LanzaTech SPAC Presentation Deck

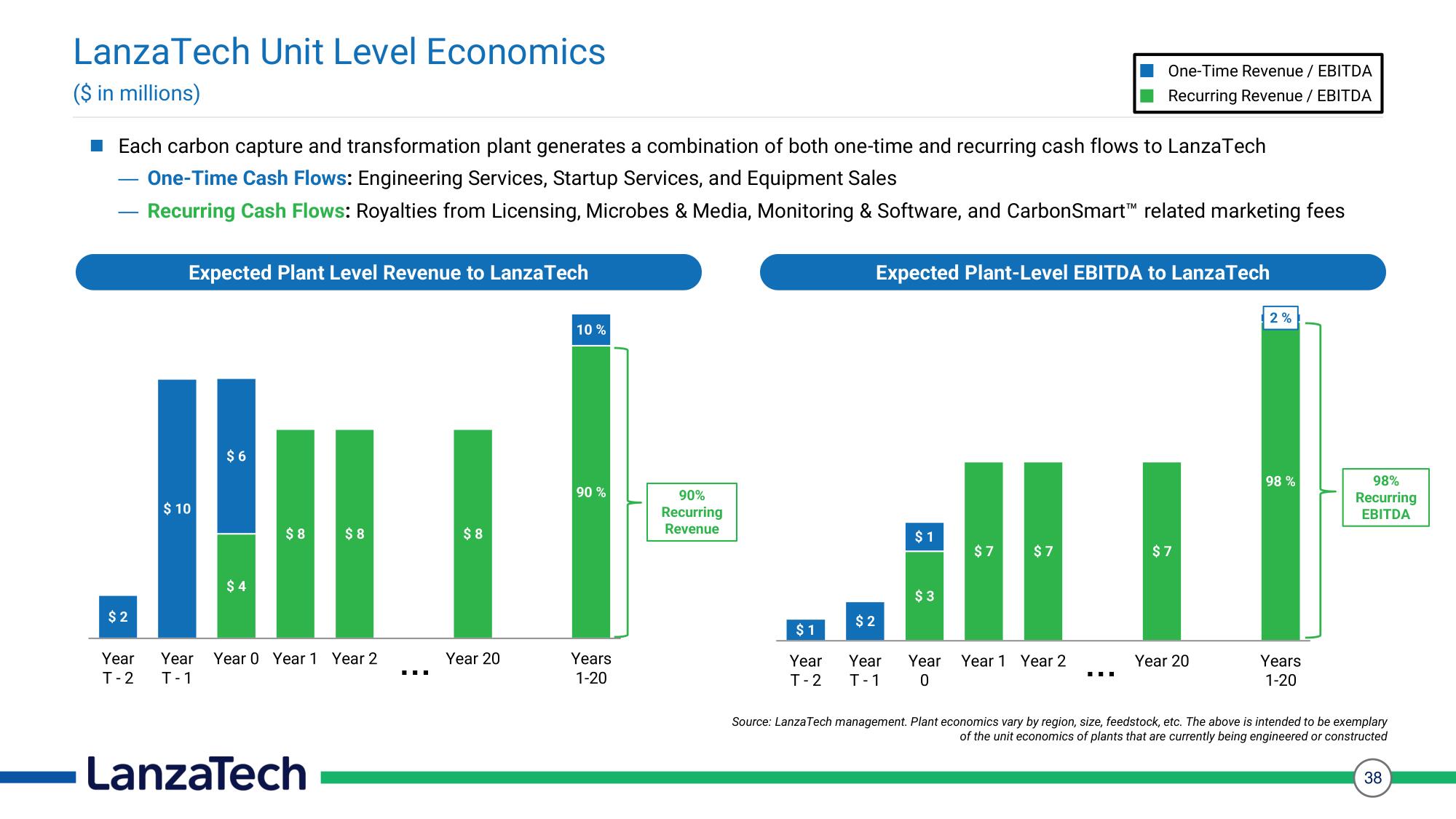

LanzaTech Unit Level Economics

($ in millions)

Each carbon capture and transformation plant generates a combination of both one-time and recurring cash flows to LanzaTech

One-Time Cash Flows: Engineering Services, Startup Services, and Equipment Sales

―

- Recurring Cash Flows: Royalties from Licensing, Microbes & Media, Monitoring & Software, and CarbonSmart™ related marketing fees

$ 2

Expected Plant Level Revenue to Lanza Tech

$ 10

$6

$4

$8

$8

Year Year Year 0 Year 1 Year 2

T-2 T-1

LanzaTech

$8

Year 20

10%

90 %

Years

1-20

90%

Recurring

Revenue

$1

Year

T-2

Expected Plant-Level EBITDA to LanzaTech

$2

Year

T-1

$1

$3

$7

One-Time Revenue / EBITDA

Recurring Revenue / EBITDA

$7

Year Year 1 Year 2

0

$7

Year 20

2%

98%

Years

1-20

98%

Recurring

EBITDA

Source: LanzaTech management. Plant economics vary by region, size, feedstock, etc. The above is intended to be exemplary

of the unit economics of plants that are currently being engineered or constructed

38View entire presentation