UBS Mergers and Acquisitions Presentation Deck

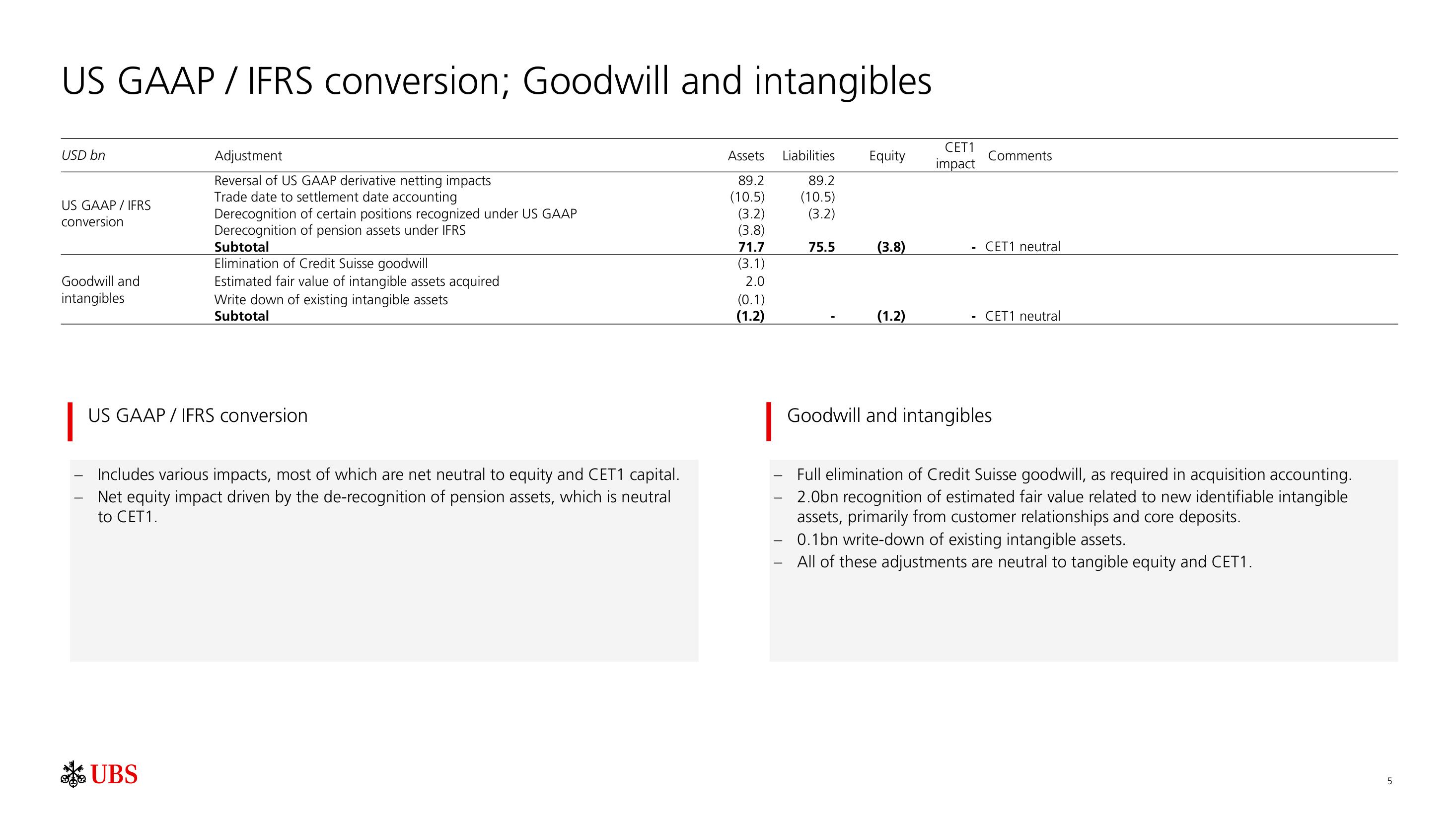

US GAAP /IFRS conversion; Goodwill and intangibles

USD bn

US GAAP / IFRS

conversion

Goodwill and

intangibles

-

Adjustment

Reversal of US GAAP derivative netting impacts

Trade date to settlement date accounting

Derecognition of certain positions recognized under US GAAP

Derecognition of pension assets under IFRS

UBS

Subtotal

Elimination of Credit Suisse goodwill

Estimated fair value of intangible assets acquired

Write down of existing intangible assets

Subtotal

US GAAP /IFRS conversion

Includes various impacts, most of which are net neutral to equity and CET1 capital.

Net equity impact driven by the de-recognition of pension assets, which is neutral

to CET 1.

Assets

89.2

(10.5) (10.5)

Liabilities

89.2

(3.2)

(3.2)

(3.8)

71.7

(3.1)

2.0

(0.1)

(1.2)

75.5

Equity

(3.8)

(1.2)

CET1

impact

Comments

CET1 neutral

CET1 neutral

Goodwill and intangibles

Full elimination of Credit Suisse goodwill, as required in acquisition accounting.

2.0bn recognition of estimated fair value related to new identifiable intangible

assets, primarily from customer relationships and core deposits.

- 0.1bn write-down of existing intangible assets.

All of these adjustments are neutral to tangible equity and CET1.

5

слView entire presentation