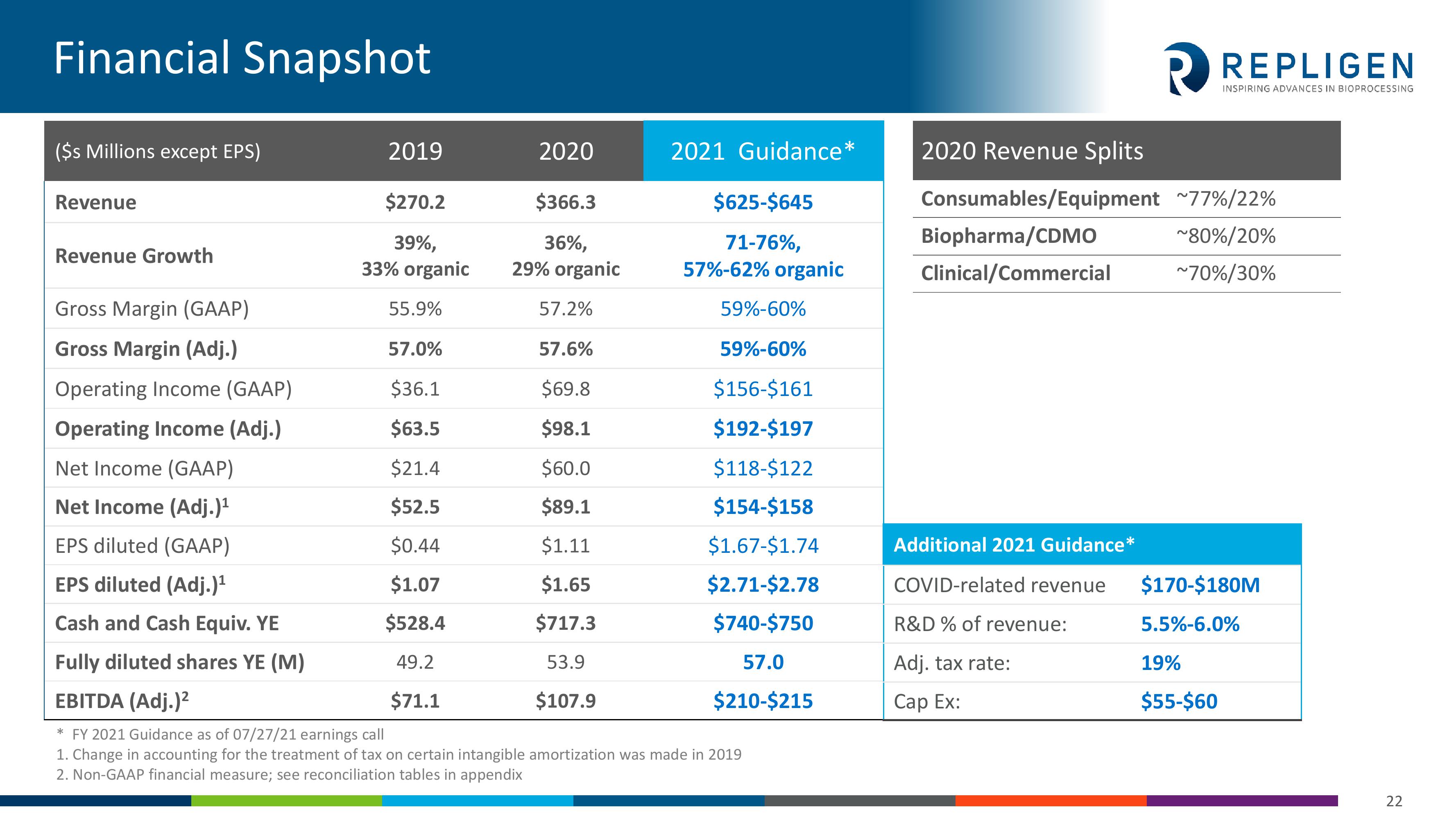

Financial Snapshot

($s Millions except EPS)

Revenue

Revenue Growth

Gross Margin (GAAP)

Gross Margin (Adj.)

2019

$270.2

39%,

33% organic

55.9%

57.0%

$36.1

$63.5

$21.4

$52.5

$0.44

$1.07

$528.4

49.2

$71.1

2020

$366.3

36%,

29% organic

57.2%

57.6%

$69.8

$98.1

$60.0

$89.1

$1.11

$1.65

$717.3

53.9

$107.9

2021 Guidance*

$625-$645

71-76%,

57%-62% organic

59%-60%

59%-60%

$156-$161

$192-$197

$118-$122

$154-$158

$1.67-$1.74

$2.71-$2.78

$740-$750

57.0

$210-$215

Operating Income (GAAP)

Operating Income (Adj.)

Net Income (GAAP)

Net Income (Adj.)¹

EPS diluted (GAAP)

EPS diluted (Adj.)¹

Cash and Cash Equiv. YE

Fully diluted shares YE (M)

EBITDA (Adj.)²

* FY 2021 Guidance as of 07/27/21 earnings call

1. Change in accounting for the treatment of tax on certain intangible amortization was made in 2019

2. Non-GAAP financial measure; see reconciliation tables in appendix

2020 Revenue Splits

Consumables/Equipment ~77%/22%

~80%/20%

~70%/30%

Biopharma/CDMO

Clinical/Commercial

RREPLIGEN

INSPIRING ADVANCES IN BIOPROCESSING

Additional 2021 Guidance*

COVID-related revenue

R&D % of revenue:

Adj. tax rate:

Cap Ex:

$170-$180M

5.5%-6.0%

19%

$55-$60

22View entire presentation